This post was originally published on this site

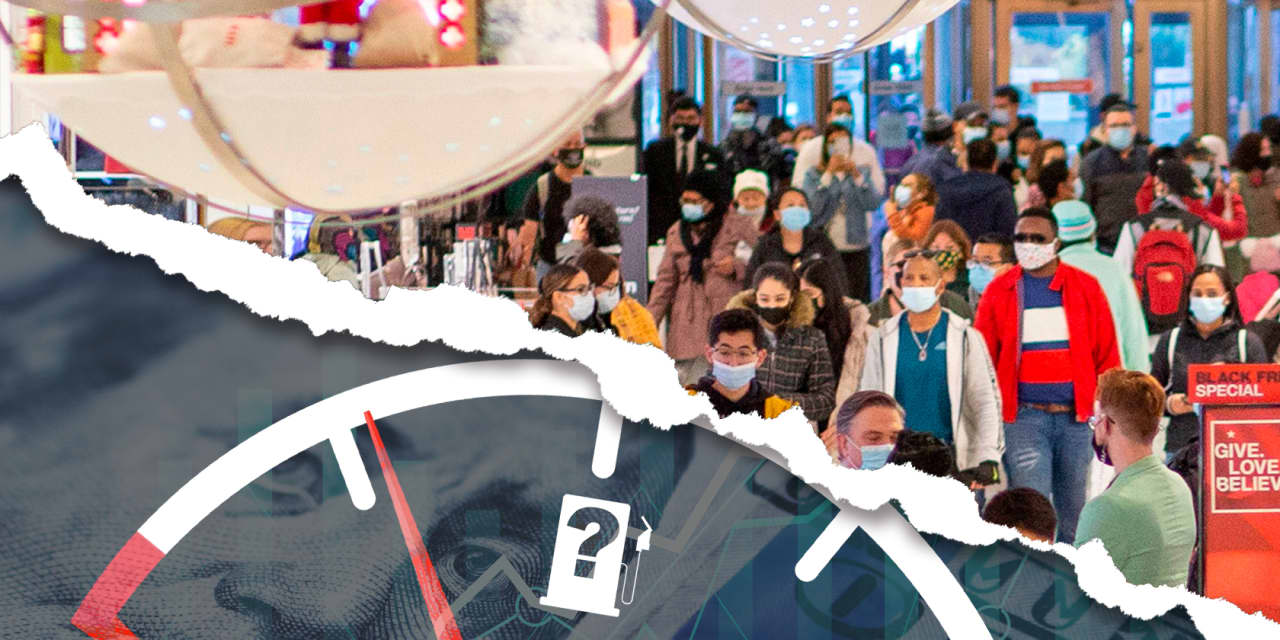

Black Friday is arriving at an interesting time for the American consumer. Shoppers have seemingly persevered this year despite an all-out assault on their pocketbooks and net worth — from falling equity prices and, more recently, home valuations, to rampant inflation that has eroded their spending power.

But after a host of large American retailers, including Walmart Inc.

WMT,

and Target Corp.

TGT,

warned their shareholders about the waning strength of the American consumer and most major investment banks warned about a looming recession in 2023, investors are justified in wondering: how much strength does the American consumer have left?

It’s a question they’ll be asking next weekend and probably through the end of January, now that the holiday shopping season has morphed into a four-month slog marked by increasingly generous discounting as retailers battle for customers’ dwindling dollars, several economists told MarketWatch.

Already, some cracks in the consumers’ facade are beginning to emerge. The October retail-sales number released this week by the U.S. Department of Commerce saw sales of goods and services increase by 1.3% in October. However, some of the reports’ details were far less sanguine: department-store sales, as well as sales of sporting goods, apparel and consumer electronics, were all notably weak, especially if inflation is factored in.

See: U.S. drivers are likely to pay highest Thanksgiving gas prices on record

And while wages have been rising this year, they have hardly kept pace with rising prices, as the October jobs report, released by the U.S. Department of Labor earlier this month, showed. Wages grew by just 0.4% in October, lowering the rate of growth for the past 12 months to 4.7%.

To top it all off, consumer debt borne by Americans rose to a fresh record at $16.5 trillion in the third quarter of 2022, according to data released four times a year by the New York Fed. Meanwhile, the personal savings rate, released monthly by the Bureau of Economic Analysis, has declined to 3.1% in September. Since 2008, readings below 4% have been exceedingly rare.

