This post was originally published on this site

The U.S. and global economies are set to slow in 2023 as central banks ramp up their fights against inflation, but the forecast is “less gloomy” than it was just several months ago, the International Monetary Fund said Monday.

The IMF said the world economy has been more resilient than expected. Steady consumer spending, strong labor markets, the end of lockdowns in China tied to the pandemic and an easing energy crisis in Europe were among the factors cited.

High inflation also began to recede around the world, the IMF noted, in part because bottlenecks in global supply chains began to unwind. Those disruptions played a big role in the surge in inflation in 2021 and 2022.

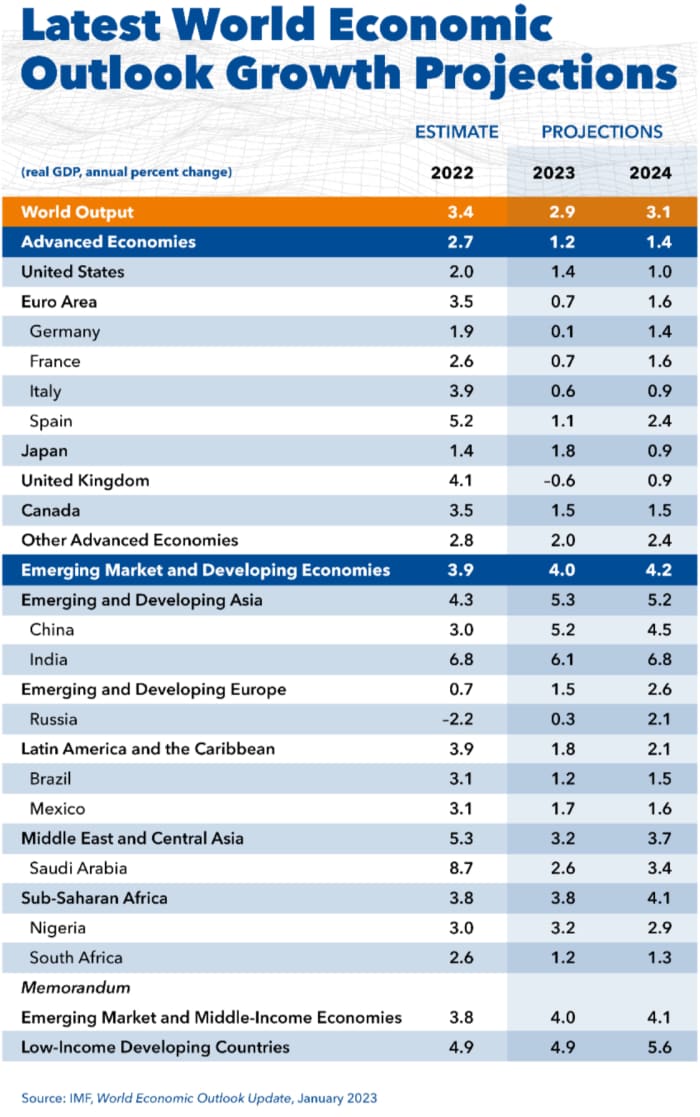

In the U.S., economic growth is forecast to slow to 1.4% in 2023 from an estimated 2% in 2022, the latest IMF quarterly forecast shows. Previously the IMF predicted the U.S. would expand just 1% this year.

Notably, the IMF is not predicting a U.S. or global recession. The agency’s outlook for the U.S. is also more optimistic compared to forecasts by U.S. economists.

Read: A ‘zero’ economy? No growth and rising unemployment forecast for 2023

Also: A recession is coming, economists say. Some even think it’s already here

The United Kingdom is the most likely of the major economies to suffer a downturn in 2023, the agency said.

IMF

“The outlook is less gloomy than in our October forecast and could represent a turning point,” said Pierre-Olivier Gourinchas, economic counselor and director of the IMF research department.

The biggest reason for optimism is waning inflation. The combination of supply chains getting back to normal and reduced customer demand in response to higher interest rates are cooling off rapid price increases.

The Chinese government’s decision to end strict economic lockdowns has also helped.

The global economy, for its part, is forecast to slow to a 2.9% rate of growth in 2023 from 3.4% in the prior year. Then growth would re-accelerate in 2024.

India and China are expected to account for about half of all global growth this year, the IMF said. They are the two most populous countries in the world.

Europe is likely to expand less than 1% in 2023 after an estimated 3.5% growth rate last year. Still-high energy costs stemming from the war in Ukraine will continue to be a drag on the region’s economy.

The biggest danger to the global economy, the IMF said, is the possibility that inflation remains stubbornly high. Even now, inflation is running higher in 80% of the world compared to pre-pandemic times.

If inflation doesn’t return to pre-crisis levels soon, the IMS cautioned, central banks could be forced to keep interest rates high and further depress the global economy.

High interest rates constrain economic growth by making it more expensive for consumers and businesses to spend and invest.

“The inflation news is encouraging, but the battle is far from won,” Gourinchas said. “The road back to a full recovery, with sustainable growth, stable prices, and progress for all, is only starting.”