This post was originally published on this site

https://images.mktw.net/im-02791006Nvidia’s shares are up in premarket trade Friday. End of message.

It seems the job of a macro-market analyst has never been easier. As go Nvidia’s fortunes so goes the S&P 500

SPX.

AI mind control is already here.

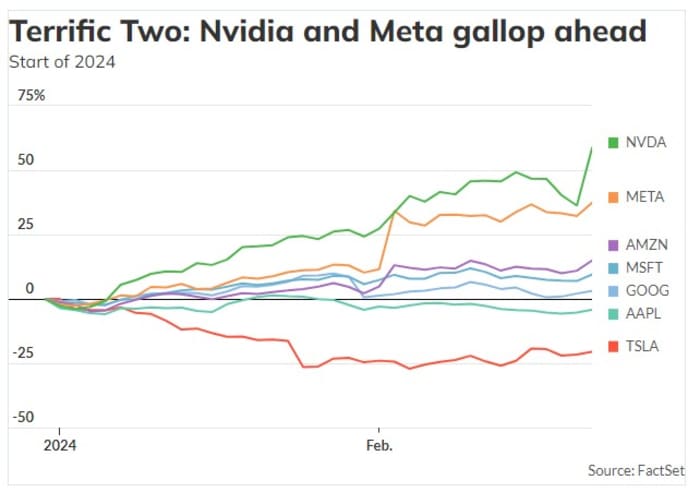

It wasn’t too long ago that it was the Magnificent Seven who corralled, then drove sentiment. But that posse is no longer a coherent force.

“R.I.P. Magnificent Seven Era” is the title of a new note from Jones Trading’s chief market strategist Mike O’Rourke, who says he came up with the moniker for big-tech in spring 2023.

It’s here we should note that some think it was Bank of America’s Michael Hartnett who first used the Mag 7 description for Alphabet

GOOG,

Amazon.com

AMZN,

Apple

AAPL,

Meta Platforms

META,

Microsoft

MSFT,

Nvidia

NVDA,

and Tesla

TSLA,

No matter, O’Rourke’s new reasoning is apposite. Simply put, he thinks Nvidia and Meta should strike out on their own given recent events. The Terrific Two, perhaps? …….Okay, sure, we can work on that.

“It was last April when we coined the term ‘Magnificent Seven’ to encapsulate the seven largest stocks in the S&P 500 as they drove 88% of the index’s gains in the first 4 months of 2023,” he writes in the note published late Thursday. “Today’s events, along with others that unfolded thus far in February 2024, have sown the seeds for the end of that remarkable run.”

The $277 billion of market cap that Nvidia added Thursday is a record that beats the previous$196 billion one set by Meta earlier this month, says O’Rourke.

“These two companies, along with these moves, are playing a prominent role in slaying the Magnificent Seven as we know them,” he adds. The main reason is that this results season has shown a clear divergence in the earnings performance of the Mag 7, he says.

For example, Nvidia stock is now trading on 33 times readily achievable forward earnings projections. “Historically, semiconductors are a cyclical business in which their multiple should shrink as they go higher, but this is a market that enthusiastically awards 35x plus multiples to Trillion Dollar enterprises,” says O’Rourke.

As for Meta, Mark Zuckerberg’s flirtation with the metaverse has been reined in, costs have been trimmed and the generally highly profitable company is well-positioned to exploit AI, O’Rourke reckons. The forward earnings multiple is 24.4, with only Google in the Mag 7 sporting a lower one.

“This earnings season has shown that Nvidia and Meta Platforms have both lower multiples and significantly faster growth than other Magnificent Seven names, and that is why other members will be deemed less attractive given their expensive multiple and megacaps status,” says O’Rourke.

As for Google’s parent, the stock offers “a respectable combination of value and growth for this group, but hardly appetizing unless it delivers on AI.” And Amazon trades at more than 40 times forward earnings with 11% revenue growth and 44% earnings per share growth, but “neither metric tells the true picture of the company and the actual numbers are likely to be vastly different,” says O’Rourke.

Then there’s Microsoft, a $3 trillion company trading on more than 35 times forward earnings that are only expected to grow by 9.5% over the next four quarters.

Particularly ripe for ejection from the Mag 7 posse are Apple and Tesla, says O’Rourke. Apple shares are down since reporting earnings earlier this month, but still trade on a multiple of 28 times forward earnings that are forecast to grow just 1% this year. “That is hardly enticing for a behemoth of this size,” he says.

Tesla faces a slowing EV sector and its earnings are forecast to slightly decline while the shares still trade on 65 times forward earnings. The company has only maintained its Mag 7 status because of a remarkable past stock performance, O’Rourke reckons.

And so R.I.P the Mag 7. “When the valuation and growth prospects become this distorted among leadership names, investors will start rotating towards the winners and maybe even look elsewhere for new opportunities,” says O’Rourke.

The era in which the Magnificent Seven “wholly drive S&P 500 gains has drawn to a close.”

