This post was originally published on this site

https://images.mktw.net/im-76790734If the past is any guide, the S&P 500 index could continue to power higher in 2024 after posting strong returns in January, according to an analysis from Bespoke Investment Group.

A team of stock-market analysts at Bespoke found that typically when the S&P 500

SPX

is trading in positive territory for the month so far, that the index continues to climb during the final four trading days of January.

And when the index finishes January in the green, the chances of it continuing to advance for the rest of the year improve dramatically.

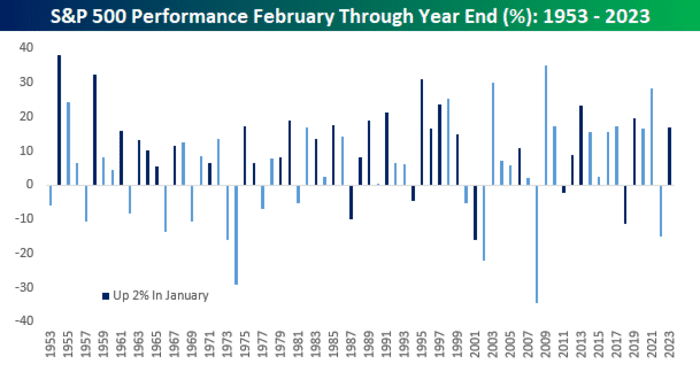

Since 1953, the year that the current five-day trading week first arrived in the U.S. stock market, when the S&P 500 was up 2% or more in January, its median performance for the rest of the year was a gain of 13.5%, Bespoke analysis said, in a report shared with MarketWatch on Friday.

Furthermore, the index recorded positive returns for the balance of the year 84% of the time. All told, the index has finished January up 2% or more 31 times between 1953 and 2023, the Bespoke team showed.

BESPOKE INVESTMENT GROUP

A new year marks a fresh start for markets, which has made the first few weeks of each year prone to scrutiny by investors looking to read the tea leaves over the next 11 months.

Read: Stocks lost money over the first 5 trading days of January. What does this mean for 2024?

To be sure, the index’s prospects for the rest of the year are typically far less rosy when it finishes January with weaker gains, or in the red. When the S&P 500 finishes January with a gain of less than 2%, its median performance for the rest of the year drops to 6.4%, with positive returns materializing just 68% of the time.

The S&P 500 has gained 2.5% since the beginning of January, according to FactSet data. The index is on track to finish lower on Friday, and was down 0.1% at 4,887 heading into the final 90 minutes of trading for the week.