This post was originally published on this site

It’s just about official: Thanks to the debt-ceiling agreement, borrowers and the student-loan system now have three months to prepare for the end of the more than three-year freeze on student-loan payments, interest and collections.

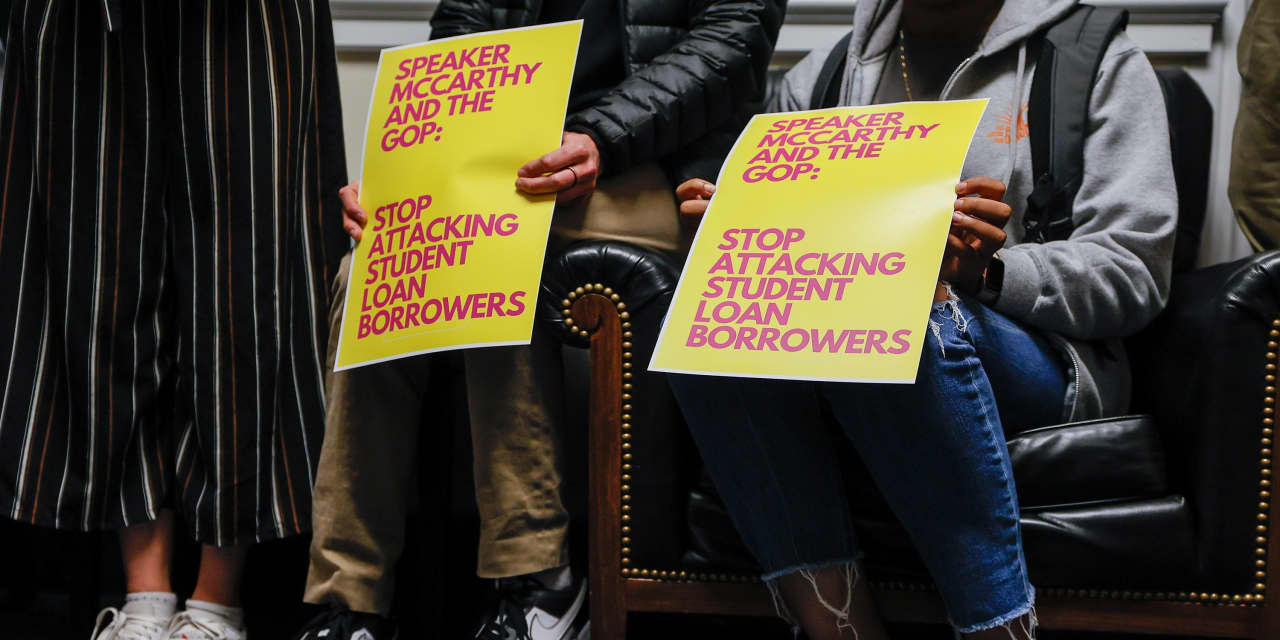

Student-loan borrower advocates and even the official in charge of restarting payments have warned ending the pause will be challenging for borrowers. Now, some advocates are concerned that the debt-ceiling deal has locked officials into resuming payments even if borrowers and the student-loan system aren’t ready and without the debt-relief the Biden administration has said is necessary to ensure a smooth transition to repayment.

“It’s really disappointing to have such a rigid, inflexible repayment restart date,” said Persis Yu, managing counsel and deputy executive director of the Student Borrower Protection Center, an advocacy group. That inflexibility “is going to be really damaging for borrowers and ties the administration’s hands.”

How are you preparing for student loan payments to resume? We want to know: Email jberman@marketwatch.com.

Under the deal reached by President Joe Biden and House Speaker Kevin McCarthy to raise the debt limit, the student-loan payment pause would end sixty days after June 30, 2023. The bill, which the House of Representatives is expected to take up for a vote on Wednesday, would also prohibit the Secretary of Education from extending the payment pause without an act of Congress.

In a sense, the debt-limit bill codifies what the Biden administration has said is its plan for resuming payments for months and staves off more drastic cuts to student-loan relief that have been part of the debt-limit debate. But it also gives officials little room to change their plans if the Supreme Court knocks down the Biden administration’s proposal to cancel up to $20,000 in student debt for a wide swath of borrowers — something they’ve argued is key to restarting student-loan payments without widespread delinquency and default.

Since November the Biden administration has said student-loan payments will resume 60 days after June 30 at the latest and they’ve been facing pressure, including from Republican members of Congress and litigation to stick to that deadline. The language in the bipartisan debt-limit agreement doesn’t go as far as Republicans’ debt-limit proposal to curtail student-debt relief. That bill, which the House passed in April, eliminates the Biden administration student debt forgiveness plan.

Both during oral arguments at the Supreme Court and in public comments, Biden administration officials have warned that restarting payments without the debt relief would push many borrowers into delinquency and default on their student loans. In the weeks and months leading up to when payments were scheduled to resume the last eight times, advocates have said that both borrowers and the system weren’t ready for payments to turn back on. For years, they’ve urged the Biden administration to not start sending student-loan bills without some kind of mass cancellation that could help cushion the blow to both borrowers’ wallets and the system more broadly.

Customer service hours cut

In the months since President Biden said payments would resume by the end of the summer, conditions have changed that will likely make the return to repayment even more challenging, Yu said. The Department of Education is paying student-loan servicers less money per account and servicers have cut back call center hours — offering none on weekends. The Department has said the cuts are a result of lawmakers’ decision not to fully fund the Office of Federal Student Aid, which oversees the student loan system.

“We now know that servicers are in a much worse position than they were,” when the date to restart payments was initially announced, Yu said. The debt-limit bill “locks” the Biden administration “into restarting a broken student loan system, and really ties their hands and puts student loan borrowers at the mercy of the Supreme Court.”