Markets

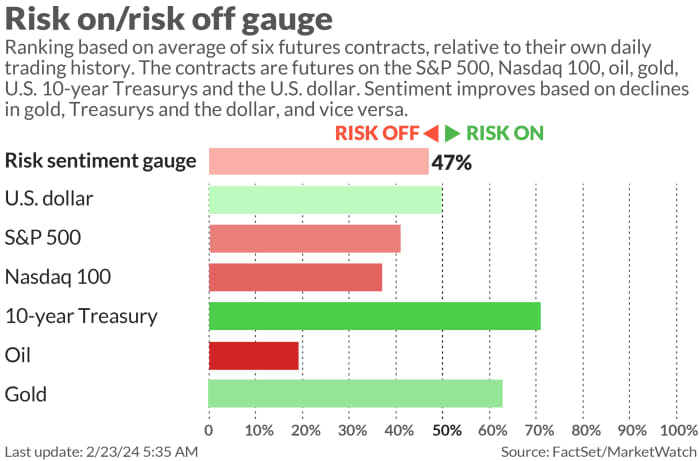

U.S. stock-index futures

ES00,

NQ00,

are higher as benchmark Treasury yields

BX:TMUBMUSD10Y

dip a tad. The dollar

DXY

is a bit weaker, while oil prices

CL.1,

fall and gold

GC00,

trades around $2,025 an ounce.

| Key asset performance | Last | 5d | 1m | YTD | 1y |

| S&P 500 | 5,087.03 | 1.14% | 3.94% | 6.65% | 26.79% |

| Nasdaq Composite | 16,041.62 | 0.85% | 3.42% | 6.86% | 38.40% |

| 10 year Treasury | 4.349 | 6.45 | 20.55 | 46.77 | 39.56 |

| Gold | 2,027.80 | 0.12% | 0.48% | -2.12% | 11.54% |

| Oil | 77.55 | -0.88% | -0.87% | 8.72% | 1.44% |

| Data: MarketWatch. Treasury yields change expressed in basis points | |||||

For more market updates plus actionable trade ideas for stocks, options and crypto, subscribe to MarketDiem by Investor’s Business Daily.

The buzz

Warner Bros. Discovery

WBD,

shares are sliding 9% after the media company posted a wider-than-expected fourth-quarter loss and revenue that fell short of estimates, weighed down by weak ad revenue and the impact of the recent writers and actors’ strikes.

Intuitive Machines

LUNR,

stock is surging 30% in premarket after the space-exploration company’s Odysseus spacecraft became the first commercial lander to successfully reach the moon.

Block

SQ,

delivered a surprise profit after the market closed Thursday and shares of the Square parent company are jumping 13%. Booking Holdings

BKNG,

results were not so well received and the stock is off 9%.

There are no notable U.S. economic data points released this Friday. Even Fed officials seem to be taking a day off from chatter.

Best of the web

How German football fans took on investors and won.

As trading frenzies grip penny stocks, criticism of Nasdaq grows.

How Wall Street banks fought to keep control of a profitable but secretive trading business.

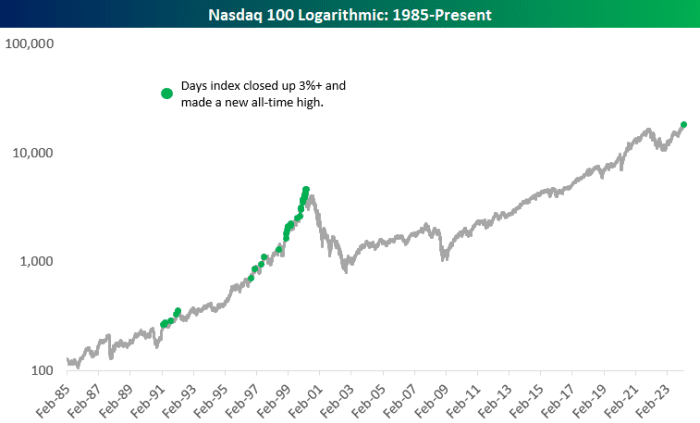

The chart

The Nasdaq 100

NDX

jumped 3% to a new high on Thursday. The chart below from Bespoke Investment has green blobs showing all the times that has happened —the previous one occurring on 3/2/2000.

Source: Bespoke Investment Group

“March 2000 certainly wasn’t a good day to suddenly turn bullish on the Nasdaq,” says Bespoke.

Top tickers

Here were the most active stock-market tickers on MarketWatch as of 6 a.m. Eastern.

| Ticker | Security name |

|

NVDA, |

Nvidia |

|

TSLA, |

Tesla |

|

SMCI, |

Super Micro Computer |

|

LUNR, |

Intuitive Machines |

|

AMD, |

Advanced Micro Devices |

|

AAPL, |

Apple |

|

AMZN, |

Amazon.com |

|

NIO, |

NIO ADR |

|

CVNA, |

Carvana |

|

PLTR, |

Palantir Technologies |

Random reads

Predictable problems. MLB’s see-through pants.

It’s a dog’s (not quite so long) life.

I love the smell of productivity in the morning.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.