This post was originally published on this site

General Motors Co.’s stock jumped 1.7% premarket Tuesday, after the car maker posted better-than-expected second-quarter earnings and raised its guidance for the second time this year.

The company

GM,

said earnings growth was driven by demand for new trucks and SUVs with the company focusing on its EV programs, and growth initiatives, including Cruise, BrightDrop and software-defined vehicles.

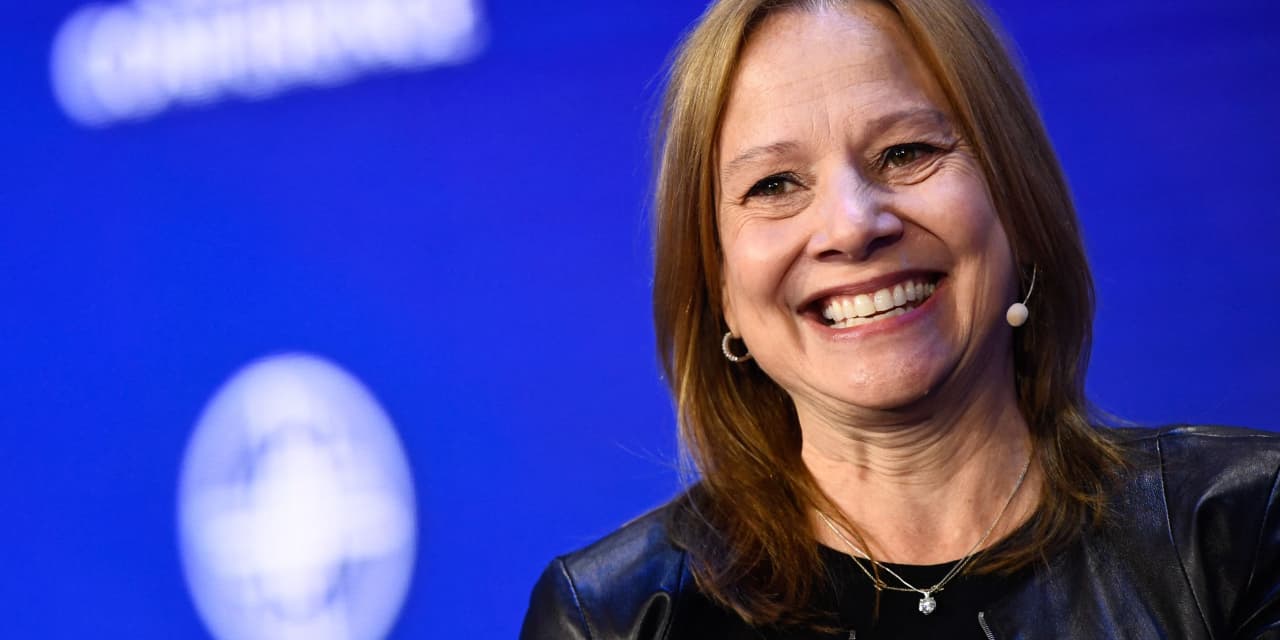

“We have earned four consecutive quarters of higher retail market share in the U.S. versus a year ago with continued strong pricing and incentive discipline, we’re leading in both commercial and total fleet deliveries calendar year to date, and we’re growing profitably in international markets such as Brazil and Korea,” Chief Executive Mary Barra said in a statement.

The Detroit-based car maker had net income of $2.566 billion, or $1.83 a share, for the quarter, up from $1.692 billion, or $1.14 a share, in the year-earlier period.

Adjusted per-share earnings came to $1.91, ahead of the $1.86 FactSet consensus.

Revenue rose to $44.746 billion from $35.759 billion a year ago, also ahead of the $42.133 billion FactSet consensus.

“In the electric vehicle market, we met our target to produce 50,000 EVs in North America in the first half of the year,” said Barra. “With both cell and vehicle production increasing, we continue to target production of roughly 100,000 EVs in the second half of this year and we’ll grow from there.”

See also: There are dozens of cheap electric-car models made in China, but Americans can’t buy them

Earnings were hit by a $792 million charge for new commercial agreements the company has made with LG Electronics and LG Energy Solution.

“The charge reflects the conscious decision GM made during the Chevrolet Bolt EV and Bolt EUV recall to serve customers in ways that go beyond traditional remedies, and GM is taking new steps that will reduce its costs and improve EV margins over time,” the company said in a statement.

GM raised its full-year guidance and now expects net income of $9.3 billion to $10.7 billion, up from prior guidance of $8.4 billion to $9.9 billion. It expects adjusted EPS of $7.15 to $8.15, up from earlier guidance for $6.35 to $7.36.

The company is also planning to cut an additional $1 billion in fixed costs on top of the $2 billion already disclosed and will spend less than expected on capital projects.

The stock has gained 17% in the year to date, while the S&P 500

SPX,

has gained 18.6%.