This post was originally published on this site

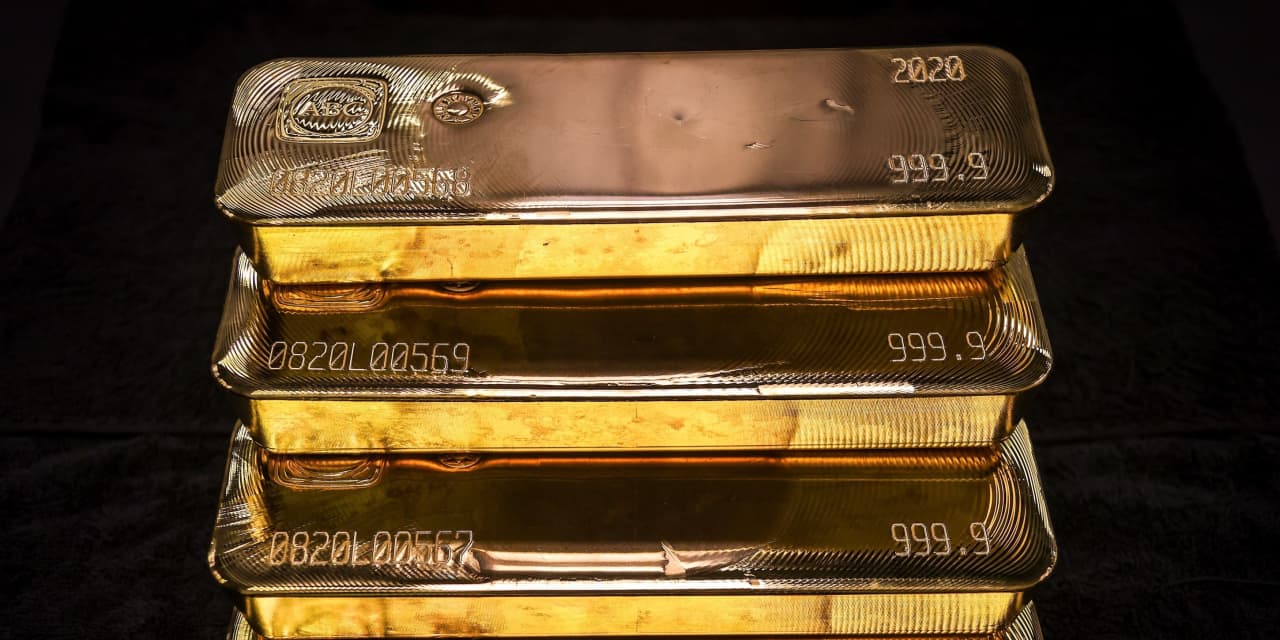

Gold futures ticked higher Friday, but remained on track for a weekly loss in the face of rising Treasury yields and a stronger U.S. dollar.

Price action

-

Gold for December delivery

GC00,

+0.23% GCZ23,

+0.23%

rose $4.90, or 0.3%, to $1,947.40 an ounce on Comex. The yellow metal was set for a weekly fall of 1%. -

December silver

SIZ23,

+0.19%

gained 7.5 cents, or 0.3%, to trade at $23.315, but was headed for a weekly pullback of more than 5%.

Market drivers

Strong U.S. economic data and a rally in oil prices to 2023 highs pushed up Treasury yields and strengthened the U.S. dollar this week on worries the Federal Reserve will need to raise interest rates further or leave them elevated for an extended stretch. Rising yields can be a negative for gold, raising the opportunity cost of holding a nonyielding asset, while a stronger dollar makes commodities priced in the unit more expensive to users of other currencies.

“Given that physical gold with its lack of yield is less attractive to investors and traders at times of high and rising rates, the next phase of ‘higher for longer’ interest rates looks challenging for gold’s ability to continue trading at such elevated levels,” said Rupert Rowling, market analyst at Kinesis Money, in a note.

While gold has pulled back from a high above $2,000 an ounce seen earlier this year, the $1,920 level remains very high historically, he said.

“The key factor that has kept gold so buoyant despite rising interest rates has been the fragility of market confidence but the longer the economic data continues to show that recession fears are overdone, the more trading activity will shift towards riskier assets and away from the ultimate haven asset in gold,” Rowling wrote.