This post was originally published on this site

U.S. stock futures on Wednesday showed Wall Street in danger of recording a seven-day losing streak as worries about rising bond yields continued to suppress investors’ risk appetite.

How are stock-index futures trading

-

S&P 500 futures

ES00,

-0.45%

dipped 25 points, or 0.6%, to 3636 -

Dow Jones Industrial Average futures

YM00,

-0.23%

fell 134 points, or 0.5%, to 29069 -

Nasdaq 100 futures

NQ00,

-0.86%

eased 120 points, or 1.1%, to 11214

On Tuesday, the Dow Jones Industrial Average

DJIA,

fell 126 points, or 0.43%, to 29135, the S&P 500

SPX,

declined 8 points, or 0.21%, to 3647, and the Nasdaq Composite

COMP,

gained 27 points, or 0.25%, to 10830. The Nasdaq Composite was down 32.6% from its record high from November last year.

What’s driving markets

Equity futures dipped after 10-year U.S. Treasury yields

TMUBMUSD10Y,

early on Wednesday breached 4% for the first time since the 2008 crisis.

Bond markets have been leading stocks of late as investors fret that the Federal Reserve’s determination to combat inflation will continue to push borrowing costs higher, damaging the economy and corporate earnings.

“Our central market view has been that pressure towards tighter U.S. financial conditions is unlikely to end until the economy either enters a clear recession or shows sustained inflation progress,” wrote Dominic Wilson, economic analyst at Goldman Sachs.

“Equity market troughs in past monetary policy-driven corrections have always been quite closely preceded by a peak in 10-year yields, a threshold not yet reached,” he added.

The market must contend with yet another flurry of Fed speakers on Wednesday. Between 8:35 a.m. and 2 p.m. Eastern, various topics will be addressed by Atlanta Fed president Raphael Bostic; Chair Jay Powell; Gov. Michelle Bowman; Richmond Fed president Tom Barkin; and Chicago Fed president Charles Evans.

Also pressuring futures was a 3% fall in Apple shares

AAPL,

amid reports the tech giant was halting plans to increase production of its new iPhones. However, Jim Cramer dismissed the significance of the news.

The S&P 500 on Tuesday fell for its sixth session in a row, shedding 6.5% over that period, and recording its longest losing streak since the beginning of the COVID-19 pandemic in February 2020.

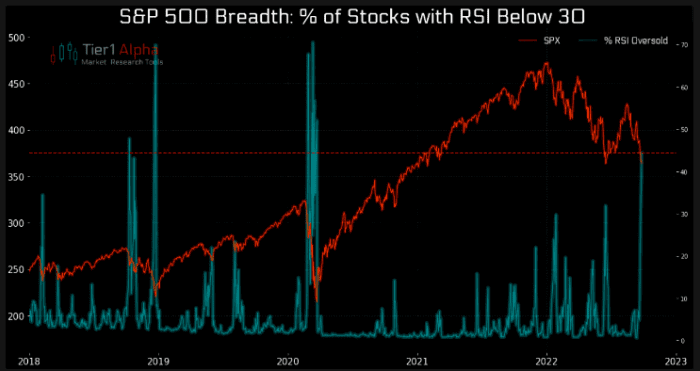

Indeed the benchmark stock index has lost ground in eight of the last nine sessions, leaving its 14-day relative strength index momentum gauge at 27, where a figure below 30 is considered oversold territory.

Around 45% of S&P 500 stocks were oversold, noted Tier 1 Alpha, the most since the COVID-19 induced market meltdown in early 2020.

Source: Tier1 Alpha

U.S. economic updates set for release on Wednesday include the August trade in goods advanced report due at 8:30 a.m. and the pending home sales index at 10 a.m.