This post was originally published on this site

https://i-invdn-com.investing.com/trkd-images/LYNXMPEJ4U0PI_L.jpg

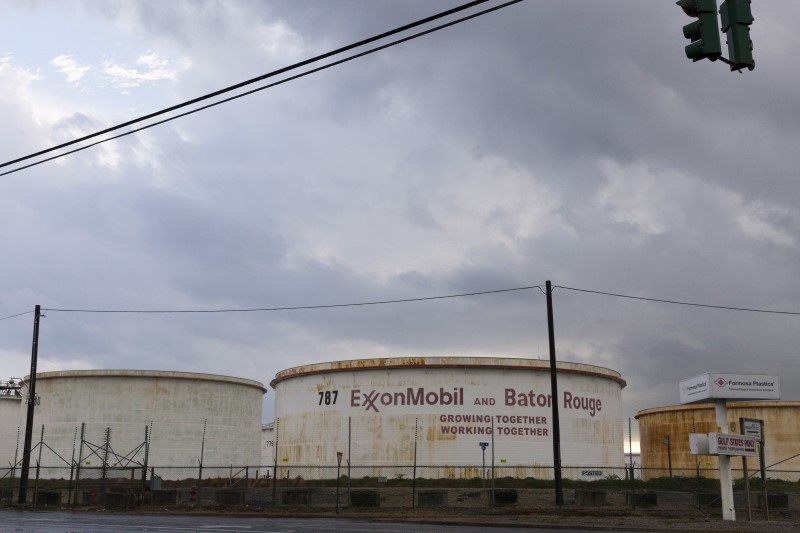

HOUSTON (Reuters) -Exxon Mobil Corp and Chevron Corp (NYSE:CVX) shareholders on Wednesday overwhelmingly rejected calls for stronger measures to mitigate climate change, dismissing more than a dozen climate-related proposals at their annual meetings.

The results supported the two largest U.S. oil producers in resisting pressure from investor groups calling for the pair to follow European rivals in accepting tougher emissions reductions goals.

Despite efforts by Shell (LON:RDSa) PLC, BP (NYSE:BP) PLC and TotalEnergies, protesters still stormed their shareholder meetings this year, seeking a faster shift away from fossil fuels. Their demands similarly failed.

Exxon (NYSE:XOM) and Chevron’s meetings were online, avoiding similar protests.

“There is no single oil major that really wants to transition,” said Mark van Baal, founder of activist group Follow This, which suffered resounding losses at several meetings. “They all want to hang on to fossil fuels as long as possible.”

His group, which represents some 9,500 shareholders in oil and gas companies, had requested Exxon set medium-term goals for reducing emissions from fuels burned by customers – or Scope 3 targets.

That resolution received less than half of the support 11% of vote cast compared with 27% from the group’s emission reduction proposal last year.

CEO Darren Woods called Follow This “an anti-oil and gas” group using environmental and social objectives “to diminish the important role Exxon plays” in the industry.

“Scope 3 gives companies like ours, zero credit for reducing other’s emissions through technologies such as carbon capture and storage,” Woods said.

Exxon is the only one of the five Western oil majors with no 2030 target for reducing customers’ carbon emissions from its products.

Exxon holders rejected all 12 shareholder proposals, the majority of which dealt with climate-related issues. None received a majority of votes cast that would signal a win, according to early results.

Chevron investors also rejected proposals on customers’ emissions reduction target, creating a board committee on decarbonization risk, and a report on worker and community impact from facility closures and energy transitions.

LOW SUPPORT

Overall, the results showed falling support for proposals designed to strengthen oil and gas firms’ contributions to tackling climate change. After winning some ground earlier this decade, the initiatives lost strength after worries soared over supply and prices following Russia’s invasion of Ukraine.

A proposal to increase Exxon’s methane gas measurement reporting won 36% of votes cast, the largest for any climate initiative. Last year, shareholders approved with 51% of the votes a request that Exxon issued an audited report on emissions using assumptions of the International Energy Agency’s Net Zero by 2050 pathway.

Shareholders also rejected creation of a worst-case scenario oil spill response plan for its Guyana operations. It received only 13% of the votes cast.