This post was originally published on this site

A previous version of this report incorrectly described a planned oil production cut. The article has been corrected.

Wall Street is nervous about the latest rush higher for stocks. Morgan Stanley leads the pack with a warning about an earnings wipe out.

Getty Images

Hunting for optimists the Monday after an explosive jobs and debt-ceiling fueled relief rally that sent the S&P 500

SPX,

to the edge of a bull market, is proving a little tough. That said, there’s nothing horrible in the setup, with tech just a little softer as oil is up after Saudi Arabia pledged another production cut.

“This is an unloved rally for sure – SPX above 4,200 and out of the [4,000-4,200] range just as the VIX

VIX,

drops to its lowest since Feb 2020,” notes Neil Wilson, chief market analyst at Finalto.

What Friday did show us is that Big Tech’s rally can spread itself around when it wants to, so more days like that and some Wall Street sourpusses may change their tune. For now, though it seems those who didn’t sell in May are being told to prune in June.

Read: A Fed skip? A pause? Even so, investors aren’t likely out of the woods.

That brings us to our call of the day, and let the tomatoes fly, as our favorite bear is back — Morgan Stanley’s “Worried” Mike Wilson, who still expects “a meaningful earnings recession this year (-16% year-over-year decline) that has yet to be priced in,” by stock markets.

While his S&P 500 base case remains unchanged at 3,900, the lower end of Street forecasts, the strategist says investors are stuck in the middle of several ‘hotter but shorter’ earnings cycles in the context of a broader secular bull market — boom, bust, boom, the strategist said in a Sunday note.

Wilson says the bank’s expectations for a bigger stock drop have been kept at bay by the outperformance of AI players and some big tech names, Fed pivot fever and hopes we’ve been through the worst of an earnings recession. But, a major repricing has hit lower quality, cyclical and small-cap stocks, he adds.

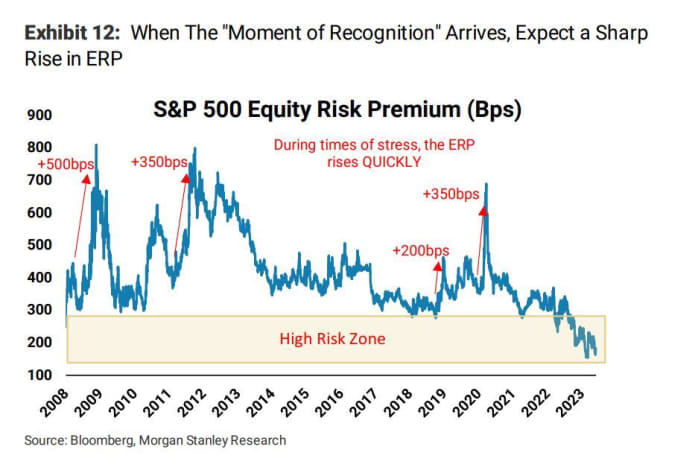

The strategist offers some guidance on when the market will finally start pricing in that earnings rout, focusing on the equity risk premium (ERP) portion of the price/earnings (PE) ratio.

The ERP is defined as the difference between the expected earnings yield and the yield on safe Treasurys, with a higher number meaning investors are being compensated more for putting money in stocks.

He said more than 100% of the reset on PE last year was due to higher 10-year Treasury yields. “Historically, that ‘moment of recognition’ for the market typically occurs when the forward NTM [next 12 months] EPS forecast for the S&P 500 goes negative on a y/y [year over year] basis.” The expected liquidity drain from the debt ceiling passage may help push this process along, he said.

Source: Morgan Stanley

So if an investor is buying what Wilson is selling they will take his advice to stick to defensive characteristics, operational efficiency and earnings stability.

But to avoid leaving things on a totally crummy note, Wilson does add a light at the end of the tunnel. Morgan Stanley expect a 23% bounce in EPS growth in 2024 and 10% in 2025, as Fed policy turns more accommodative in 2024 (not 2023). Here are more drivers of the next recovery/bull market post correction:

