This post was originally published on this site

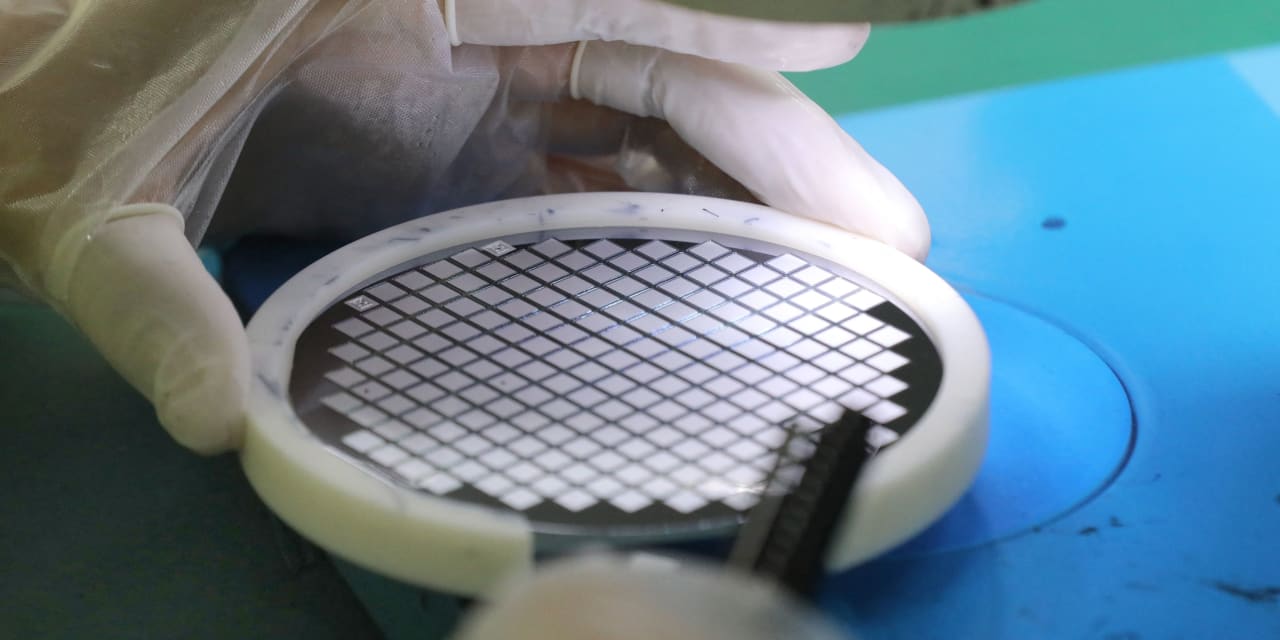

China’s semiconductor industry is in the midst of a corruption tsunami, just as the U.S. intensifies rules aimed at hampering Beijing’s chip-sector capabilities.

At least a dozen top-level executives have come under investigation since a campaign ramped up in July targeting the so-called Big Fund — a government-supported fund set up to build an independent Chinese semiconductor industry.

China’s graft problems come as the global chip industry is undergoing profound changes due to political tensions, supply-chain disruptions and component shortages.

The Big Fund is officially known as the China Integrated Circuit Industry Investment Fund and is managed solely by a firm called Sino IC Capital, an arm of the state-run China Development Bank

1062,

At least five of Sino IC Capital’s former senior executives have been ensnared in the corruption probe.

The investigation intensified this year after several of the Big Fund’s expensive projects foundered. Those include perhaps its most prestigious project, in which state-backed Tsinghua Unigroup formed partnerships with Intel

INTC,

and HP

HPE,

and became the biggest recipient of cash from the Big Fund.

Mismanagement and suspected graft hamstrung Tsinghua Unigroup’s projects, and after defaulting on debts it went bankrupt last year.

Chinese analysts the told financial news outlet Caixin that alleged financial corruption wasn’t the sole driver of the crackdown. Beijing sees the mismanagement as a key part of the fund’s failure to develop powerhouse chip producers.

The latest downfall came Thursday, when Ren Kai, vice president of Sino IC Capital, was detained, according to China’s Central Commission for Discipline Inspection. The company publicly confirmed the probe but provided no further information.

Twisting a knife into China’s industry troubles are multiple steps taken by the Biden administration to bolster America’s chip independence and cut off supply connections to China. On Aug. 9, Biden signed into law the $280 billion CHIPS and Science Act, which will initially allocate $52 billion to boost the U.S. semiconductor industry.

The U.S. is also working on the so-called Chip 4 alliance, a semiconductor partnership with Japan, South Korea and Taiwan. The majority of the world’s chips are made in Taiwan, which is also home to the industry’s leading firm, the Taiwan Semiconductor Manufacturing Company

TSM,

The moves have inflamed Beijing.

“Whether it’s the bill or the Chip 4 alliance, they all come with a strong coercive nature — asking others to take sides between China and the U.S.,” read an article this month in the state-run Global Times.

“In a sense, they have gone beyond the scope of ordinary industrial supportive policies, and are more like a set of punches by Washington to ‘choke the throat of China’s development,’” the article said.

Read: The U.S. must take the lead on globalization if it hopes to compete with China

Analysts agree that the U.S. moves and China’s industry scandals will set back Beijing’s efforts toward technological prowess and independence.

But it’s not all black and white. One company affiliated with the Chinese military, Semiconductor Manufacturing International Corporation

981,

— which is not caught up in the current alleged misconduct — last month achieved a chip-advancement breakthrough that puts it in league with sector leaders in Taiwan and the U.S., according to Canadian technology research firm TechInsights.

China’s homegrown chipmakers are also seeing a possible window to replace restricted outside technology. After the country’s semiconductor stocks lost more than a third of their value earlier this year due to competition concerns, the tensions with the U.S. stoked a surge last month that helped the sector index hit a four-month high.

None of the firms mentioned in this article responded to requests for comment. As is standard practice in China, individuals under investigation are unreachable, and no contact information for legal representatives could be found for them.