This post was originally published on this site

The pace of cord cutting picked up in the first quarter as the relevance of traditional video continued to fade.

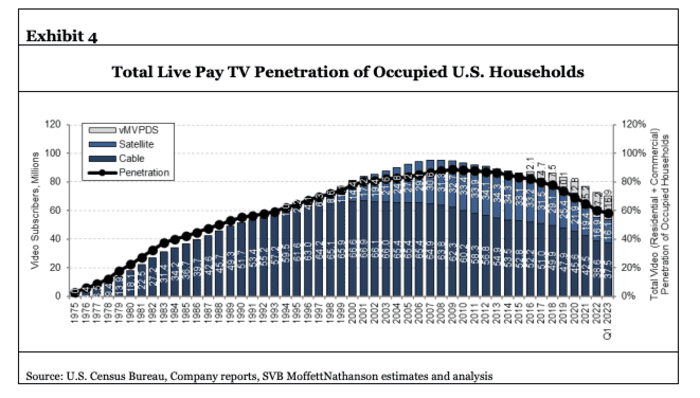

More than 2.3 million people in the U.S. abandoned their pay-TV subscriptions during the quarter, according to estimates from SVB MoffettNathanson analyst Craig Moffett. These losses marked a “significant acceleration” compared with a decline of 2.0 million subscribers in the year-earlier first quarter, constituting a 6.9% drop—”the fastest pace ever recorded,” by Moffett’s math.

As consumers continue to cut the cord, the portion of occupied U.S. households paying for video packages has been on the decline. Penetration peaked upwards of 80% about 15 years ago, according to Moffett’s estimates, but it now stands at 58.5% of households, even when including virtual multichannel video programming distributors (vMVPDs), or services like Dish Network Corp.’s

DISH,

Sling TV and Alphabet Inc.’s

GOOG,

GOOGL,

YouTube TV that let people watch traditional channels virtually.

SVB MoffettNathanson

The current penetration is similar to levels last seen in 1992, “two years before the debut of DirecTV brought ‘cable TV’ to rural America for the first time,” Moffett wrote in a note to clients.

When just looking at traditional pay TV, the penetration rate falls to 45%, the lowest level in 37 years, according to Moffett.

It’s no surprise that consumers continue to ditch their linear video packages as the quality of traditional TV content has worsened.

“The entertainment networks have been stripped bare, with their best programming having long-since moved to SVOD,” or “streaming video on demand,” he wrote. “The regional sports networks have gone bankrupt, folded their

tents, and left town. Even the news networks, with fewer and fewer subscribers left to pay the bills, have cut their budgets.”

Moffett sees the industry now amid an “impoverishment cycle,” which has “stripped traditional video of viewership, driving media companies to move their best content elsewhere… and therefore driving viewership lower still.”

Even vMVPDs, the online services like Hulu Live, Sling TV and YouTube TV, are struggling for momentum on the whole, with losses of 250,000 households in aggregate in the first quarter, a decline that Moffett said is one of the worst on record.

“As we’ve seen for the past four years, subscribership now drops sharply in Q1 after the football season ends,” he wrote.

Some services seem to be faring better than others, however, as he estimates YouTube TV picked up 300,000 in the first quarter, while Hulu “has barely grown over the past three years.”