This post was originally published on this site

https://i-invdn-com.investing.com/news/LYNXMPEDAF0YT_M.jpgInvestingPro users get all market reports first. Subscribe now for up to 50% off part of our New Year’s sale and never miss another market-moving headline.

Ford Motor (NYSE:F) is expected to report its Q4/23 earnings on Feb 6, after the market close. Analysts forecast an EPS of $0.12 and revenues of $41.4 billion.

Earlier this month, Morgan Stanley reiterated an Overweight rating and $15.00 price target on Ford and named it their new top pick in US autos.

The firm commented:

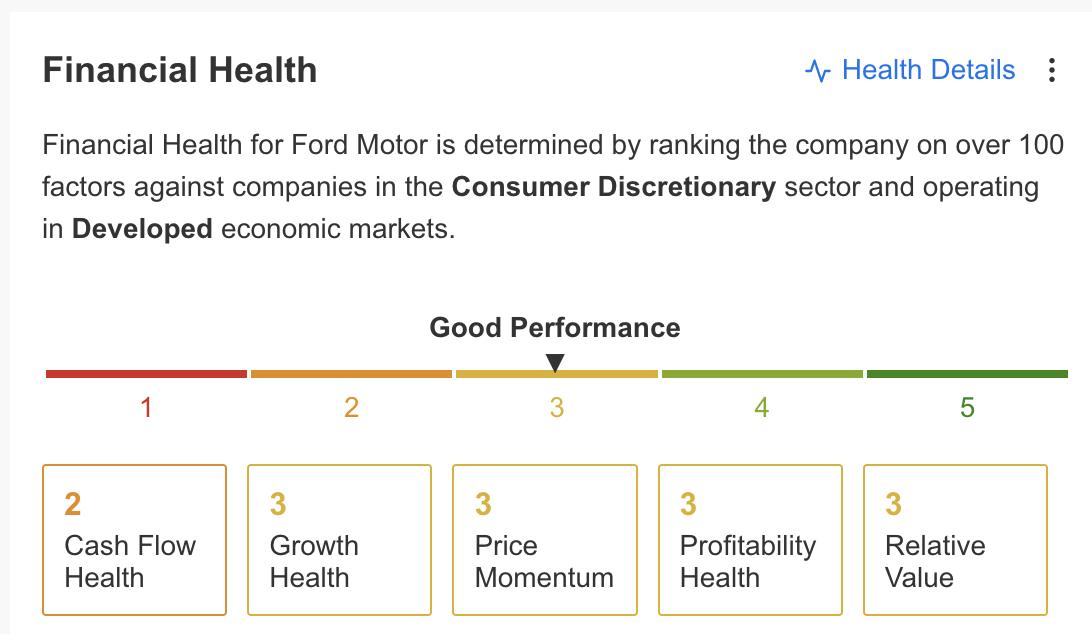

Going into earnings, Ford’s Financial Health on InvestingPro, which is determined by ranking the company on over 100 factors against companies in the Consumer Discretionary sector and operating in Developed economic markets, scores a ‘Good Performance’.

PayPal (NASDAQ:PYPL) is set to report earnings for Q4/23 on Feb 7, post-market close. Wall Street analysts expect the company to post an EPS of $1.36 and revenues of $7.88B for the quarter.

Earlier this week, the company announced a workforce reduction of about 9%, as reported by Bloomberg News, in a move attributed to restructuring initiatives led by new CEO Alex Chriss.

