This post was originally published on this site

Biogen’s

BIIB,

stock is rising again as investors double down on the company’s promising yet still experimental treatment for Alzheimer’s disease.

The company’s stock soared Monday morning after Roche Holding

ROG,

and MorphoSys

MOR,

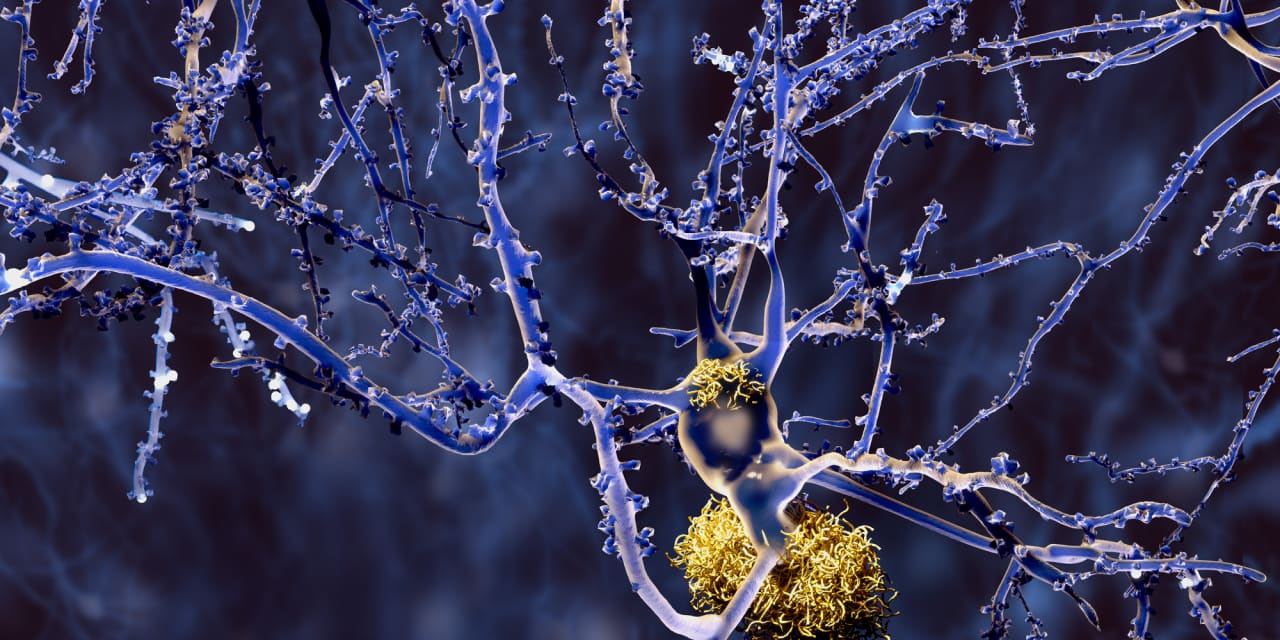

said their own Alzheimer’s drug failed to meet the primary endpoints in two late-stage clinical trials. The drug, gantenerumab, neither reduced cognitive decline in a statistically significant way nor cleared the amyloid plaques commonly found in the brains of people diagnosed with the disease.

lecanemab, the drug being tested by Biogen and Eisai Co. Ltd.

4523,

also aims to reduce amyloid plaques, an unproven but still compelling method of treating Alzheimer’s disease. However, Monday’s news didn’t dissuade investors. Some Wall Street analysts say that gantenerumab’s failure isn’t indicative of all amyloid-plaque-clearing treatments. And even though the drug failed within the parameters of the clinical trials, it did demonstrate some amyloid activity, which further bolsters the case for lecanemab and for Eli Lilly & Co.’s

LLY,

donanemab.

“The fact that [gantenerumab] showing any directional signals of activity reaffirms that beta-amyloid antibodies are active and should eliminate any residual concerns that [lecanemab]’s success was a fluke,” RBC Capital Markets analyst Brian Abrahams told investors on Monday. “Rather, [lecanemab] just looks to be a better antibody.”

Other companies developing anti-amyloid treatments for Alzheimer’s also saw their stock prices jump on Monday. Lilly’s stock was up 0.7% in trading on Monday morning, as were shares of Prothena Corp.

PRTA,

which gained 4.9%. Lilly’s donanemab is currently being tested in late-stage trials, and Prothena has a beta-amyloid antibody in a Phase 1 clinical trial.

“Not all drugs that attack the same target are identical,” Howard Fillit, chief science officer at the Alzheimer’s Drug Discovery Foundation, said in a statement. “The complexity of the aging brain means there are likely nuances in how drugs work to do things like clear amyloid and tau proteins, reduce inflammation, and improve the brain’s metabolism. Each drug needs to be evaluated individually.”

With Roche’s drug out of the running, lecanemab and donanemab are now the frontrunners in the race to develop better treatments for Alzheimer’s. (Biogen’s Aduhelm, which was approved in mid-2021, has foundered over questions about its price and effectiveness.) William Blair’s Myles Minter predicts lecanemab will generate $8.5 billion in sales for Biogen and Eisai by 2030 if it’s approved next year.

“This is the near bull case for Biogen,” he told investors.

Investors will be paying close attention on Nov. 29, when Eisai is expected to share additional clinical data about lecanemab, as well as during the first three months of next year, when Eisai is expected to file for approval of the drug.

Biogen’s stock has gained 26.7% so far this year, while the broader S&P 500

SPX,

is down 16.2%.