This post was originally published on this site

Social Security is once again in play, no matter how much people deny it.

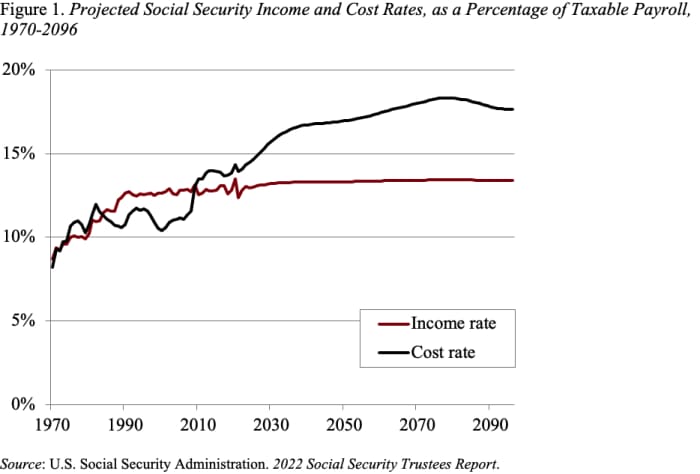

In part, that’s a good thing, because Social Security benefits cost more than the income rolling in (see Figure 1). So far, this mismatch between the cost of benefits and revenues hasn’t had any impact on beneficiaries, because the shortfalls have been covered by the reserves in the trust fund. Those trust fund reserves, however, will be depleted in 2035 and, without legislation, revenues will be sufficient to cover only about three quarters of scheduled outlays.

Read: What’s behind Bernie Sanders and Elizabeth Warren’s bold tax hike to shore up Social Security?

Since Social Security is forbidden by law to spend money it doesn’t have, benefits will be cut automatically across the board — that means both current and future beneficiaries will take a huge hit.

Something has to be done. I love the Social Security program, believe it is the backbone of our retirement system, and would like to see 75-year financial balance restored. But I care about how that is done. In my view, cutting benefits, as opposed to putting in more revenues, would be a serious mistake.

If it’s a clean fight, my judgment is that the “increase revenues” team will win. But I worry about a dirty fight. People sometimes talk as if there is a third way to fix Social Security. The most prominent example is raising the Full Retirement Age (FRA). But as I have noted repeatedly, raising the FRA is not simply a question of postponing benefits; it is a benefit cut.

Another “third way” example is “progressive price indexing.” It sounds like an obscure technical correction, but since wages rise faster than prices, it is a powerful mechanism to cut benefits.

The reason that the proposal is characterized as “progressive” is the notion that the lowest 30% of wage earners — those who make less than about $30,000 today — would see their benefits calculated as under current law; those workers who earn the taxable maximum — currently $160,000—would have their benefits calculated using price indexing; and those with earnings between $30,000 and $160,000 would see an increasing amount of benefit cuts.

Progressive price indexing would dramatically change Social Security’s benefit structure over time.

Read:The clock is ticking too fast for Social Security and Medicare funding to keep up

Today, high earners contribute more in payroll taxes and receive a larger dollar benefit than lower earners. Eventually all Social Security beneficiaries with earnings above the cutoff would receive the same dollar benefit regardless of how much they contributed to the system. That is, under the proposal, Social Security would eventually provide a flat benefit rather than an earnings-related benefit for much of the population.

So be alert and help make this a fair fight. If you hear people talking about raising the full retirement age or introducing progressive price indexing as if they were alternatives to benefit cuts, call them on it.

Let’s at least get the scoring right.