This post was originally published on this site

https://images.mktw.net/im-86437284The stock market can be fickle, and it doesn’t always reward the pioneers of a new technology over the long term.

That is one important lesson from the telecom bubble of the late 1990s and early 2000s that investors in the artificial-intelligence boom of today would be well-served to remember, according to Deutsche Bank analyst Jim Reid.

Reid rattled off a list of potential similarities, and obvious differences, between the two periods in a recent missive to clients that was shared with MarketWatch.

See: 3 things could pop megacap stock bubble — and ‘weigh heavily’ on broader market

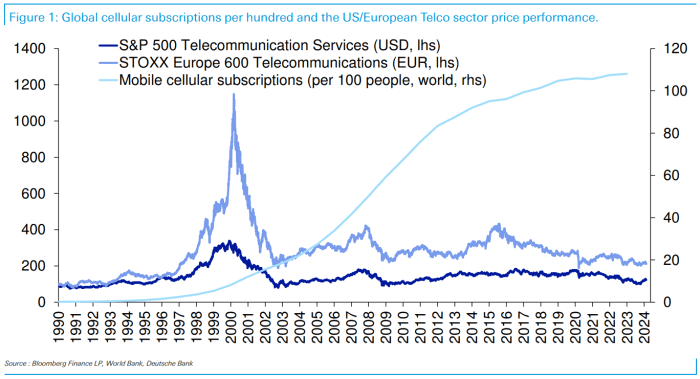

One important wrinkle that Reid highlighted is that telecom stocks never made it back to their bubble-era peaks, even as cellphone adoption by 2024 surpassed even the rosiest forecasts from the bubble era.

Deutsche Bank

The takeaway for the AI stocks of today is that widespread adoption of the technology isn’t enough to justify the lofty valuations enjoyed by the so-called Magnificent Seven and other AI plays. Ultimately, whether or not the technology becomes “democratized” — that is, transformed into a commodity that every U.S. company can easily implement — might have an even greater impact on valuations over the long term.

“‘If it were 1997 today, and you were told that global cellular subscriptions would go from 1 per 100 [people], to nearly 110 per 100, with around 8 billion contracts globally in 2024, would you have thought telecom valuations were going to be sustainably propelled into the stratosphere?’ Obviously, with hindsight, the answer is ‘no’ — the value in mobile subscribers accrued elsewhere,” Reid noted.

“Elsewhere,” in this case, includes companies that pioneered the mobile internet and the cloud, including several members of the modern-day Magnificent Seven like Alphabet Inc.

GOOGL,

GOOG,

Microsoft Corp.

MSFT,

Meta Platforms Inc.

META,

Amazon.com Inc.

AMZN,

and, of course, Apple Inc.

AAPL,

which revolutionized the market for smartphones with its introduction of the iPhone in 2007.

Investors failed to anticipate this commoditization in the late 1990s, as well as the heavy regulation that would ultimately limit the telecom-services industry’s profit margins.

Some skeptics of the AI stock-market boom believe a similar fate awaits the Magnificent Seven. They argue, according to Reid, that AI is a general-purpose technology, like the steam engine or electricity. As such, the benefits will likely be more evenly distributed across all companies, rather than being concentrated in a small group of elite firms simply because they pioneered the technology.

To be sure, several factors set the AI darlings of today apart from the telecom giants of the late 1990s. Perhaps the most obvious is that many telecom firms assumed very large debt loads to finance the laying of fiber-optic cables and the purchase of expensive mobile licenses, Reid said.

By comparison, the AI darlings of today have much stronger balance sheets, and increases in capital expenditures and other expenses have generally grown alongside revenue and free cash flow. What’s more, their products have stronger brand identities and value, and they benefit from a robust network effect that keeps users locked into their respective ecosystems.

They also don’t directly compete with one another, at least not as far as their AI businesses are concerned, although there is some overlap, Reid said.

To be sure, a lot has changed in the telecommunications-services space since 1996. The industry was absorbed into the newly created S&P 500 communications-services sector

XX:SP500.50

back in 2018.

Today, the telecom-services industry classification includes just three companies: Verizon Communications Inc.

VZ,

AT&T Inc.

T,

and T-Mobile US Inc.

TMUS,

These companies fetch modest valuations compared to the days when companies like Lucent Technologies and its competitors dominated the U.S. stock market.

Furthermore, the notion that only a handful of companies have benefited from the AI boom is a bit misleading. While the Magnificent Seven drove the bulk of the S&P 500’s advance last year, a team of analysts at Bespoke Investment Group recently pointed out that 67 AI-linked stocks in the S&P 500 have gained 45.3%, on average, since the end of November 2022, when the first version of ChatGPT was publicly released.

See: AI stocks in the S&P 500 have outperformed this year — and not just the ‘Magnificent Seven’

The AI theme took a hit on Tuesday as U.S. markets reopened following a long holiday weekend. Chip maker and AI darling Nvidia Corp.

NVDA,

fell more than 4.3%, its biggest daily drop since October, as investors awaited the latest quarterly-earnings report from the company, due out after the bell on Wednesday.

U.S. stocks finished lower, with the S&P 500

SPX

down 30.06 points, or 0.6%, to 4,975, while the tech-heavy Nasdaq Composite

COMP

shed 144.87 points, or 0.9%, to 15,630.78. The Dow Jones Industrial Average

DJIA,

meanwhile, fell 64.19 points, or 0.2%, to 38,563.80.