This post was originally published on this site

https://images.mktw.net/im-63559076

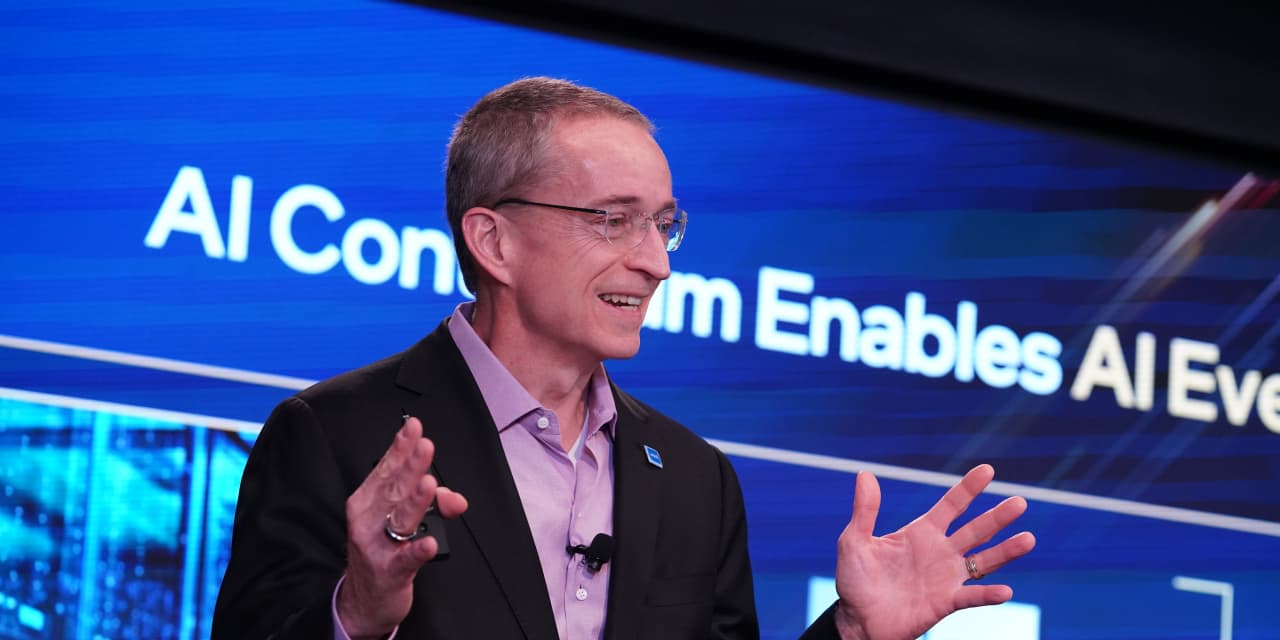

Intel Corp.’s bear camp got a little smaller Friday as a BofA Securities analyst ended his negative call on the stock.

BofA’s Vivek Arya still has concerns about Intel

INTC,

including that there’s limited upside in the PC market and that the company is shedding server market share to Advanced Micro Devices Inc.

AMD,

and ARM Holdings PLC

ARM,

But he’s feeling more encouraged about other areas of the business, including its Mobileye autonomous-driving unit and its foundry plans.

See also: Intel announces new PC, server chips designed for AI uses

What’s more, Arya thinks that Intel is undervalued on a sum-of-the-parts basis. That could change as the company moves to separate its design and manufacturing financials early next year.

“This should help compare each business unit to its respective [comparables],” he noted.

Additionally, Intel has signaled an interest in spinning off its field-programmable gate-array business into a separate public company, “potentially gearing up the stock for a revaluation on a sum-of-the-parts basis,” Arya said.

He upgraded the stock to neutral from underperform in his latest note, while lifting his price objective to $50 from $32.

Arya also changed his thinking on shares of AMD, boosting his rating to buy from neutral and upping his price objective to $165 from $135.

“We view AMD as well-positioned to gain incremental share of the hugely profitable $100 billion-plus accelerator market while continuing to make progress in server [central processing units] against incumbent [Intel],” he wrote.

Nvidia Corp.’s stock

NVDA,

is still his preferred way to play compute and artificial-intelligence trends, but Arya said that AI and generative AI “are multi-year phenomena and represent opportunities for many.”

Read: Could Nvidia’s stock — up 231% this year — actually be a bargain?

AMD shares were up 0.6% late in Friday’s session, while Intel’s stock was ahead 1.9%.