This post was originally published on this site

The second half of the year kicks off with a holiday-shortened week, though jobs data comes at the end of it. That’s as Tesla may have lit a firecracker for tech with some pretty bullish sales numbers out Sunday.

“Can tech keep up the pace?” is a burning question for many with regards to a sector that helped drive the S&P 500

SPX,

to its best first half since 2019. On the plus side, history dictates that one good half can lead to another, though some worry too much investor exuberance could spoil things.

So naturally, another obvious question looking ahead is how to find outperformers like the so-called “Magnificent Seven” tech names that led the first half — Amazon

AMZN,

Microsoft

MSFT,

Alphabet

GOOGL,

Meta

META,

Tesla

TSLA,

and Nvidia

NVDA,

Our call of the day, from a team at Goldman Sachs led by chief U.S. equity strategist David Kostin, offers up some ideas on that front and spoiler, Tesla is among them.

To find the new names, Goldman spiffed up its “Rule of 10” stock screen that pinpoints companies with realized and future sales growth greater than 10% for 2021 to 2025. They note that strong sales growth has been a common thread running through each of those names, as each have grown sales at a faster rate than the broader index since 2010, except 2022.

“The largest tech stocks in the U.S. equity market make it clear that identifying firms capable of posting sustained 10%+ sales growth in their nascent stages can be rewarding for investors. Rapid and consistent sales growth was a common attribute of today’s largest stocks as they ascended the index ranks,” said Kostin and the team.

Roughly 20 names meet this criteria and among them is one of those big tech outperformers — Tesla. Salesforce

CRM,

has consistently made the cut, said Goldman. The top 10 names on this list are Enphase Energy

ENPH,

Tesla, SolarEdge

SEDG,

Palo Alto Networks

PANW,

ServiceNow

NOW,

Paycom Software

PAYC,

Fortinet

FTNT,

DexCom

DXCM,

and Insulet

PODD,

Goldman also presented a screener for stocks based on net income growth. Those must have more than 10% per year net income growth for the 2021 to 2025 period.

Currently 18 names fit this criteria and are trading at below average premiums to the S&P on a price/earnings and price to earnings growth ratio, they say. The top 10 are Baker Hughes

BKR,

Match Group

MTCH,

Insulet , Aptiv, Bookings Holdings

BKNG,

ServiceNow, Schlumberger

SLB,

Chipotle

CMG,

Paycom and Halliburton

HAL,

And eight companies are on both lists: Paycom, Fortinet, Insulet, Salesforce, Intuit, Cadence Design Systems

CDNS,

and Aptiv.

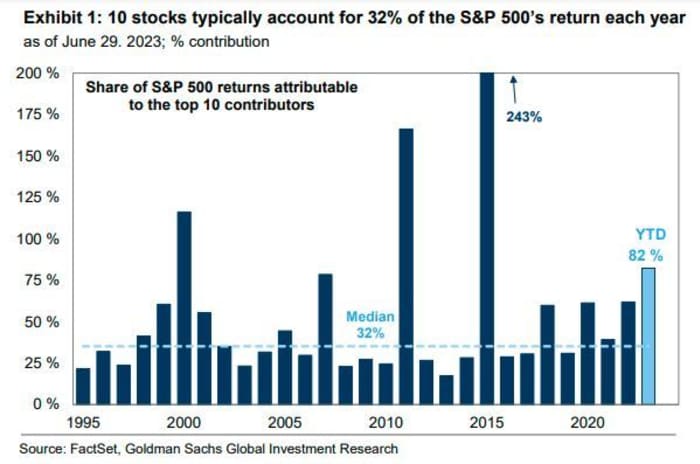

As an aside, Kostin and the team address the whole narrow market issue, saying that in any given year, returns have been concentrated on a group of outperformers. Observe the below chart:

“Excluding the top 10 contributors in each year, the S&P 500 would have delivered an 8% average annual return since 1990 (vs. 12% for the full index),” they said. The top 10 contributors account for roughly 12 percentage points of the S&P 500’s 15% year-to-date return.

The market

It will be a shortened session for Wall Street ahead of Tuesday’s 4th of July holiday. Ahead of that, equity futures

ES00,

YM00,

are mostly lower, except for tech

NQ00,

thanks to Tesla, while bond yields

TMUBMUSD10Y,

were mildly mixed. Oil prices

CL.1,

got a lift after Saudi Arabia and Russia said they would extend oil production cuts into August. Asia had a strong session, led by a 1.7% gain for the Hang Seng

HSI,

For more market updates plus actionable trade ideas for stocks, options and crypto, subscribe to MarketDiem by Investor’s Business Daily.

The buzz

Tesla

TSLA,

delivered 466,140 vehicles in the second quarter, surpassing estimates as the EV maker boosted dividends and incentives. That should “beat the bears back into hibernation,” says Wedbush analyst Dan Ives. Indeed, the stock is up over 6% in premarket trading.

Upbeat delivery data has also lifted shares of XPeng

XPEV,

and Nio

NIO,

by 10% and 6%, respectively.

Shares of Fidelity National Information Services

FIS,

also surged 6% after a report late last week cited private-equity interest in buying a possible majority stake in the company’s Worldpay business.

Apple

AAPL,

has reportedly slashed its production targets for its pricey Vision Pro headset, as components makers are struggling with its complicated design. The report comes as Apple closed above a $3 trillion valuation on Friday.

A holiday shortened week will finish with the June jobs report on Friday. The week begins with the S&P U.S. manufacturing purchasing managers index at 9:45 a.m., followed by the Institute for Supply Management’s manufacturing index at 10 a.m. and construction spending on Monday. Other highlights include minutes of the Fed’s June meeting on Wednesday and the ISM services index on Thursday.

A private gauge for China’s factory activity showed slightly lower activity in June.

It was a lukewarm weekending opening for Walt Disney

DIS,

and Lucasfilm’s “Indiana Jones and the Dial of Destiny.”

The grandmother of a slain French teen has pleaded for calm after a fifth night of riots in France. The government says social media has fueled the unrest.

Best of the web

These are your options if you can’t pay back your student loans when payments start up again.

Leveraged-loan logjam eases after banks unload tens of billions of debt.

Carmakers are getting into the mining business.

The chart

Here’s a chart from head of @topdowncharts, Callum Thomas, looking at some residential property values that are starting to roll over a bit:

@callum_thomas

Top tickers

These were the top-searched tickers on MarketWatch as of 6 a.m.:

| Ticker | Security name |

|

TSLA, |

Tesla |

|

NIO, |

Nio |

|

AAPL, |

Apple |

|

NVDA, |

Nvidia |

|

GME, |

GameStop |

|

MULN, |

Mullen Automotive |

|

AMC, |

AMC Entertainment |

|

AMZN, |

Amazon.com |

|

PLTR, |

Palantir Technologies |

|

TOP, |

TOP Financial Group |

Random reads

It’s no joke. Elon Musk and Mark Zuckerberg may really get in a cage and fight.

Fed up with the U.K., the Orkey Islands want to be part of Norway.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch reporter Charles Passy and economist Stephanie Kelton.