This post was originally published on this site

While prominent gurus in the financial world have declared the end of the regional banking crises after the failure for four large regional banks, depositors and shareholders of those banks don’t necessarily agree.

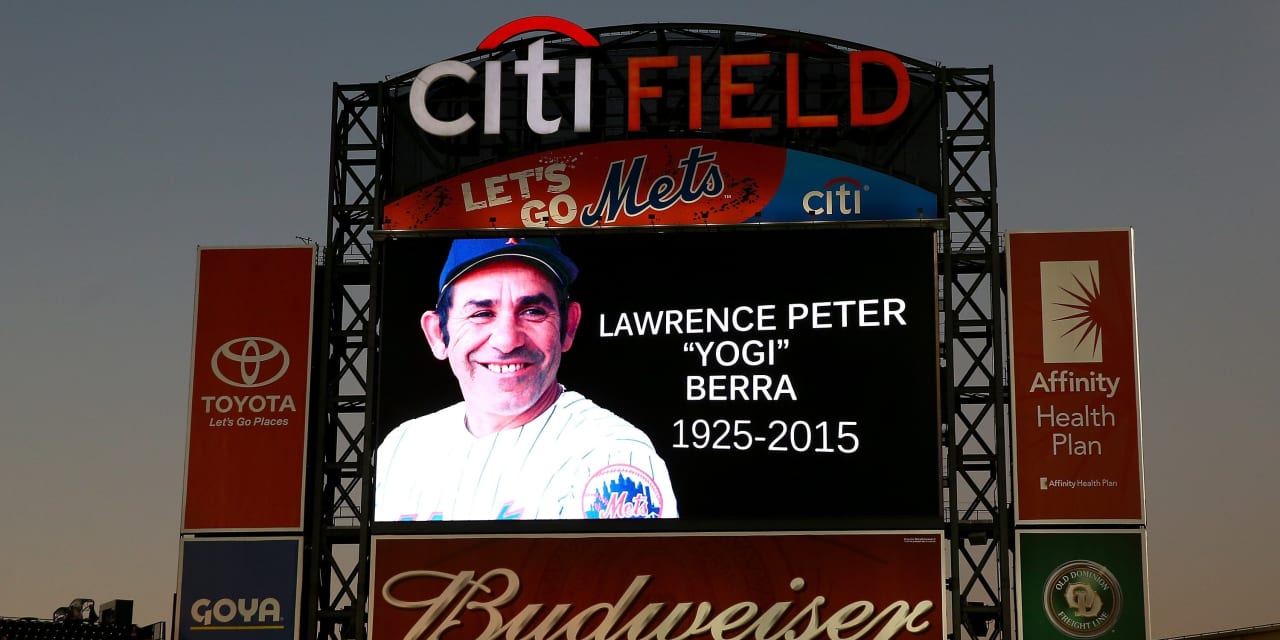

As baseball Hall of Famer Yogi Berra once said, it ain’t over until it’s over. And the banking crisis still has legs, apparently.

PacWest Bancorp

PACW,

said Thursday it saw a 9.5% drop in deposits in the days following JPMorgan Chase’s

JPM,

acquisition of First Republic Bank on May 1, the fourth government-brokered bank transaction this year.

“This event heightened market and customer fears of additional bank failures, including PacWest,” the bank said in a filing with the U.S. Securities and Exchange Commission.

The announcement triggered a fresh selloff in regional-bank stocks, even through another bank that’s seen its stock price fall sharply this year — Western Alliance Bancorp

WAL,

— put out a positive statement about an increase in deposits in early May.

Also on Thursday, Jamie Dimon, the CEO of JPMorgan Chase, noted in an interview with Bloomberg that regulators should clamp down on any illegal market activity in the shorting of bank stocks, although Dimon added he remains cautious on any new regulations or a ban on short selling.

In the current environment, investors are still questioning the strength of the U.S.’s mid-sized banks and the ability of business and government leaders to backstop them.

