This post was originally published on this site

Applied Materials Inc.’s stock dropped more than 7% in extended trading Thursday after a report that the chip maker is under a criminal investigation by the Justice Department for potential export violations.

Reuters reported Thursday that the company is being probed for possibly sending hundreds of millions of dollars’ worth of equipment to Chinese chip maker Semiconductor Manufacturing International Corp. through South Korea as a way to evade a ban on U.S. exports of advanced chip technology to China.

“The company is cooperating with the government and remains committed to compliance and global laws, including export controls and trade regulations,” Applied Materials said in a statement.

That news overshadowed a positive earnings report, as Applied Materials on Thursday afternoon reported quarterly results that topped analysts’ revenue and earnings estimates.

Applied

AMAT,

reported fiscal fourth-quarter net income of $2 billion, or $2.38 a share, compared with net income of $1.6 billion, or $1.85 a share, in the year-ago quarter. Adjusted earnings were $2.12 a share.

Net sales were $6.72 billion, down from $6.75 billion a year ago.

Analysts surveyed by FactSet had expected on average net earnings of $1.99 a share on revenue of $6.52 billion.

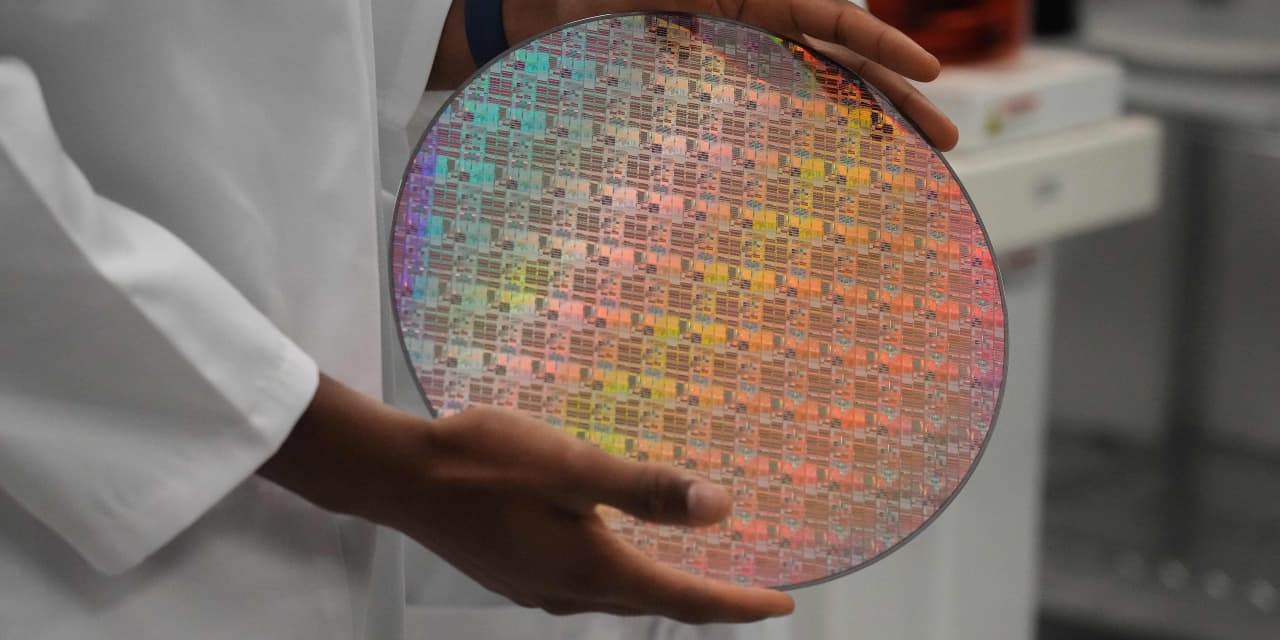

“Applied Materials delivered record revenue, earnings and cash flow in fiscal 2023 and is outgrowing the wafer fabrication equipment market for the fifth year in a row,” company CEO Gary Dickerson said in a statement announcing the results.

The company offered fiscal first-quarter earnings guidance of $1.72 to $2.08 a share. Analysts polled by FactSet are expecting on average $1.84 a share.

Shares of Applied have soared 59% this year, while the broader S&P 500 index

SPX,

has increased 17%.

Mike Murphy contributed to this report.