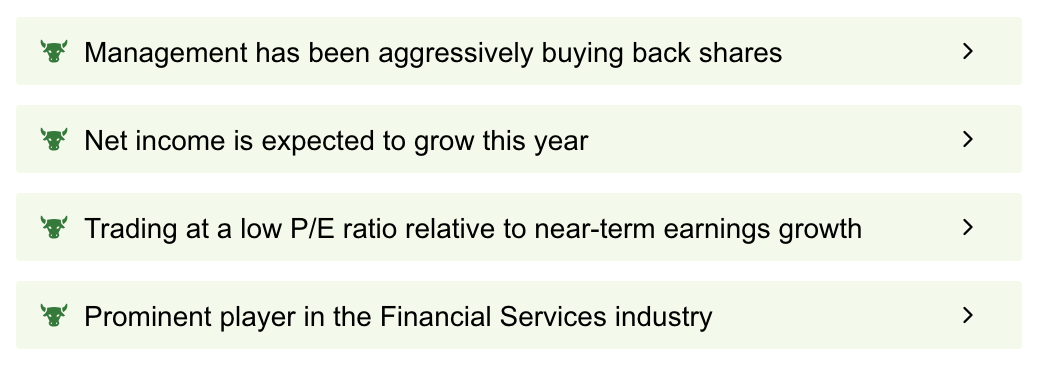

Our ProTips – exclusive to InvestingPro users – underline PayPal’s strengths, including management’s aggressive share buyback, expected net income growth this year, and low P/E ratio relative to near-term earnings growth.

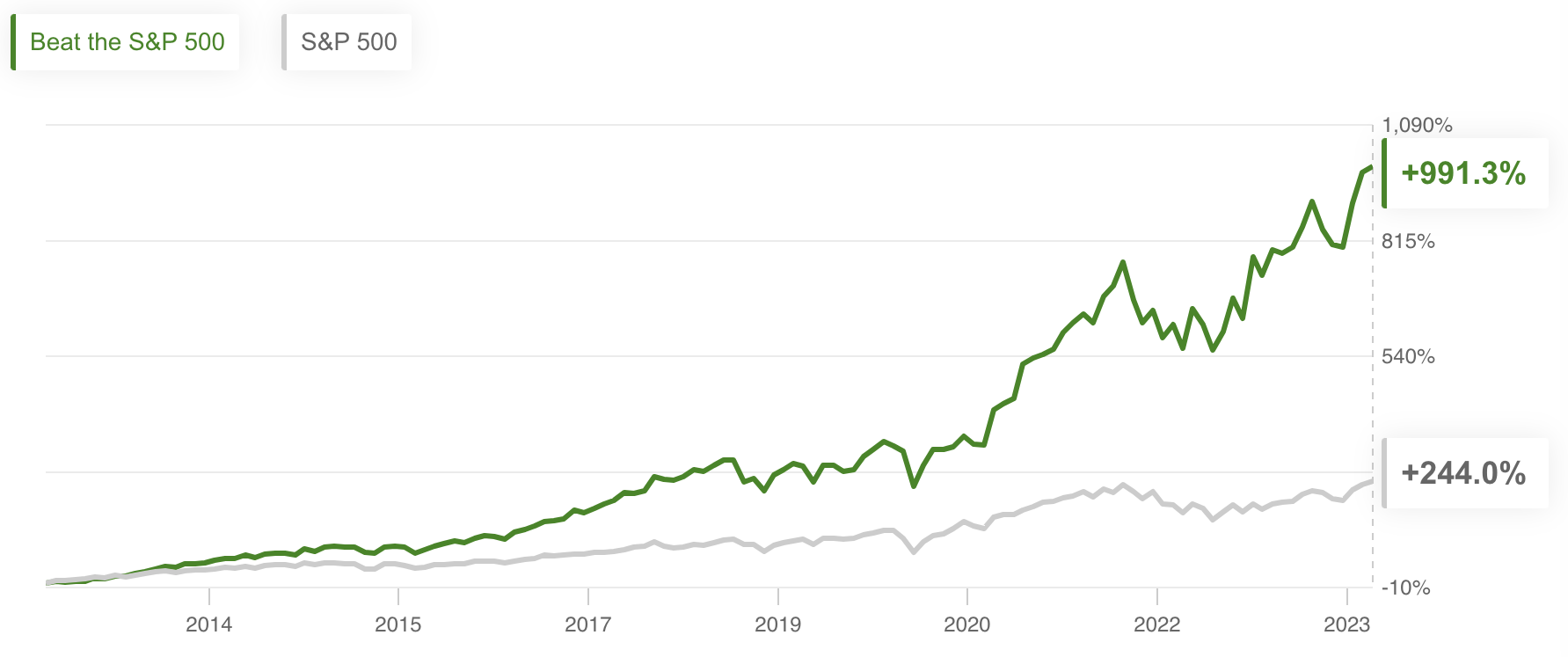

PayPal has been an integral part of our ProPicks Beat the S&P 500 strategy. Powered by advanced AI technology, strategy outperformed the market by a lofty 747.3% over the last decade.

