This post was originally published on this site

Microsoft Corp.’s protracted, circuitous bid to acquire Activision Blizzard Inc. not only changed the gaming market but most likely upended potential future moves by federal regulators to block vertical deals, a central tenet of their antitrust campaign against Big Tech in the past few years.

Indeed, the $69 billion megadeal, the largest consumer-tech acquisition since AOL bought Time Warner for $182 billion in 2000, shatters a recent push by the Federal Trade Commission in particular to curb the growth of Big Tech.

For a decade, Big Tech has gotten even bigger through so-called vertical deals that let companies expand into new business lines. In addition to Microsoft’s

MSFT,

acquisition of Activision, examples include Amazon.com Inc.’s

AMZN,

$13.4 billion purchase of Whole Foods in 2017 and the 2014 acquisitions by Facebook

META,

as the company was then known, of photo-sharing app Instagram for $1 billion and messaging service WhatsApp for $19 billion.

Of 24 billion-dollar tech deals since 2013, 20 are classified as vertical transactions, according to market researcher Dealogic.

Read more: Microsoft’s Activision Deal Gets Green Light From UK Regulator

The mantra among Big Tech seems to be “merge now while you can,” because the law makes it hard to derail vertical deals. “It is almost near impossible,” Abiel Garcia, former deputy attorney general for the state of California, said in an interview.

After relying for decades on a University of Chicago antitrust-law philosophy that holds that big business contravenes competition by creating higher prices for consumers and fewer product choices, federal regulators have shifted their strategy to a so-called neo-Brandeisian principle based on the impact of vertical deals that harm companies. That has been the overriding focus of FTC Chair Lina Khan and Jonathan Kanter, the top antitrust official at the Justice Department.

But so far that stratagem has flopped, and Microsoft’s deal to snap up Activision is another blow to Khan, who was appointed in 2021 promising to rein in Big Tech growth, and to Kanter. The FTC and the Justice Department have tried to block at least a dozen big deals over the past two years, with little success so far.

Microsoft-Activision is the latest example of a case that courts “have not bought into,” Garcia said, out of a reluctance to make precedent-setting decisions on vertical deals that would most likely to be overturned on appeal.

“It is hard to prove there is harm” with vertical deals, Garcia said. To deter if not stop Big Tech megadeals requires a congressional solution, he added, but there has been a dearth of significant tech legislation in the past two decades. Two bills that address stifled competition, innovation and oversight of tech acquisitions sit in the Senate, as they did in the previous session, with little momentum.

California, which has taken the national lead in protecting consumers’ digital privacy, is mulling what changes it can make to its antitrust laws.

Until that happens, the acquisition machine continues to run unabated. This year, Alphabet Inc.’s

GOOGL,

GOOG,

Google, Apple Inc.

AAPL,

and Meta Platforms Inc. have gobbled up nearly 200 companies in deals that were not reported because they don’t meet the $111. 4 million threshold established by the FTC under Section 7A of the Clayton Act.

“More cycles of acquisitions are likely, which could create larger and even more powerful digital ecosystems,” Diana Moss, former president of the American Antitrust Institute, warned in a study from early 2021. “Updated statistics show persistent under-enforcement of merger law in digital technology.”

How Microsoft persevered with Activision

Federal regulators have found themselves on the losing end of antiquated antitrust law, skeptical courts and canny concessions from Microsoft.