Americans’ average net worth is still more than 20% higher than it was before the pandemic.

According to Dec Mullarkey, managing director of investment strategy and asset allocation at SLC Management, “the consumer is in pretty good shape.”

But that’s quickly changing, it seems.

And, as the holidays approach, some economists are starting to see more signs that consumer spending might not be able to keep growing at such a steady pace, said Van Hesser, a senior managing director and chief strategist at Kroll Bond Rating Agency who focuses on the consumer in his work.

“The way we think about it is this holiday season might be the last hurrah for the consumer in this cycle,” he said

How far will retailers go with the discounting?

Thanks to the lingering effects of the pandemic, many big-box retailers have been stuck with unsold inventory, from consumer electronics to home furnishings. Now, the holiday shopping season and Black Friday will test how far they they are willing to go with their discounts to dump this inventory, or risk being stuck with it as the full effect of the Federal Reserve’s interest-rate hikes slam the economy in 2023.

“I think that going into a perceived downturn for the economy — who knows whether it’s going to occur or not, but the perception is generally that it’s going to happen — if you’re going into that and you’re long inventory, what you’re going to do is try to get rid of that stuff as best you can,” said Josh Shapiro, chief U.S. economist at MFR.

One major issue is that consumers have been bombarded with emails and advertisements about sales for weeks now, so the deals offered by retailers will likely need to be pretty attractive to catch consumers’ attention.

“Many consumers are just numb to Black Friday sales because they have been seeing it for the past six weeks,” said Natalie Kotlyar, national leader of BDO’s retail and consumer products practice.

This puts smaller retailers in a particularly difficult position, said James Gellert, chief executive officer of RapidRatings.

“Many of the smaller and private companies upstream in the retail supply chain have been squeezed and are struggling to absorb higher materials and labor costs without the ability to pass all of those costs through, Gellert said.

Ultimately, how far retailers go to move their inventory can tell investors a lot about how the retail sector is faring.

‘Black Friday’ isn’t a marathon, it’s a months-long slog

After being pulled forward during the pandemic, U.S. consumers’ appetite for non-staple goods like electronics and furniture has diminished substantially.

“Home goods has been a hot-ticket item for many years. How many air fryers does one person need?” Kotlyar said.

And now, some expect Black Friday might confirm what they have been seeing all year: steady declines in spending on consumer goods as Americans adjust to budgeting for other priorities, like going out to eat at restaurants or attending concerts and sporting events.

“Clearly the consumer is getting weaker, and if you look at what happened with Target and Walmart and other companies that reported this week, that is very consistent with the numbers they reported and the guidance they provided,” said Phil Orlando, the chief equity market strategist at Federated Hermes.

Holiday shopping has expanded aggressively in recent years to include four months — September, October, November and January, Orlando said.

One issue with this, however, is that investors are now left wondering what data like Octobers’ retail sales spending truly means. Does it suggest that consumers are simply front-loading their holiday shopping? Or does it mean holiday sales will be “particularly festive” this year

How much ‘fuel’ is left in the ‘tank’?

It can be difficult to gauge how much fuel consumers have left in the tank. Ultimately, the answer is likely more complicated than a simple ‘yes’ or ‘no’.

Although consumers received trillions of dollars’ in cash during the pandemic, households’ bloated savings have swiftly declined this year as inflation has surged while the value of financial assets has shrunk.

The amount of excess savings on household balance sheets has been cut in half over the past year, and it’s believed that much of what’s left resides with wealthier households, according to a report from Oxford Economics.

Another issue that Oxford Economics pointed out is that most of the savings reserves in the U.S. economy resides with wealthier households, which typically have a lower propensity to spend them down.

While wealthier Americans should have little trouble handling the increased debt burden, lower and middle-class families have been forced to rely on credit cards more extensively.

Looking ahead, the U.S. economic data calendar is relatively light during the upcoming holiday-shortened week, although investors will receive the minutes from the Federal Reserve’s latest meeting.

U.S. stocks cemented a loss for the week on Friday, as renewed worries about the pace of monetary tightening from the Fed helped undermine stocks: the Dow Jones Industrial Average

DJIA,

finished with a marginal weekly loss at 33,3745.69, while the S&P 500

SPX,

pulled back 0.7% to 3,965.34 and Nasdaq Composite

COMP,

fell 1.6% to 11,146.06.