This post was originally published on this site

According to a valuation model that measures bitcoin

BTCUSD,

on its network effects, the bellwether cryptocurrency is fairly valued at $29,500—about 10% above its current price.

In my prior columns about this model, based on Metcalfe’s Law, I said that I was unaware of any alternate models — and invited you to let me know if you came across any. Investment researcher Morningstar recently reported on three additional models, and I’m devoting this column to discussing their relative merits.

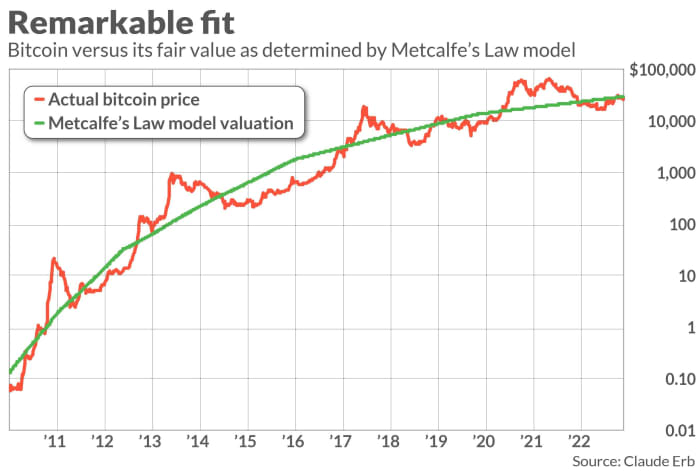

Before focusing on them, let me review the Metcalfe’s Law model, which was introduced to me several years ago by Claude Erb, a former commodities portfolio manager at TCW Grup. Metcalfe’s Law holds that the value of a network is proportional to the square of the number of users. To apply this law, Erb assumes that every bitcoin that has been mined represents one user in the network.

As Erb would be the first to tell you, his model has flaws. Many bitcoins have been lost, for example. Some investors own more than one bitcoin, while others own only a fraction. Nevertheless, as a general matter, it is undeniable that a network becomes more valuable as it encompasses more participants. And it has an impressive record, as you can see from the accompanying chart.

This record doesn’t just represent an after-the-fact fitting of the model to the data, furthermore. I first devoted a column to the model in late 2020, just as bitcoin was beginning an incredible three-month run in which it tripled from around $20,000 to over $60,000. The model insisted that such a price rise was unjustified, and bitcoin subsequently fell back to below $20,000. At that point I reported that, per the model, bitcoin was now undervalued—and it subsequently rallied more than 50% to where it trades now, within shouting distance of fair value.

Alternate valuation models

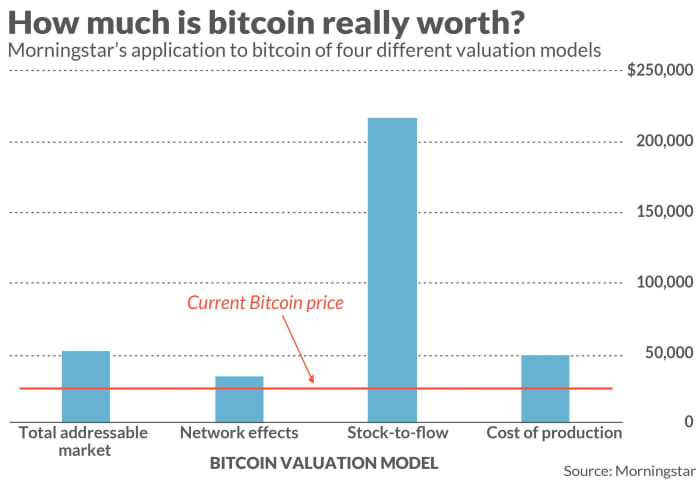

Each of the three alternative valuation models that Morningstar discusses concludes that bitcoin’s value is far higher than $29,500 — as high as $216,000, in fact. (See chart below.) To be clear, Morningstar is not endorsing any of the models, acknowledging that “right now, bitcoin is still a bit of a mirror: People will see what they want to see.” They analyze the models as a first step in introducing more rigor in assessing bitcoin’s fair value.

The three alternative valuation models Morningstar discusses are:

- Total addressable market: This approach starts by estimating the total size of the market and then estimating the share of that market that bitcoin could eventually represent. Using this approach, Morningstar estimates bitcoin’s valuation at $50,870, which they arrive at by assuming bitcoin eventually will represent 15% of gold’s total market cap.

- Stock-to-flow: This approach relates bitcoin’s valuation to its scarcity — specifically, the extent to which demand for the cryptocurrency can be met with new supply. Based on an econometric model Morningstar constructed from bitcoin’s historical stock-to-flow ratio, it is projected to rise to $216,600 by May 2028.

- Cost of production: This approach is based on the idea that bitcoin’s price must at least be as high as the expense necessary to mint one coin. The cost-of-production model, based on assumptions about the cost of electricity and computing power, concludes that bitcoin’s breakeven price is $47,600.

In an interview, Erb emphasized that, on the one hand, he doesn’t believe his Metcalfe’s Law-based model is the final word on bitcoin valuation. He says he agrees with those statisticians who like to say that “all models are wrong, but some are useful.” On the other hand, however, he believes his model is more useful than the other three that Morningstar introduced, which he believes don’t even meet a rudimentary smell test of plausibility.

The total addressable market model, he says, is “hilarious: This method just fishes around for any comparison. There is no “there” there with the $50,000 ‘valuation.’ Why not say that bitcoin should be worth 20% of total human capital?”

His opinion of the cost of production model isn’t any better, calling it “laughable: Lucid sells the Air EV for a lot less than its cost of production. Apple sells the iPhone for a lot more than the cost of production. The cost of production illusion quickly devolves into a never ending series of qualifications, assumptions and definitions in order to explain what one means… Also, more practically, to whom does this $47,000 cost of production apply? Someone mining in Texas, Iceland, etc.?”

Erb also is cynical about the “stock to flow” approach. He says it has a superficial plausibility because adherents insist that the model is used to value commodities and metals. But, even though he was for years a commodities fund manager, Erb says he “never ran across a miner of gold, silver, copper, etc. who has ever laid claim to this idea.”

Erb insists that if valuation models don’t meet even minimal standards of plausibility, all they really do is “provide those who want to invest in bitcoin with an opportunity to shop for the mental model that makes them most comfortable with the prospect of buying and owning bitcoin.”

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at mark@hulbertratings.com

More: Coinbase and Binance crackdown hurts the U.S. more than it does bitcoin and other crypto