This post was originally published on this site

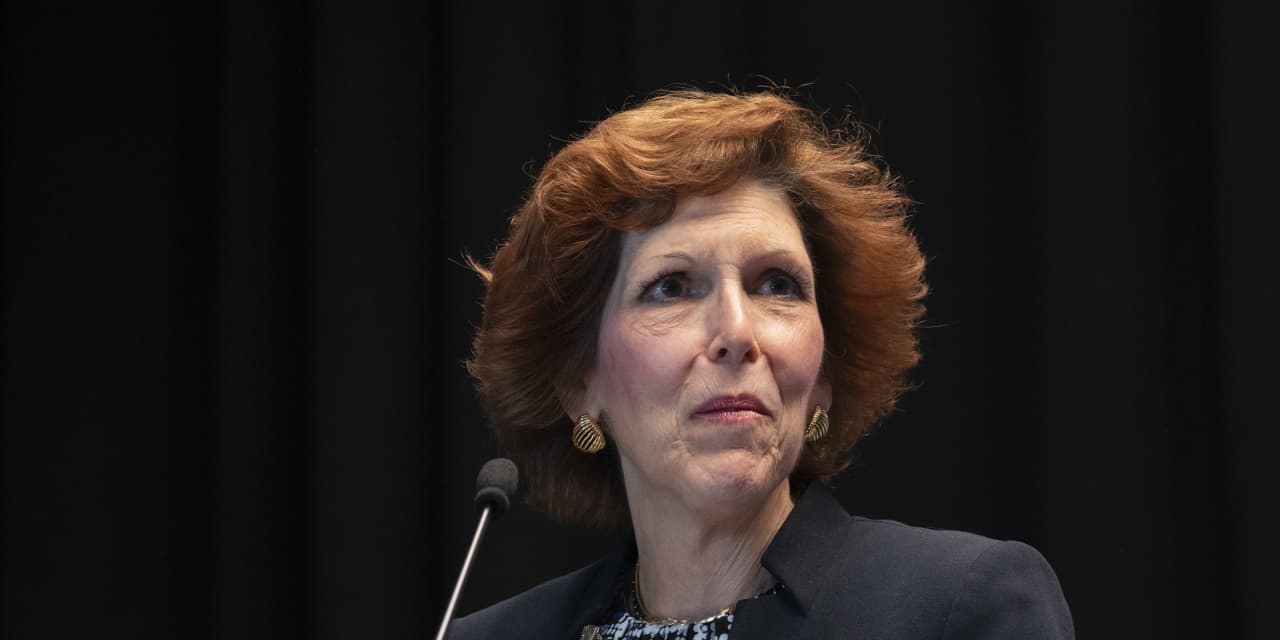

Cleveland Federal Reserve President Loretta Mester on Thursday pushed back on the notion that the central bank might pause hiking interest rates out of a concern that something might “break” in the economy.

In an interview on CNBC, Mester was asked time and again about whether the Fed was worried it would overdo its rate hikes and have to quickly shift policy, as the Bank of England did this week.

See: Fed officials are in rare unanimity on bringing inflation back down to 2% target, Kashkari says

Even though it is raising its interest rates to combat inflation, the Bank of England on Wednesday announced a new round of bond buying after the U.K. bond market was unsettled by the government’s new fiscal policy.

Mester countered that one of the lessons of the situation in the U.K. might be that the Fed needed to be “diligent about getting inflation down.”

“The confidence of the markets and market participants and the public generally is that the Fed is on the job and making sure [the U.S.] gets back to price stability,” she said.

Asked why isn’t there an argument for a pause, Mester replied: “We can have that conversation but we’re still not even in restrictive territory on the funds rate.”

While the Fed has moved its funds rate up 300 basis points since March, “look how high inflation is,” she added.

The Fed’s benchmark rate is now 3%-3.25% after three straight 0.75 percentage point rate hikes.

Mester says she wants to see the Fed’s benchmark rate get above 4% and held there because she sees more persistence in inflation than some of her colleagues do.

The Cleveland Fed president said she would be happy if the public’s expectations about inflation came down from where they are now. She said she’d also be happy if her business contacts were holding their retail prices steady or moving them down.

Mester is a voting member this year of the Fed’s policy making committee.

See also: Chicago Fed president defends dot plot as he says interest-rate plateau may be warranted next year

The yield on the 10-year Treasury note

TMUBMUSD10Y,

rebounded to 3.78% after slumping yesterday on the Bank of England policy shift.