This post was originally published on this site

https://images.mktw.net/im-783732Welcome back to Distributed Ledger. This is Frances Yue, crypto and markets reporter at MarketWatch.

Ether

ETHUSD,

has outperformed bitcoin so far this year. However, the second-largest cryptocurrency is further off its all-time high than is bitcoin

BTCUSD,

Ether is more than 40% lower than its record high of $4,686, while bitcoin is roughly 26% lower than its all-time high of $68,990, according to CoinDesk data. Both cryptocurrencies’ prices peaked in November 2021.

Still, ether is likely to reach a new record high this year, according to Jeff Owens, co-founder of layer1 blockchain Haven1.

Find me on X at @FrancesYue_ to share any thoughts on crypto or the newsletter.

Ether to rally?

On March 13, the Ethereum network is set to see a major upgrade, called Dencun, which could bring the biggest changes to the blockchain since last April, when the Shanghai upgrade was carried out.

The Dencun upgrade will make it less expensive to conduct transactions on networks built on top of Ethereum, by offering designated space to store data.

That, coupled with optimism around the potential approval of exchange-traded funds investing directly in ether, will provide tailwinds for the cryptocurrency to possibly surpass its record high this year, Owens wrote in emailed comments.

A number of asset managers, such as BlackRock

BLK,

Franklin Templeton, VanEck, Grayscale Investments, Ark Invest and 21Shares, have filed applications for spot ether ETFs, which are pending approval from the U.S. Securities and Exchange Commission.

James Seyffart, ETF research analyst at Bloomberg Intelligence, said he sees May 23 as the most important date to watch for the fate of spot ether ETFs in the medium term. That is the final deadline for the SEC to decide whether or not to approve VanEck’s ether ETF application.

Martin Leinweber, digital asset product strategist at MarketVector Indexes, said he thinks it’s more likely that the SEC will approve ether ETFs in the second half of this year than in May.

The path for ether ETFs “is a little bit more unclear than that for bitcoin ETFs,” Leinweber said in a phone interview.

SEC Chair Gary Gensler has repeatedly said that bitcoin is the only cryptocurrency he’s willing to publicly label as a commodity.

Ether’s price also faces headwinds as Ethereum faces competition from other similar blockchains, such as Solana, with some supporters of the latter arguing that the network is much faster and cheaper, Leinweber said.

Smaller crypto to catch up?

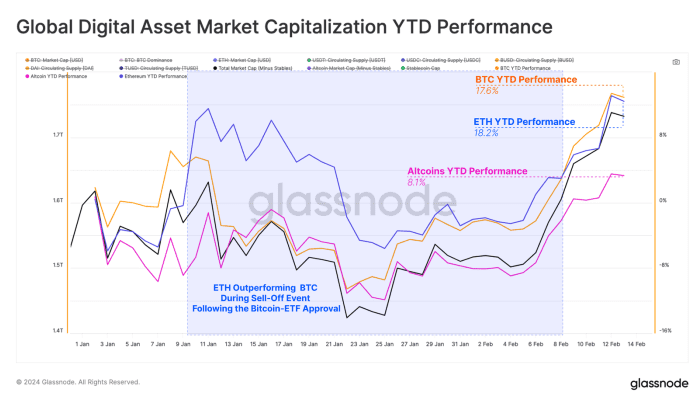

The prices of smaller coins have been lagging behind the largest two cryptocurrencies by market cap so far this year, according to blockchain-data provider Glassnode.

Glassnode

That is to be expected for crypto bull markets, during which bitcoin usually leads the rally at first, while smaller coins outperform later, according to Leinweber.

“It will take a little more time until we get the shift [of the rally] from bitcoin to ether and then to the altcoins,” Leinweber said.

Crypto in a snap

Bitcoin gained 1.6% over the past seven days, and ether gained 8.8% during the same period, according to CoinDesk data.

Must-reads

- Winklevoss twins donate $4.9M to crypto super PAC Fairshake (Cointelegraph)

- Crypto Tycoon Do Kwon Should Be Extradited to U.S., Montenegro Court Rules (The Wall Street Journal)