Richard Cordray, the chief operating officer of Federal Student Aid, told lawmakers last week that his office is “working closely” with loan servicers and other stakeholders to “execute a comprehensive plan founded on clear communication, high-quality customer service, and targeted support for those having trouble making their payments.”

“We know the transition back into repayment will not be easy for borrowers, and we are committed to giving them the information and resources they need to succeed when payments resume,” he said in his written testimony.

The Department hasn’t announced the details of how it will do that, but some reporting indicates it could, for example, offer borrowers a relatively long grace period if they miss payments after the freeze ends.

Betsy Mayotte, the president and founder of the Institute for Student Loan Advisors, said no matter what steps the Department takes to ease the transition and no matter how much time officials had to prepare for payments to turn back on, ending the freeze was going to be a daunting task. Indeed, when student-loan payments resumed after past, more limited pauses, defaults and delinquencies spiked.

“No matter how much prepwork we do, the system wasn’t built — and you can’t prepare — for 30 million or how many million it is borrowers to all restart repayment at the same time,” she said. “This is going to be a tidal wave.”

Some advocates have pushed for the Department of Education to make major changes to the student-loan system before resuming payments so it could better withstand the end of the freeze. The Biden administration has announced several initiatives aimed at transforming the experience of repaying student debt, but many aspects of the system are unchanged from before the pandemic, when more than 1 million borrowers defaulted on their student loans each year.

For example, borrowers who have the right to have their debt discharged under the law, may wind up making payments on loans that should be cleared from the books when payments resume, Yu said. In addition, the Biden administration’s proposal to make student loan payments more affordable likely won’t be ready by the end of the summer. And the Department of Education hasn’t implemented a measure passed by Congress that would make it easier for borrowers to remain on an affordable repayment plan and not face a surprise large payment due to paperwork mishaps.

For their part, borrowers should start preparing now for payments to resume, as they can expect protracted call wait times and a longer than typical turnaround for paperwork as the deadline for student loan bills gets closer, Mayotte said. Below are some steps to take.

How to prepare for payments to resume:

Find your student loans: Student-loan servicers are borrowers’ first point of contact when making payments or changing their payment plan. But after three years without payments — or if they’re making payments for the first time — borrowers may not know who their servicer is, particularly because borrowers’ loans may have been transferred after some large servicers left the student-loan program. To find out who is handling their loans borrowers should head to studentaid.gov, Mayotte says.

“During the pause we also had a lot of servicer changes and those continue as we speak,” she said.

Figure out your monthly payment: Borrowers can use free calculators on the Department of Education’s website or on the website of Mayotte’s organization to figure out how much their monthly student loan bill will be under different repayment plans. Under the standard plan, which borrowers are enrolled into by default after they leave school, borrowers will pay their loans off in 10 years through mortgage-style payments.

If that doesn’t seem affordable, borrowers should take steps, including getting in touch with their servicer, to enroll in an income-driven plan. Under these repayment schemes, borrowers repay their debt as a percentage of their income.

“Applying for a lower payment option now is going to avoid the avalanche for requests for those lower payment options and it won’t start their payments any sooner,” Mayotte said.

The Biden administration has proposed sweeping changes to income-driven repayment, which could make it more affordable and less onerous for many borrowers. Their version of the plan likely won’t be available by the end of the summer when payments are set to resume. But borrowers who enroll in a different plan can always switch, when the new plan becomes official, Mayotte said. In addition, the Department of Education has said that borrowers who sign up for one of the plans already available, called REPAYE, will automatically be enrolled in the new plan when it’s implemented.

Enroll in auto debit: In remarks to lawmakers last week, Cordray advised borrowers who know they can make their payments to enroll in auto debit. The federal government gives a quarter of a percentage point discount for auto debit and by setting it up borrowers can be sure they won’t miss their payments.

Get the ball rolling to take advantage of other changes to the student loan system: Borrowers using income-driven repayment plans can have their remaining balance canceled after up to 25 years of payments, but many borrowers spent years in repayment options that didn’t count towards that forgiveness because servicers steered them in that direction, according to the Department. Under an initiative the Biden administration announced last year, borrowers can have time spent in forbearance count towards that relief, bringing them closer to forgiveness.

But some borrowers have to take action in order to access this benefit. Borrowers with Federal Family Education Loans need to consolidate their loans into Direct federal student loans by the end of the year if they want their account to be adjusted. Mayotte says borrowers who need to should take steps to consolidate “sooner rather than later.”

“Keeping in mind the avalanche that we’re anticipating to hit the servicing side of things,” she added.

There’s a group of borrowers who are an exception to this advice, she noted. Borrowers who have a commercially-held FFEL loan — or a loan that is held by a private lender, but backed by the federal government — should wait until the Supreme Court issues its decision on debt relief, Mayotte said. That’s because once these borrowers consolidate they likely will be barred from receiving mass debt forgiveness.

In addition, borrowers who are in default on their loans should start taking steps to benefit from a Biden administration initiative aimed at helping this group. For a year following the pause these borrowers will be current on their loans under a program called Fresh Start.

But in order to stay current on their loans once that year is up, they have to take action. Mayotte says borrowers in default should find out who owns their loans (more information on how to do that here). Then they should call that organization and say they want to take advantage of Fresh Start, she said. Once their loan is transferred to a loan servicer they should get in touch with that organization to sign up for an affordable repayment plan, she said.

Watch out for scams: “As we’re getting down to the wire especially with all these unique and temporary programs out there this is just fodder for the scammers,” Mayotte said. Any entity that is asking for money to enroll in a government repayment or forgiveness program is a scam, she said. Student loan servicers are paid by the government to manage these programs at no cost to borrowers.

Borrowers “should never have to pay for student loan advice,” Mayotte said.