This post was originally published on this site

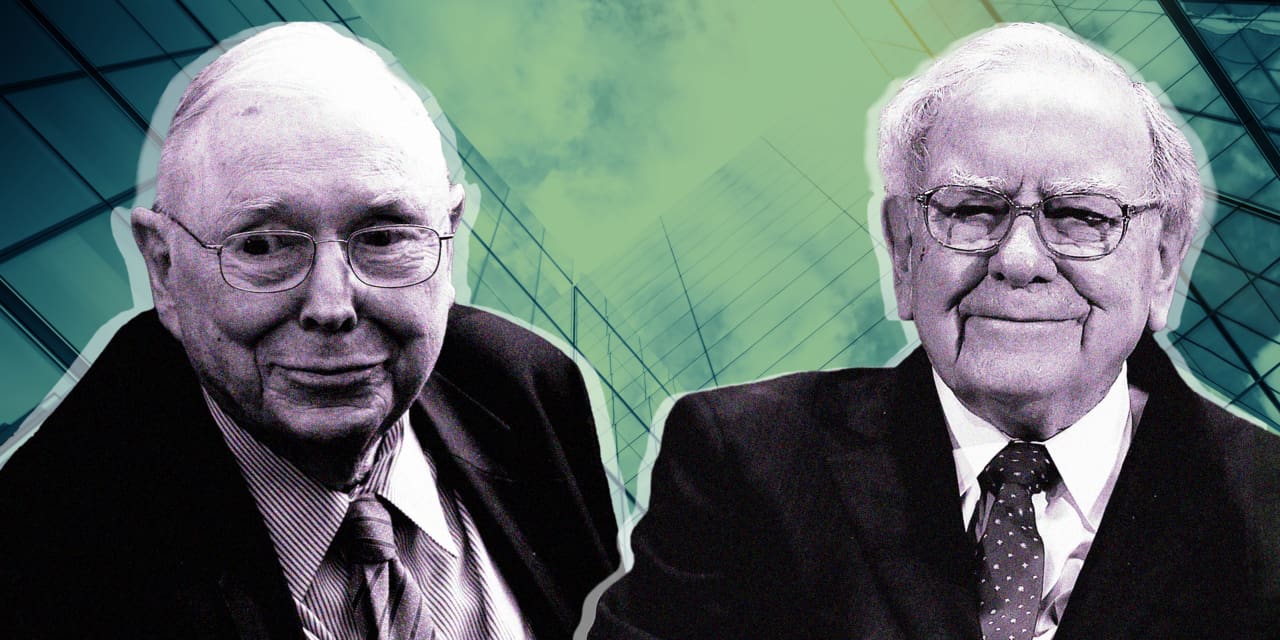

Charlie Munger’s death will likely put pressure on Berkshire Hathaway Inc. Chairman Warren Buffett to provide more detail about the investing activity of two key understudies.

“You begin a pivot to Todd Combs and Ted Weschler,” Bill Smead, chief investment officer at Smead Capital Management, a longtime Berkshire shareholder, said in a phone interview. Combs and Weschler together run about 10% of Berkshire’s $350 billion investment portfolio.

While Berkshire remains the 93-year-old Buffett’s show, a lack of detail around the performance and approach of Combs and Weschler has been a frustration, Smead said. That will likely change as Munger’s absence leaves a huge “void.”

“They will become Buffett’s alter ego rather than Munger,” he said.

See: Charlie Munger’s death ends partnership with Warren Buffett that built Berkshire Hathaway

Smead said that could mean a role for the pair at Berkshire’s annual meeting in Omaha, where Buffett and Munger famously held court each May in hourslong question-and-answer sessions that informed and delighted shareholders and, in recent years, a worldwide audience.

Buffett and Munger “were generous and open” about their investing process, Smead said. While Combs and Weschler appear to be excellent stock pickers who share their mentors’ mindset, they remain something of a mystery, he said.

A Berkshire Hathaway representative said it was too soon to say what changes may be in store for the annual meeting.

Munger, 99, died Tuesday at a California hospital, Berkshire Hathaway announced Tuesday afternoon. Buffett and Munger were known to talk by phone for hours a day. Buffett, 93, often described Munger as his “right-hand man,” who helped shape Berkshire’s investing approach.

Berkshire shares were little changed Wednesday. Class A shares

BRK.A,

were up 0.1% on Wednesday, while Class B shares

BRK.B,

rose 0.2%. Berkshire shares are up nearly 17% so far in 2023, versus a gain of more than 18% for the S&P 500

SPX.

Munger’s death didn’t take Berkshire Hathaway shareholders by surprise, but the end of perhaps the most significant partnership in the history of modern investing inevitably raises important questions for investors.

“My feeling is that Berkshire is not going to be able to replace Charlie Munger and nor do I anticipate they’re going to try,” said Cathy Seifert, an analyst at CFRA Research, who has a buy rating on Berkshire Hathaway.

But the long-serving vice chairman was such a crucial element to the success of Berkshire Hathaway that investors in the near-term will likely be looking for any sign the loss is having an impact on Buffett, she said in a phone interview.

Seifert, in a client note late Tuesday, said that Munger’s passing “could test (to a degree) transition plans Berkshire established several years ago, though we do not expect any significant issues to arise.”

Berkshire in 2021 confirmed that Greg Abel, who oversees Berkshire’s noninsurance operations, will be Berkshire’s post-Buffett CEO. Aijit Jain is expected to continue running the insurance businesses after Buffett leaves the scene, while Combs and Weschler are expected to head up investment operations, according to Barron’s.

Investors should also pay attention to appointments to Berkshire’s board after a number of recent departures, Seifert said. She expects there to be pressure to add more diverse members to the board.

Opinion: Who will say no to Warren Buffett now that Charlie Munger is gone?