This post was originally published on this site

https://i-invdn-com.investing.com/news/LYNXNPEB8R00J_M.jpg

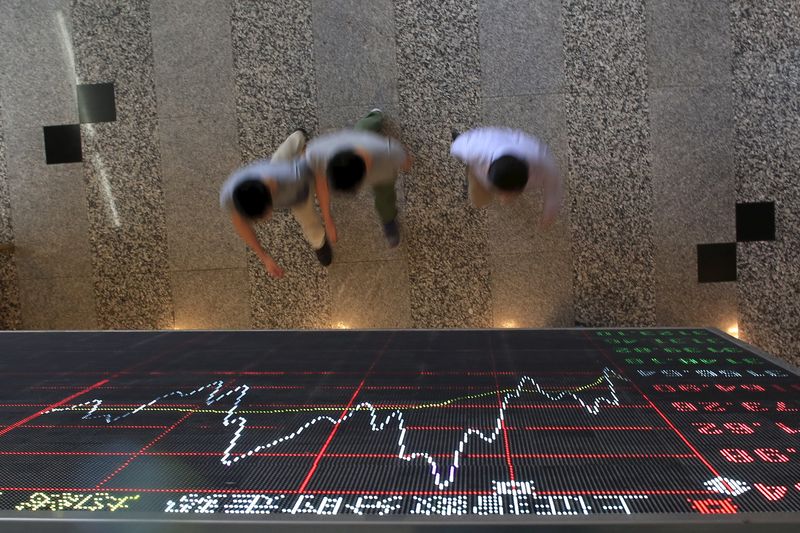

China’s Shanghai Shenzhen CSI 300 and Shanghai Composite indexes rose 0.1% and 0.4%, respectively, while Hong Kong-listed Chinese stocks pushed the Hang Seng index up 1.3%.

President Joe Biden said during the Group of Seven summit in Japan that he expects relations between the U.S. and Beijing to improve “very shortly,” and that the G7 had also decided on a united approach to China.

His comments somewhat improved sentiment towards Chinese markets, which were reeling from two straight weeks of losses after a slew of disappointing economic readings for April.

An improvement in Sino-U.S. relations could invite foreign investors back into China, offering the country a much-needed source of capital as it struggles with a post-COVID economic rebound.

The People’s Bank of China kept its loan prime rate steady near historical lows on Monday, but slowing growth in the country saw markets positioning for an eventual cut this year.

Other China-exposed stock markets also advanced, with South Korea’s KOSPI up 1%.

But broader Asian markets were mixed as U.S. lawmakers flagged little progress towards reaching a deal to raise the debt ceiling. Biden is set to continue talks with Republican lawmakers later on Monday.

Australia’s ASX 200 index fell 0.3%, while the Taiwan Weighted index lost 0.1%.

Japan’s Nikkei 225 and TOPIX rose about 0.1% each, hovering around more than 30-year highs following a stellar rally over the past two weeks. But gains now appeared to be running out of steam, with softer-than-expected machinery orders data pointing to continued weakness in Japan’s key manufacturing sector.

Thailand’s SET Index tumbled 1% and was the worst performer among its Asian peers for the day, as markets awaited the formation of a new government after the pro-democracy opposition unexpectedly defeated the incumbent military-backed bloc in elections held last week.

Growing concerns over a U.S. debt default, which could have dire consequences for the global economy, rattled broader Asian markets. Treasury Secretary Janet Yellen said the government faces a mid-June deadline to reach a deal.

U.S. stock futures were also largely muted in anticipation of more cues on a deal.