This post was originally published on this site

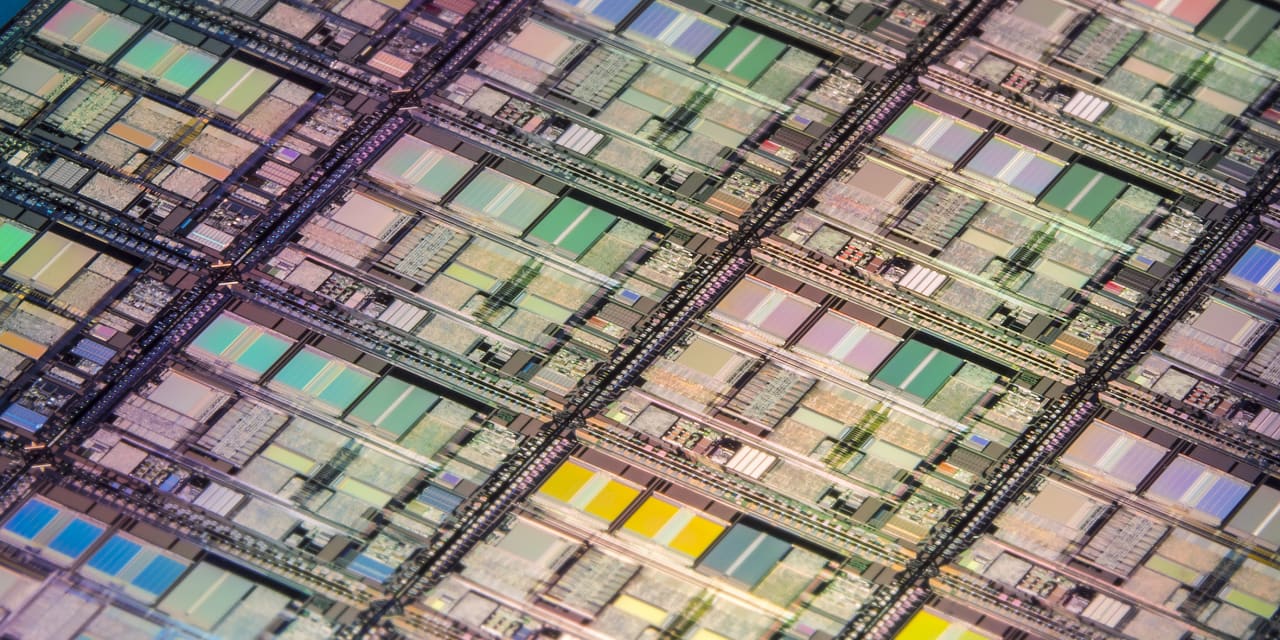

U.S. chip-equipment suppliers are pulling out staff based at China’s leading memory-chip maker and pausing business activities there, according to people familiar with the matter, as they grapple with the impact of Commerce Department semiconductor export restrictions.

State-owned Yangtze Memory Technologies Co. is facing a freeze in support from key suppliers including KLA Corp.

KLAC,

KLAC -2.17%▼ and Lam Research Corp.

LRCX,

the people said. The suspensions follow last week’s sweeping curbs imposed by the U.S. on China’s chip sector, ostensibly to prevent American technology from advancing China’s military power, though the impact might reach further into the industry.

The U.S. suppliers have paused support of already installed equipment at YMTC in recent days and temporarily halted installation of new tools, the people said. The suppliers are also temporarily pulling out their staff based at YMTC, the people said.

Chip-making equipment vendor Applied Materials Inc. on Wednesday slashed its sales projection for the current quarter by about $400 million, citing the restrictions. The company, one of the largest producers of chip equipment in the world, counts China’s leading chip-makers among its many customers. It generated more than 27% of its sales from China in the second quarter, or nearly $1.8 billion. A large portion of those sales go to multinational firms that operate in China and are expected to be exempt from controls targeting Chinese chip-makers.

An expanded version of this report appears on WSJ.com.

Popular on WSJ.com:

China’s Universities Rise in World Rankings as American Schools Continue to Falter

That Sky-High I Bond Interest Rate Will Be Coming Down to Earth