This post was originally published on this site

While September has lived up to its reputation as a brutal month for stocks, October tends to be a “bear-market killer”, known for its historically strong returns especially during midterm election years.

Skeptics, however, are warning investors that negative economic fundamentals could overwhelm seasonal trends as what’s traditionally the roughest period for equities comes to an end.

The S&P 500

SPX,

was on track for a monthly decline of 7.9% at Thursday’s close, while the Dow Jones Industrial Average

DJIA,

was down 7.2% and the Nasdaq Composite

COMP,

pushed its total monthly loss to 9.1%, according to Dow Jones Market Data.

The indexes had booked modest gains in the first half of the month after investors fully priced in a large interest rate hike in the FOMC meeting late September as August’s inflation data showed little signs of easing price gains. However, the central bank’s more-hawkish-than-expected stance on its monetary policy made stocks give up all those initial gains. The Dow entered its first bear market since March 2020 in the last week of the month, while the large-cap index slid to another 2022 low.

See: It’s the worst September for stocks since 2008. What that means for October.

October’s track record may offer some comfort as it has been a turnaround month, or a “bear killer,” according to the data from Stock Trader’s Almanac.

“Twelve post-WWII bear markets have ended in October: 1946, 1957, 1960, 1962, 1966, 1974, 1987, 1990, 1998, 2001, 2002 and 2011 (S&P 500 declined 19.4%),” wrote Jeff Hirsch, editor of the Stock Trader’s Almanac, in a note on Thursday. “Seven of these years were midterm bottoms.” 2022 is also a midterm election year, with congressional elections in November.

According to Hirsch, Octobers in the midterm election years are “downright stellar” and usually where the “sweet spot” of the four-year presidential election cycle begins (see chart below).

“The fourth quarter of the midterm years combines with the first and second quarters of the pre-election years for the best three consecutive quarter span for the market, averaging 19.3% for the DJIA and 20.0% for the S&P 500 (since 1949), and an amazing 29.3% for NASDAQ (since 1971),” wrote Hirsch.

SOURCE: STOCKTRADERSALMANAC

Skeptics aren’t convinced the pattern will hold true this October. Ralph Bassett, head of investments at abrdn, an asset management firm, said these dynamics could only play out in “more normalized years.”

“This is just such an atypical period for so many reasons,” Bassett told MarketWatch in a phone interview on Thursday. “A lot of mutual funds have their fiscal year-end in October, so there tends to be a lot of buying and selling to manage tax losses. That’s kind of something that we’re going through and you have to be very sensitive to how you manage all of that.”

Seasonality trends for October

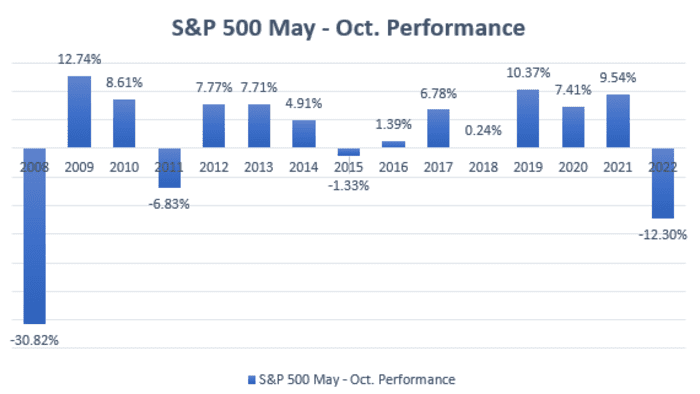

The old Wall Street adage, “sell in May and go away,” refers to the market’s historical underperformance during the six-month period from May to October. Stock Trader’s Almanac, which is credited with coining the saying, found investing in stocks from November to April and switching into fixed income the other six months would have “produced reliable returns with reduced risk since 1950.”

Strategists at Stifel, a wealth management firm, contend the S&P 500, which has fallen more than 23% from its Jan. 3 record finish, is in a bottoming process. They see positive catalysts between the fourth quarter of 2022 and the start of 2023 as Fed policy plus S&P 500 negative seasonality are headwinds that should subside by then.

“Monetary policy works with a six-month lag, and between the Nov-2nd and Dec-14th final two Fed meetings of 2022, we do see subtle movement toward a data-dependent Fed pause which would bullishly allow investors to focus on (improving) inflation data rather than policy,” wrote strategists led by Barry Bannister, chief equity strategist, in a recent note. “This could reinforce positive market seasonality, which is historically strong for the S&P 500 from November to April.”

Seasonality trends, however, aren’t written in stone. Dow Jones Market Data found the S&P 500 recorded positive returns between May and October in the past six years (see chart below).

SOURCE: FACTSET, DOW JONES MARKET DATA

Anthony Saglimbene, chief markets strategist at Ameriprise Financial, said there are periods in history where October could evoke fear on Wall Street as some large historical market crashes, including 1987 and 1929, occurred during the month.

“I think that any years where you’ve had a very difficult year for stocks, seasonality should discount it, because there are some other macro forces that’s pushing on stocks and you need to see more clarity on those macro forces that are pushing stocks down,” Saglimbene told MarketWatch on Friday. “Frankly, I don’t think we’re going to see a lot of visibility at least over the next few months.”

U.S. stock indexes drifted mostly lower on Friday in choppy trade after an inflation reading showed inflation accelerated even more than expected in August.