D.A. Davidson analysts cited stock weakness based more on perception than reality in its downgrade last week to neutral from buy of PacWest stock.

“Given the current environment, we view PACW as not trading on fundamentals, given market fears, and move to the sidelines,” analyst Gary Tenner said in a research note.

The KBW Nasdaq Bank Index

BKX,

was recently down 27% in 2023 and the sector has weighed on the broader market. PacWest’s stock was down 23% on Thursday and has tumbled by 80% in 2023. Western Alliance Bancorp’s stock is down by more than 54% this year and East West Bancorp

EWBC,

is down 34%. Those losses could certainly be seen as a crisis for bank stock owners.

Meanwhile, political and business leaders continue to work to restore faith in the banking system by declaring the worst is over after the collapse of Silicon Valley Bank and its sale to First Citizens Bancshares

FCNCA,

the purchase of Signature Bank by New York Community Bancorp

NYCB,

and JPMorgan’s acquisition of First Republic. A fourth bank, Silvergate Bank, liquidated in March as well with no buyer.

Just to put these developments into context, First Republic had $213 billion in assets and amounted to the largest bank failure since the 2008 financial crisis and the second biggest of all time to Washington Mutual, which went bust some 15 years ago. All three of the banks were formerly components of the S&P 500

SPX,

Two days after the First Republic deal was announced on May 3, former Treasury Secretary Lawrence H. Summers told Bloomberg Television, “I think that we actually are probably over the vast majority of the banking traumas.”

Some institutions, “have looked vulnerable for some time” and have been affected by recent stock sell-offs, he said. Concerns over commercial real estate still persist and its impact on bank creditworthiness, he said.

But many of the circumstances around First Republic were unique to the bank and not systemic, Summers said.

“There are still questions that are going to be around, but I think we should keep some perspective on this and people should recognize that deposits in the banking system will be money good,” Summers said, adding he was more concerned about the debt ceiling in Congress.

Asked about systemic risk from the banks balance sheets being lower because of a quick rise in interest rates, Summers said that view ignores the benefits of higher interest rates on bank balance sheets in other places such as interest payments they receive on their investments.

For his part, Dimon has said repeatedly that the financial system remains sound and that the current regional bank predicament was past us with his bank’s purchase of First Republic.

“This part of the crisis is over,” Dimon said on May 1 as his company aired plans to absorb First Republic Bank. “For now, let’s take a deep breath.”

On Thursday, however, Dimon hedged a bit, saying that we’re “getting near the tail end” of the banking crises.

“The banking crisis I still believe will kind of sort its way through and not and it’s like, oh, 2008 or ’09,” he said.

Fed Chairman Jerome Powell used his bully pulpit on the heels of the Fed’s latest interest rate hike to reassure investors about regional banks.

The sale of First Republic Bank after Silicon Valley Bank and Signature Bank, “kind of draws a line in the sand,” Powell said last week.

“There were three large banks, really from the very beginning, that were at the heart of the stress that was saw in early March — the severe period of stress,” Powell said. “Those have now all been resolved.”

Although the crisis started with issues around the value of long-dated assets in a rising interest rate environment and a need to withdraw deposits by Silicon Valley Bank’s clientele of startup companies, it continues to trigger fears around the stability of the banking system.

And those problems are not easily dismissed as unique to a particular bank.

In a Gallup poll released on May 4, 48% of people said they were worried or very worried about their deposits, higher than the 45% result during the Global Financial Crisis in 2008.

With the deposit update from PacWest, Fed funds futures traders on Thursday placed an almost 50% chance on Federal Reserve policy makers cutting interest rates at their July 25-26 meeting.

Meanwhile, the Federal Deposit Insurance Corp. met to discuss how its insurance fund will be replenished in a process that will add to the costs of banks as they reimburse the government for backstopping deposits at Silicon Valley Bank, and First Republic Bank.