This post was originally published on this site

The only thing that will make companies lower prices is if consumers stop complaining about paying more for the things they need and want, and actually start refusing to buy them.

As the U.S. corporate earnings reporting season progresses, with earnings from major retailers Walmart Inc.

WMT,

Target Corp.

TGT,

and Home Depot Inc.

HD,

on tap next week, investors can get a ground-floor view of how consumer demand may have been hurt, or not, by higher prices, and what the companies plan to do, or not do, about it.

This dynamic, of how consumers adjust their spending habits when prices change, is referred to by economists as the price elasticity of demand.

Those who trust companies will choose to ratchet down prices on their own, or at least not raise them because the rise in input costs have been slowing, haven’t been listening to what the many companies have told analysts in post-earnings conference calls.

Read: U.S. inflation eases again, PCE shows. Prices rise at slowest pace in almost two years.

Kraft Heinz Co.

KHC,

acknowledged after its second-quarter report that its relatively higher prices have hurt demand, but not by enough for the branded food and condiments company to consider cutting prices.

Colgate-Palmolive Co.

CL,

said it will continue to raise prices, even as inflation slows and selling volume declines, as the consumer-products company continues to be laser focused on boosting margins and profits.

And while PepsiCo Inc.

PEP,

was worried that elasticities would increase, given how its lower-income customers were being particularly pressured by inflation, the beverage and snack giant reported strong results as it witnessed “better elasticities” in most of the markets in which it operated.

“Obviously, there is still carryover pricing, and I don’t think we’ll do anything different than our normal cycles on pricing in the balance of the year,” PepsiCo Chief Financial Officer Hugh Johnston told analysts, according to an AlphaSense transcript.

Basically, as MarketWatch has reported, so-called “Greedflation” is still alive and well.

Jamie Cox, managing partner for Harris Financial Group, said as long as the job market stays strong, as it is now, corporate greed will continue to pay off.

“If something is more expensive, and you have a job, you’ll complain about it, but you won’t substitute it for something cheaper,” Cox said. For companies to cut prices, “you have to have the consumer go on strike, and they’re not there yet,” Cox added.

The reason elasticity is so important in the current environment is because as long as consumers continue to pay the higher prices companies are charging, inflation will remain stubbornly high, and the more likely the Federal Reserve will continue to raise interest rates, or at the very least not lower them.

But the longer interest rates stay high enough to crimp economic growth, the more likely the stock market will reverse lower as recession fears rise.

“At some point, people are going to say, all right enough,” said Paul Nolte, senior wealth manager and market strategist at Murphy & Sylvest Wealth Management. “But we just haven’t seen that yet.”

What is elasticity?

Economists use the term “price elasticity of demand” to refer to the way in which consumers adjust their spending habits when prices change.

“Elasticity tries to measure how much more producers will want to produce if prices rise, and how much more consumers will want to buy if prices fall,” explained Bill Adams, chief economist at Comerica.

Elasticity often depends on the type of product a company sells.

For example, consumer discretionary companies that sell products and services that people “want,” will often experience greater price elasticity than consumer staples companies that sell things that people need, such as groceries and prescription drugs.

But even for needs, consumers often still have a choice, as less expensive generic, or private-label alternatives, may be available.

Andre Schulten, chief financial officer of consumer staples products seller Procter & Gamble Co.

PG,

which recently beat earnings expectations as it continued to raise prices, told analyst while there was “some trading into private label,” the overall market share of private label products were flat for the year.

As Harris Financial’s Cox said, consumers may be complaining about higher prices, but they aren’t yet desperate enough to stop buying.

The Federal Reserve’s latest Beige Book economic survey stated that business contacts in some districts noted a “reluctance” to raise prices as consumers appeared to have grown more sensitive to prices, but other districts reported “solid demand” allowed companies to maintain prices and profitability.

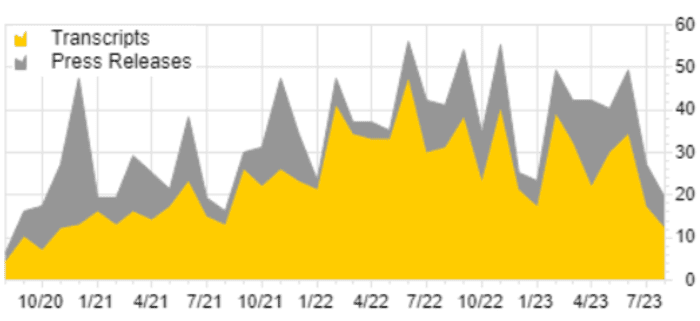

That’s likely why companies and analysts have become less concerned about price elasticity. Based on a FactSet analysis, mentions of the word “elasticity” in press releases and conference calls of S&P 500 companies

SPX

increased as inflation and interest rates started surging in early 2022 through the end of the year.

With inflation trends softening this year, the Fed took a brief pause in raising rates in June, helping fuel further stock market gains, before raising rates again in July.

Mentions of “elasticity” in earnings press releases and transcripts of S&P 500 companies

FactSet

As the chart shows, “elasticity” popped up in more than 55% of earnings releases and conference calls in mid-2022, but with the second-quarter 2023 earnings-reporting season more than half over, mentions had dropped to about 20%.

Perhaps that will pick up, as retailers, especially those catering to lower-income customers (see PepsiCo’s comment above), assess the demand impact of continued price increases.

Meanwhile, branded foods company Conagra Brands Inc.

CAG,

which is the parent of a wide range of food brands including Birds Eye, Duncan Hines, Hunt’s, Orville Redenbacher’s and Slim Jim, were starting to see a different dynamic.

Chief Executive Sean Connolly said consumers were shifting behavior in some categories as prices remained high. Rather than trade down to lower-priced alternatives, he noticed some consumers are buying fewer items overall, “more of a hunkering down than a trading down.”

That’s exactly the kind of consumer behavior that is needed, to get companies to stop feeding greedflation and to start pulling back on prices.