- More stable starting point for consumer balance sheets in aggregate

- AI and its diffusion across sectors

- Productivity pickup

- Capex cycle, industrial automation

- Positive operating leverage and margin expansion re-emerge

- Cleantech and reshoring of related critical infrastructure

- Housing supply shortage

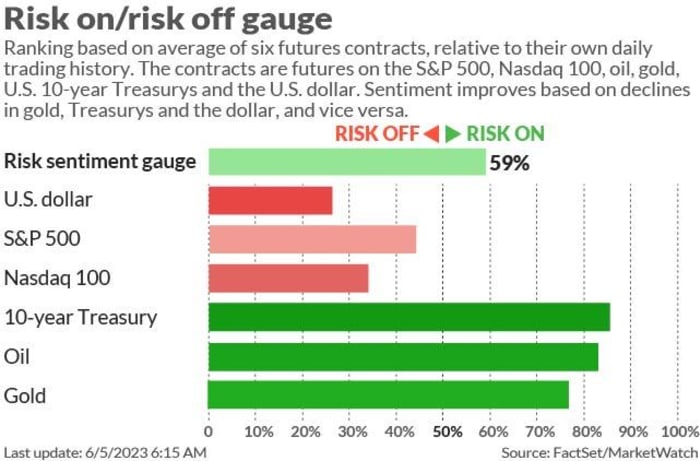

The markets

Stock futures

ES00,

NQ00,

are mixed after Friday’s powerful post-jobs rally that also sent the Dow industrials

DJIA,

surging 700 points. The 10-year Treasury note is up 5 basis points to 3.737%. The dollar

DXY,

is higher and gold

GC00,

and silver

SI00,

are lower.

Oil prices

CL.1,

BRN00,

is higher in the wake of OPEC’s decision to cut oil supply by 1 million barrels a day.

For more market updates plus actionable trade ideas for stocks, options and crypto, subscribe to MarketDiem by Investor’s Business Daily. Follow all the stock market action with MarketWatch’s Live Blog.

The buzz

It’s a mostly quiet week for data. Monday kicks off with the S&P U.S. services purchasing managers index will be released at 9:45 a.m., followed by factory orders and the Institute for Supply Management services gauge at 10 a.m. And it’s a blackout period for the Fed as its June 13-14 Fed meeting looms.

U.S. regulators are planning fresh rules that will force bigger banks to lift their capital requirements by an average 20%, The Wall Street Journal reported.

UBS said its acquisition of rival Credit Suisse Group should be completed as early as June 12, at which point the latter’s shares will be delisted and those shareholders will get one UBS share for every 22.48 outstanding ones held.

A private gauge of China’s service activities rose up in May, expanding for the fifth straight month.

Palo Alto Networks

PANW,

stock is up 5% on S&P 500 inclusion, replacing Dish Networks

DISH,

whose shares fell 6%.

Best of the web

Americans are ‘more afraid of running out of money than death’

Opinion: Ukraine’s uncertain future looks a lot like Spain’s bloody past

The chart

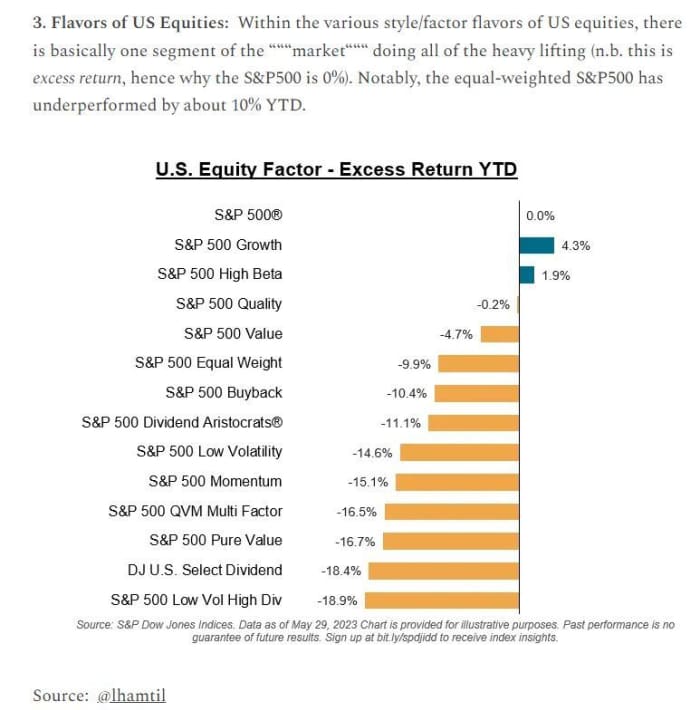

Here’s another look at how lopsided the stock market is currently, with this chart included in The Weekly S&P500 #ChartStorm, from @lhamtil:

The tickers

These were the top tickers on MarketWatch, as of 6 a.m.:

| Ticker | Security name |

|

TSLA, |

Tesla |

|

NVDA, |

Nvidia |

|

GME, |

GameStop |

|

AAPL, |

Apple |

|

AMC, |

AMC Entertainment |

|

AI, |

C3.ai |

|

PLTR, |

Palantir Technologies |

|

NIO, |

NIO |

|

BUD, |

Anheuser-Busch InBev |

|

MULN, |

Mullen Automotive |

Random reads

The world is running low on pink paint. Thanks a lot, Barbie.

$2 million for three brand-new, 13-year old Teslas.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch reporter Charles Passy and economist Stephanie Kelton.