This post was originally published on this site

https://images.mktw.net/im-23435245The traditional portfolio of stocks and bonds has been on a tear over the past two months as the S&P 500 nears a record high, but it’s the big gains in fixed income that stand out, according to Bespoke Investment Group.

Fixed-income assets are typically the “insurance” part of the classic 60-40 portfolio, usually holding up during market weakness even if that wasn’t the case in 2022, Bespoke said in a note emailed Thursday. Both stocks and bonds in the U.S. have rallied during the fourth quarter and are up so far in 2023.

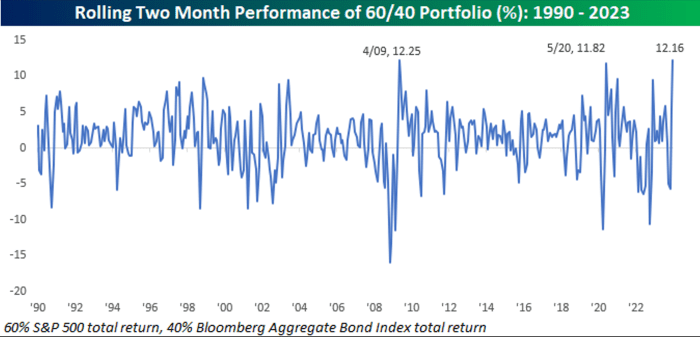

“With just two trading days left in the year, the market is on the verge of history,” Bespoke said. “After being written off for dead in the last year, the traditional 60/40 portfolio of 60% stocks and 40% bonds is within a whisker of its best two-month rally since at least 1990.”

Read: ‘The switch was flipped’: ETF flows pick up as stocks, bonds head for 2023 gains

In 2022, bonds failed to provide a cushion in the 60-40 portfolio as the Federal Reserve aggressively raised interest rates to battle surging inflation. Stocks and bonds tanked last year, with the S&P 500

SPX

seeing its ugliest annual performance since 2008, when the global financial crisis was wreaking havoc in markets.

Over the past two months, the classic 60-40 mix has seen a gain of 12.16% based on the total returns of the S&P 500 and Bloomberg Aggregate Bond Index, according to Bespoke. The current rolling two-month performance is stronger than gains seen in the two-month rally after the onset of the Covid-19 pandemic through May 2020, the firm found.

BESPOKE INVESTMENT GROUP NOTE EMAILED DEC. 28, 2023

“The only other period that was better for the strategy was the two months ending in April 2009,” the firm said. “Back then, the strategy rallied 12.25%, so if the next two trading days even see marginal gains, the current rally will set the record.”

Bonds surge

The Vanguard Total Bond Market ETF

BND

and iShares Core U.S. Aggregate Bond ETF

AGG

have each seen a total return of slightly more than 7% this quarter through Wednesday, according to FactSet data.

That puts the Vanguard Total Bond Market ETF on track for its best quarterly performance on record, while the iShares Core U.S. Aggregate Bond ETF is heading for its biggest total return since 2008, FactSet data show. The iShares Core U.S. Aggregate Bond ETF gained a total 7.4% in the fourth quarter of 2008.

In April 2009, “the bond leg” of the 60-40 portfolio was up just 1.87% on a rolling two-month basis, while in May 2020 it gained 2.25%, the Bespoke note shows.

“During this current period, bonds have rallied an unprecedented 8.87%, which far exceeds any other two-month period since at least 1990,” the firm said. “While they still underperformed stocks in the last two months, they have never acted as a smaller drag on the strategy during a period of strength.”

Bespoke found that the S&P 500, a gauge of U.S. large-cap stocks, is up 14.35% over the last two months on a total-return basis, “which is certainly strong relative to history but not anywhere close to a record.”

The U.S. stock market was trading slightly higher on Thursday afternoon, with the S&P 500 up 0.2% at around 4,791, according to FactSet data, at last check. That’s within striking distance of the index’s closing peak of 4,796.56, reached Jan. 3, 2022, according to Dow Jones Market Data.

As stocks were inching higher Thursday afternoon, shares of both the Vanguard Total Bond Market ETF and iShares Core U.S. Aggregate Bond ETF were trading down modestly, according to FactSet data, at last check.

The yield on the 10-year Treasury note

BX:TMUBMUSD10Y

was rising about seven basis points on Thursday afternoon, at around 3.85%, but is down so far this quarter, FactSet data show. Bond yields and prices move in opposite directions.

Bond prices are rallying as many investors anticipate the Fed is done hiking rates — and may begin cutting them sometime next year — as inflation has fallen significantly from its 2022 peak.

As for year-to-date gains, the S&P 500 has surged 26.6% on a total-return basis through Wednesday, while the iShares Core U.S. Aggregate Bond ETF has gained a total 6.1% over the same period, FactSet data show.