This post was originally published on this site

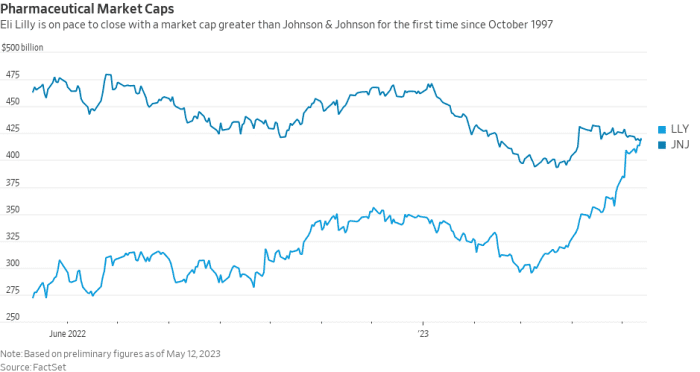

Eli Lilly & Co. was on track Friday to close with a greater market capitalization than Johnson & Johnson for the first time since October 1997, according to Dow Jones Market Data.

The stock

LLY,

has been steadily rising since the release of positive data from a trial of a treatment for Alzheimer’s disease in early May, showing significant slowing of cognitive and function decline in patients with early symptomatic Alzheimer’s disease.

Nearly half, or 7% of participants, had no clinical progression at one year, compared to 29% on placebo. The drug, called donanemab slowed clinical decline by 35% compared to a placebo and resulted in 40% less decline in the ability to perform activities of daily living, including managing finances, driving, engaging in hobbies and conversing about current events, the company said.

The company is planning to proceed with global regulatory submissions as quickly as possible and expects to make a submission to the U.S. Food and Drug Administration this quarter.

For more, see:Eli Lilly stock jumps 5% after Alzheimer’s treatment slows disease progression in major trial

That’s not all. In April, Eli Lilly released data on its new obesity drug tirzepatide that showed patients in a trial losing up to 15.7% of their body weight, or about 34.4 pounds.

More than 80% of people taking tirzepatide lost at least 5% of their body weight, the company said, compared with about 30% of those taking a placebo.

The degree of average weight reduction seen in the trial “has not been previously achieved” in similar Phase 3 trials, Dr. Jeff Emmick, senior vice president for product development at Lilly, said in a statement.

Source: FactSet, Dow Jones Market Data

The company is planning regulatory submissions for that drug later this year. Tirzepatide was approved by the FDA last year as Mounjaro, a treatment for Type 2 diabetes.

Lilly has several other pipeline prospects, including lebrikizumab, a treatment for atopic dermatitis; mirikizumab for ulcerative colitis; empagliflozin, a treatment for chronic kidney disease; and pirtobrutinib for relapsed/refractory mantle cell lymphoma.

Lilly’s stock is up about 20% in the year to date and up 50% in the last 12 months.

Johnson & Johnson’s stock

JNJ,

meanwhile, has fallen 9% in the year to date and is down roughly the same over the last 12 months.

The company swung to a first-quarter loss as it booked a multibillion-dollar charge to settle lawsuits stemming from its talc-containing powders.

J&J booked a $6.9 billion one-time litigation charge relating to lawsuits filed by people alleging the company’s talc-containing powders caused cancers, asbestos poisoning and other illnesses. The company has offered to pay at least $8.9 billion to settle the suits, and remove an overhang on the stock.

For more, see: J&J’s proposal to settle talc lawsuits for $8.9 billion sends stock up the most in more than a year