This post was originally published on this site

Do you think the national debt — currently $31 trillion and counting — is huge?

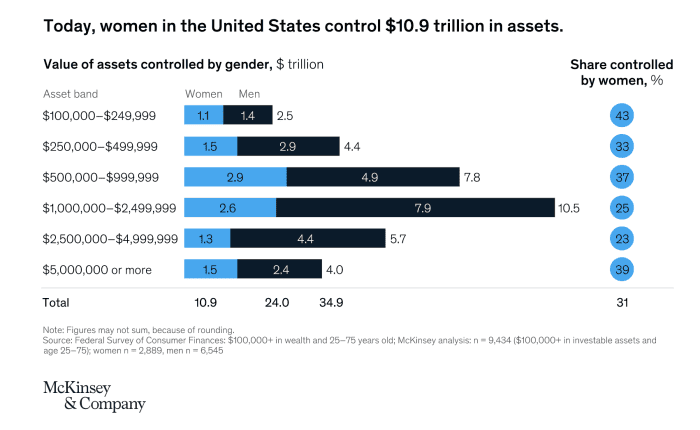

Well, here’s another number almost as big, and unlike the debt, is good news: $30 trillion. That’s the level of assets that single women—many of them widows—will control by the end of the decade. That’s bigger than the entire U.S. economy, currently estimated at close to $27 trillion.

It’s also nearly triple the 2020 level, says consulting firm McKinsey, which says this vast wealth transfer—now well under way—is occurring as women, who tend to outlive men by about five years, take control of assets that have largely, and traditionally, have been controlled by men. For example, in two-thirds of affluent households, men have been the key financial decision makers, the report says.

But that is about to change.

“After years of playing second fiddle to men, women are poised to take center stage,” McKinsey adds.

How prepared are these women to manage their finances? Even though men have generally called the shots, Connecticut-based financial adviser Sheryl O’Connor thinks their spouses, on their own, will prove to be pretty savvy.

“I think their knowledge varies widely,” she tells MarketWatch, “but it’s safe to say that widows today are much more knowledgeable than previous generations.” O’Connor cites a recent survey of high-net worth (HNW) women, divorcées and widows, and found them knowledgeable of, and focused on, critical issues like long-term financial planning, long-term care and insurance.

That being said, O’Connor cautions that “What most women don’t anticipate is how different their financial situation will be as a surviving spouse. One major misconception, she says: Women may think that when they are on their own, their finances will be simpler to manage and that they’ll spend less. But in reality, she warns that 1) inflation will increase their expenses, particularly for healthcare, and that 2) survivor benefits on their husband’s pension (if there was one) and higher required minimum distributions (RMDs) will increase their income.

“Coupled with having to single-file, they’ll probably be pushed into a higher tax bracket than when they filed jointly as a couple,” O’Connor says. She suggests that widows talk to a financial planner to untangle these issues.

Healthcare spending alone can be a land mine. Fidelity Investments, the Boston-based asset management giant, is days away from releasing its latest healthcare spending estimate for a hypothetical couple retiring at age 65. Last year, it said that such a couple would spend $315,000 over the remainder of their lives—again, for all out-of-pocket healthcare spending. For single women aged 65, the estimate was $165,000, given that women usually outlive their spouses. Thanks to last year’s inflation, the new figures are certain to be higher.

O’Connor, who has been in the financial services industry for more than a quarter-century, notes another concern.

“Many widows who inherit assets feel guilty because the reason for this inheritance was their husband’s death,” she says. “This guilt may cause them to make bad decisions and mismanage these assets, putting their financial security in jeopardy.”

But being widowed might not be the only reason an older woman finds herself on her own, wading through the thicket of financial decisions that must be made. So-called “gray divorces” are surging, with couples who have been married, sometimes for decades, calling it quits. Financially, this can be much harder on women given studies showing that poverty afflicts far more divorced women than men.

Incidentally, the fact that so many more women are beginning to control so much more money could bode well for part of the financial service industry that is underrepresented by women: financial advisers. Only about 15% of advisers are women, McKinsey’s study says, adding that “70% of women switch their wealth relationship to a new financial institution within a year of their spouse’s death.”