This post was originally published on this site

The policy-sensitive 2-year Treasury yield rose for an 11th straight time on Thursday, its longest stretch of advances in more than five years, as traders priced in a greater chance of further interest-rate hikes by the Federal Reserve through July.

What happened

-

The yield on the 2-year Treasury

TMUBMUSD02Y,

4.533%

jumped 16.5 basis points to 4.508% from 4.343% on Wednesday. The yield is up 60.9 basis points over the last 11 trading days, the longest such stretch since January 2018. -

The yield on the 10-year Treasury

TMUBMUSD10Y,

3.821%

rose 9.7 basis points to 3.814% from 3.717% as of late Wednesday. That’s the highest level since March 9, based on 3 p.m. Eastern time figures from Dow Jones Market Data. -

The yield on the 30-year Treasury

TMUBMUSD30Y,

3.993%

climbed 3.9 basis points to 4.003% from 3.964% Wednesday afternoon. That’s the highest level since March 2.

What drove markets

Debt-ceiling concerns and Federal Reserve policy continued to impact different parts of the market for U.S. government paper.

Yields on Treasury bills maturing from June 1-8 all fell below 7% earlier in the session, according to Tradeweb, in a sign of somewhat easing tensions over the debt ceiling. The yield on the 1-month Treasury bill

TMUBMUSD01M,

maturing on June 20 fell to 5.58%, just shy of recent highs, after ratings agency Fitch placed the U.S.’s AAA credit rating on watch for a possible downgrade.

Meanwhile, fed funds futures traders saw a growing likelihood that the central bank will hike interest rates again in June, following Wednesday’s release of the Fed’s May meeting minutes. Markets are pricing in a 52.8% probability that the Fed will hike by another 25 basis points, to 5.25%-5.5%, on June 14, according to the CME FedWatch Tool. Traders also see a 24.9% chance of another hike of that size in July, assuming the June move takes place.

In U.S. economic data released on Thursday, new jobless claims for the seven days that ended on May 20 rose by 4,000 to 229,000 from 225,000 in prior week, the Labor Department said Thursday. In addition, updated figures show the U.S. grew at a somewhat faster but still tepid 1.3% annual pace in the first quarter.

What analysts are saying

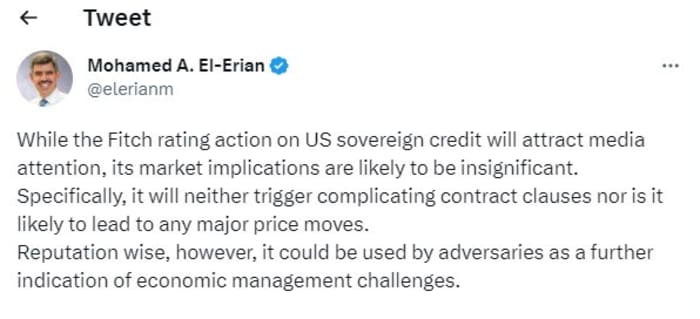

Here’s Mohamed El-Erian, president of Queens’ College at Cambridge University, and an advisor to Allianz and Gramercy, on the fallout from Fitch’s warning.

Source: Twitter