This post was originally published on this site

https://i-invdn-com.investing.com/news/LYNXNPEE9H1O1_M.jpg

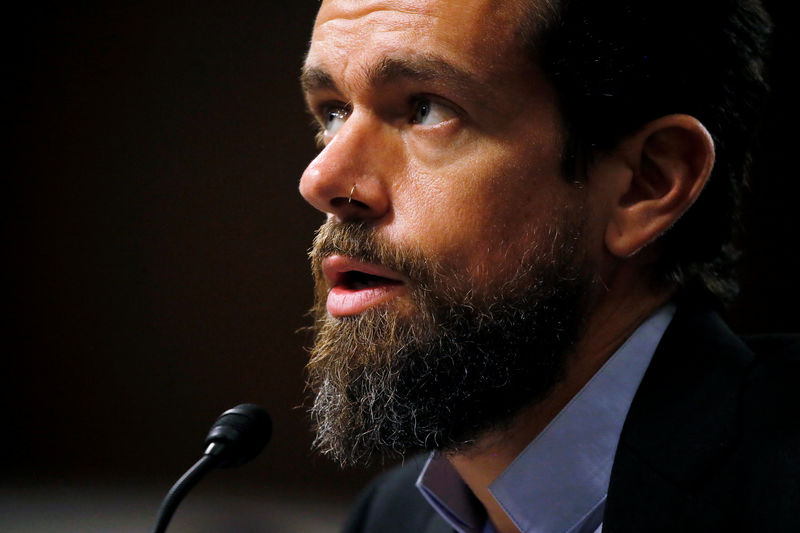

Block (NYSE:SQ) shares tumbled Thursday after Hindenburg Research released a short report claiming the company, co-founded by Twitter creator Jack Dorsey, misled investors with “inflated metrics.”

The short-selling firm states that its two-year investigation has concluded that Block has “systematically taken advantage of the demographics it claims to be helping.”

Block shares are down more than 18%, adding to a 6% decline on Wednesday. The stock has fallen over 45% in the last 12 months.

Hindenburg argues that the “magic” behind Block’s business has not been disruptive innovation but the company’s “willingness to facilitate fraud against consumers and the government, avoid regulation, dress up predatory loans and fees as revolutionary technology, and mislead investors with inflated metrics.”

In addition, they state that Block has “wildly” overstated its user counts and has understated its customer acquisition costs, claiming that former employees estimated 40% to 75% of accounts they reviewed were fake, involved in fraud, or were additional accounts belonging to one individual.

“The company’s ‘Wild West’ approach to compliance made it easy for bad actors to mass-create accounts for identity fraud and other scams, then extract stolen funds quickly,” Hindenburg claimed. “Even when users were caught engaging in fraud or other prohibited activity, Block blacklisted the account without banning the user.”