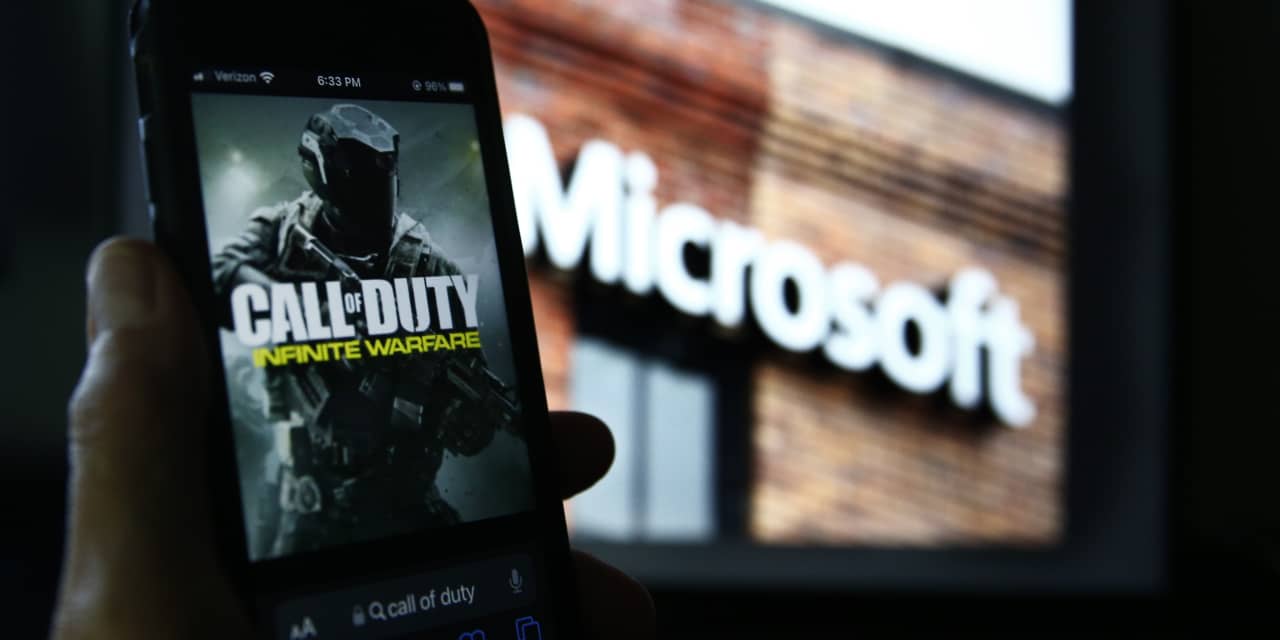

The software giant, which was ensnared in an antitrust saga with the Justice Department in the 1990s and early 2000s, made several compromises to get the current deal approved. It agreed to offer ongoing access to “Call of Duty,” one of Activision’s flagship games, on digital platforms from other companies such as Sony Group Corp.

6758,

and Nintendo Co.

7974,

Additionally, Microsoft said it will license part of Activision’s business with cloud gaming to a rival in the U.K.

The absence of new antitrust laws makes it even harder for regulators to win cases, contends Yuri Khodjamirian, chief investment officer for financial-services company Tema ETFs, who has written on the topic. “In many ways, antitrust law is quite backwards looking, while technology is forward-looking, as they often develop undefined markets such as cloud gaming,” he said.

“In Europe, a regulator like the European Commission does not have to prove its case in court. The EC is judge, jury and executioner. It has a lot of leeway,” said Khodjamirian, who resides in London.

Despite its latest setback in court and even as the Microsoft-Activision deal closed, the FTC intends to proceed with its challenge of the merger, according to a spokeswoman who deemed the deal a “threat to competition.”

The agency’s long-term goal may be to act as a deterrent to an industry that essentially had a rubber stamp to hoover up smaller companies for more than a decade, according to antitrust experts.

“Don’t just look at the win-loss record. The threat of federal action may deter deals and cause some companies to abandon acquisitions, legal experts say. The FTC has made it clear that companies will face opposition seven ways to Sunday,” Garcia said.

Ultimately, regulators are “trying to solve a societal problem without a legal solution. As a society, we have willfully made a pact with Big Tech for products and services,” Khodjamirian said. “People love Amazon products in exchange for our data, and some people want to walk that back.”

A 2021 Bain study concluded that tech acquisitions did not hurt competition or harm customer value. “When the facts are reviewed, most big tech M&A spending actually benefits consumers and doesn’t hamper competition. That’s according to Bain’s analysis of all $300 million-plus acquisitions, totaling more than $150 billion, from 2005 to 2020 by the five U.S. hyperscalers: Alphabet, Amazon, Apple, Facebook, and Microsoft,” it said.