This post was originally published on this site

Investors should be cautious as valuations in the U.S. stock market have climbed back to levels as “extreme” as those seen in 2022 around the start of the bear market, according to a note Monday from Morgan Stanley Wealth Management.

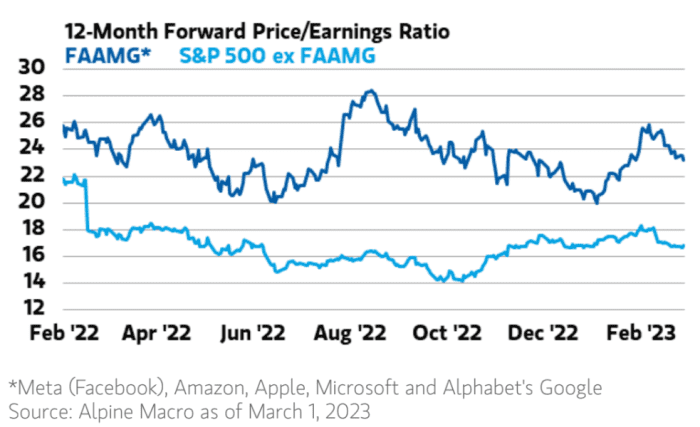

The expansion of the U.S. equity market’s price-to-earnings multiples appears “premature,” as they’ve “returned to the highs reached when the current bear market began,” Morgan Stanley Wealth Management’s global investment committee, led by Lisa Shalett, said in the note.

That goes for a tech-heavy group of stocks known as FAAMG, as well as equities outside that cohort, the note says, referring to Facebook parent Meta Platforms Inc.

META,

Amazon.com Inc.

AMZN,

Apple Inc.

AAPL,

and Microsoft Corp.

MSFT,

and Google parent Alphabet Inc.

GOOGL,

The S&P 500 index, a gauge of U.S. large-cap stocks, officially entered a bear market in June 2022. Morgan Stanley tracked the stock market’s valuation in the chart below.

MORGAN STANLEY WEALTH MANAGEMENT NOTE DATED MARCH 6, 2023

The chart shows valuations for FAAMG stocks peaked in the late summer of 2022, while those for the S&P 500, when stripping out those stocks, are back around levels seen in June. That’s the month the S&P 500 confirmed a bear market.

Price-to-earnings, or P/E multiples “typically expand during a recession as company earnings hit their cycle troughs,” Morgan Stanley Wealth Management said in the note. “This expansion has not come from falling earnings. In fact, S&P 500 profits were up 4.6% in 2022 versus 2021.”

Furthermore, stock-market “damage” could come from a potentially looming recession or even a so-called “soft landing” for the economy, if the Federal Reserve continues raising interest rates to combat high inflation, according to the report.

Read: Powell to talk to Congress about the possibility of more interest-rate hikes, not fewer

“S&P 500 earnings estimates for 2023 have declined more than 12% year over year, and at $222 per share, they indicate scant profit growth,” Morgan Stanley Wealth Management’s global investment committee said.

“The upward movement in P/Es has come from price gains even as interest rates were rising,” the note says. “Caution is warranted.”

The U.S. stock market was climbing Monday, with the S&P 500

SPX,

up 0.6%, as major benchmarks attempt to extend last week’s gains, according to FactSet data, at last check. The S&P 500 is up around 6% so far this year, based on Monday trading activity and after rising 1.9% last week.