Want to see more market-beating picks? Subscribe here for up to 50% off as part of our New Year’s sale and see all 70+ market-beating AI-picked stocks from our strategies.

*Readers of this article get an extra 10% off our annual and 2-year Pro plans with codes PROPICKS2024 and PROPICKS20242.

Walt Disney (NYSE:DIS) is expected to report earnings for Q1/23 on Feb 7, after the market close. Street estimates stand at $1.04 for EPS and $23.8B for revenues.

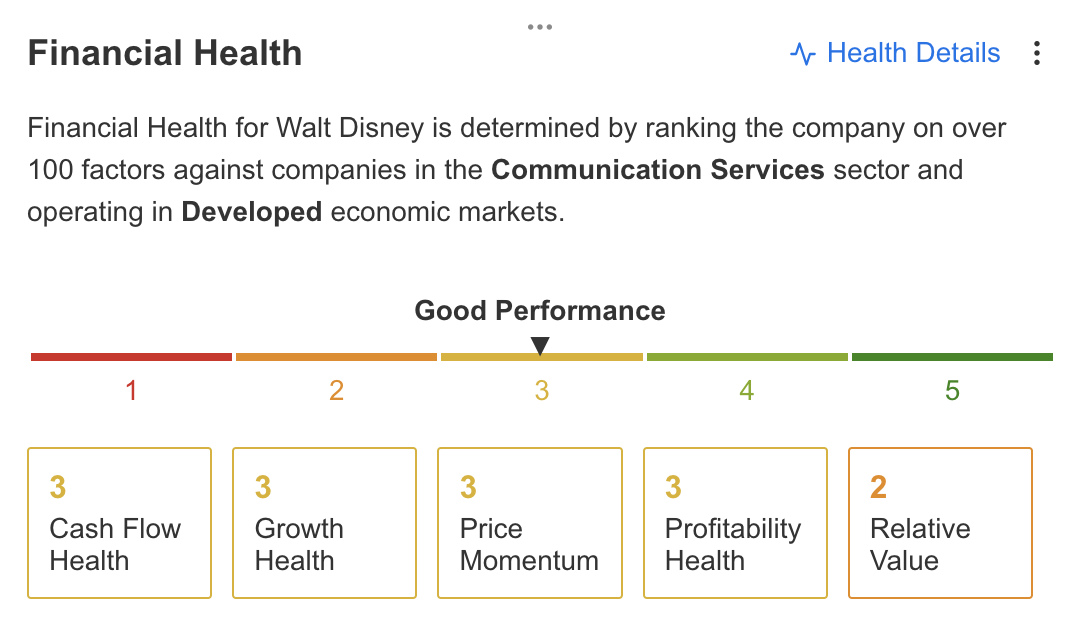

According to InvestingPro’s Financial Health section, which is determined by ranking the company on over 100 factors against companies in the Communication Services sector and operating in Developed economic markets, Disney exhibits a ‘Good Performance’.

Investors will be keenly interested in Burbank, California-based company’s capacity to increase its Disney+ subscriber count. They anticipate insights from the report will provide clues about the feasibility of Disney’s plan to attain profitability in this segment by the end of the fiscal year.

Moreover, the market will be paying particular attention to the company’s strategy to trim expenses and decrease content-related spending, all the while meeting the rising demands of consumers.

Snap (NYSE:SNAP) is expected to report earnings for Q4/23 on Feb 6, after the market close. Street estimates stand at $0.06 for EPS and $1.38B for revenues.

Most recently, in January, the company earned two upgrades. Deutsche Bank upgraded Snap from Hold to Buy with a price target of $19.00 (from $10.00), noting they see a clear, strong catalyst path toward upward revenue and EBITDA revisions.

Meanwhile, OTR Global upgraded Snap from Mixed to Positive.

Institutions and billionaire investors worldwide are already well ahead of the game when it comes to AI-powered investing, extensively using, customizing, and developing it to bulk up their returns and minimize losses.

Now, InvestingPro users can do just the same from the comfort of their own homes with our new flagship AI-powered stock-picking tool: ProPicks.

With our six strategies, including the flagship Beat the S&P 500, which outperformed the market by a lofty 747% over the last decade, investors have the best selection of stocks in the market at the tip of their fingers every month.

*Readers of this article get an extra 10% off our annual and 2-year Pro plans with codes PROPICKS2024 and PROPICKS20242.