This post was originally published on this site

The U.S. housing market has been pushed into a recession, helped by pandemic-era prices and mortgage rates now surpassing 7%.

“The headwind from higher mortgage rates has already been visible in recent data,” Goldman Sachs

GS,

economists wrote in a note on Oct. 7 titled “How deep will the correction go.”

With the Case-Shiller index showing the largest month-over-month decline since 2012, on top of falling mortgage applications, these charts suggest “a further weakening in demand,” they added.

Here’s a look at how bad the downturn is, in five charts:

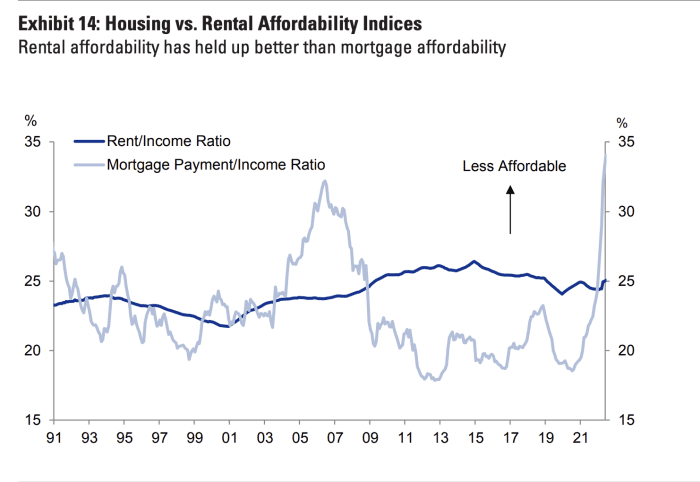

Mortgage rates will “remain persistently high,” the Wall Street bank said, “causing unsustainable levels of housing affordability to continue weighing on housing demand.”

Expect the 30-year mortgage to remain elevated, and end the year at 6.4%, and home prices to correct by as much as 20% in overpriced markets like Boise and San Diego, economists said.

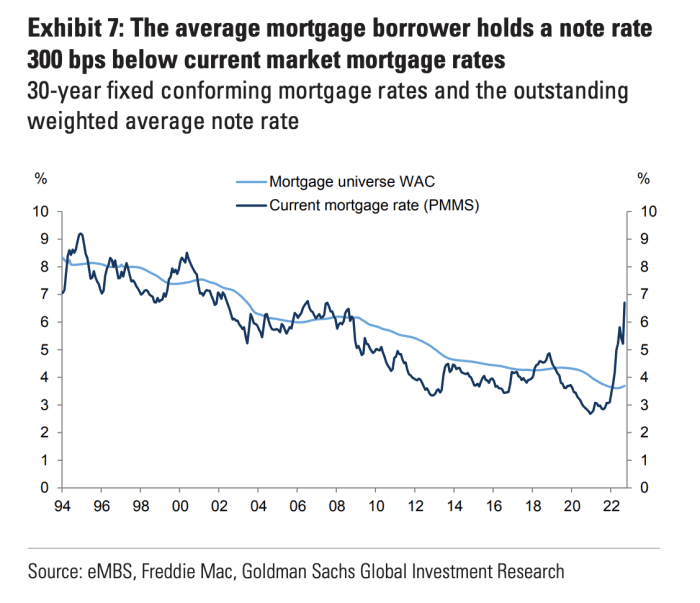

The last two years of extremely low interest rates were not lost on homeowners who held mortgages — many refinanced. Roughly 90% of mortgages are fixed rate, Goldman noted, with an average note rate of 3.6%.

And unlike other countries, only around 6% of active mortgages are currently floating rate, they added, citing Black Knight

BKI,

data.

A higher share of people with variable-rate mortgages translates to a higher risk of existing borrowers becoming unable to meet rising payments in the future, Goldman added, as mortgage rates continue upwards.

Buyers who continue to stay on the sidelines, spooked by the rates, have continued to rent while waiting out the downturn. And rents have been a lot more affordable than owning a home at these rates.

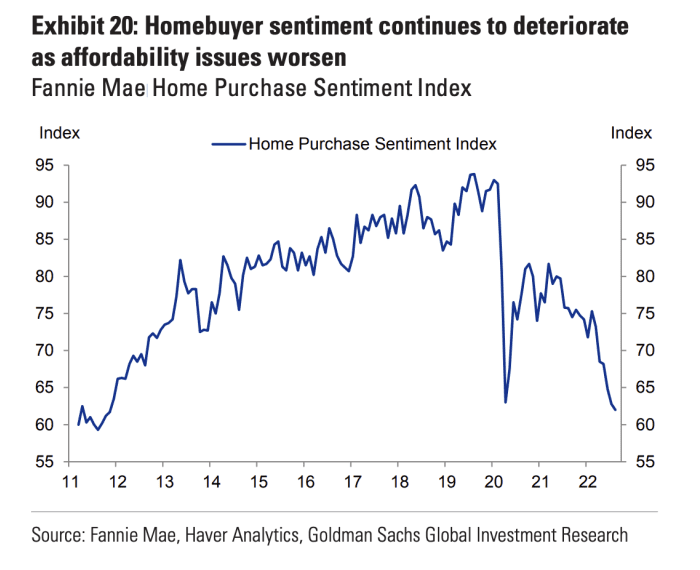

Homebuyer sentiment has plunged to the lowest level since 2011. Buyers are expecting home prices to fall, Fannie Mae said recently.

Yet it isn’t all doom and gloom, Goldman stressed.

“We expect the housing-market correction in aggregate to be milder than affordability by itself would dictate, driven by two key reasons,” the Wall Street bank added, which is due to low housing supply and a low risk of a foreclosure wave.