This post was originally published on this site

The U.S. initial public offering market is facing what may be the biggest deal of the year this week as AIG spinoff Corebridge Financial seeks to raise up to $1.8 billion in proceeds.

The deal, if it goes ahead at that size, would also account for more than a quarter of the year’s proceeds to date, according to Bill Smith, co-Founder and Chief Executive of Renaissance Capital, a provider of institutional research and IPO exchange-traded funds. The statistic is a sign of just how dead the market has been.

By comparison, the biggest IPO in 2021 was that of Rivian Automotive Inc.

RIVN,

which raised $12 billion to mark the largest deal since Alibaba Group Holding Ltd.

BABA,

went public in 2014.

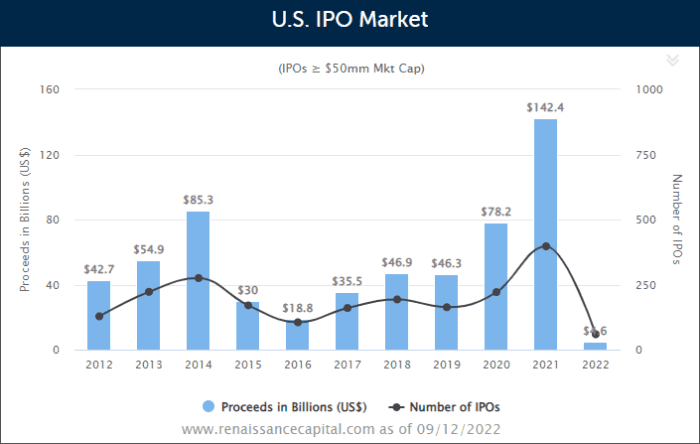

There were concerns heading into 2022 that the IPO market would slow after a record-setting 2021 given the background of rising inflation and higher interest rates, but few could have predicted that issuance would come to such a screeching halt.

“So far this year, the IPO market has been unusually quiet, caught in a “perfect storm” of compounding factors – investor fatigue after 2021, plummeting returns, volatility from the Ukraine war, tightening rates, recession fears,” said Avery Spear, senior data analyst at Renaissance.

There were 1,000 IPOs in 2021 for the first time ever, according to Dealogic data, which showed a record $315 billion raised when that total had never before hit $200 billion in a year.

More than half of those deals were special-purpose acquisition corporations, or SPACs, as 606 blank-check companies went public in 2021.

Stock performance, however, was subdued. About two thirds of the companies that went public through traditional IPOs last year had shares trading below their offer price by year-end, according to PwC. The list included Robinhood Markets Inc.

HOOD,

Poshmark Inc.

POSH,

and Bumble Inc.

BMBL,

Those losses extended into 2022. Robinhood has fallen 37% in the year to date, while Poshmark is down 18% and Bumble is down 16%. That lackluster performance, combined with volatile markets, led many potential issuers to hold back.

Just 59 IPOs have priced in 2022 so far, down 79.2% from the same period in 2021, according to Renaissance data. Total proceeds raised stands at $4.6 billion, down 95% from a year ago.

Source: Renaissance Capital

Corebridge is AIG’s

AIG,

life insurance unit, and it will go public at a valuation of $14.7 billion, according to Smith.

“J.P. Morgan is lead left, but there are 43 banks on the cover — the most in over a decade by our count,” Smith said in commentary.

Corebridge offers individual retirement, group retirement, life insurance and asset management services.

“The company is profitable and has delivered solid growth, though it is exposed to market movements and could be impacted by weak economic conditions,” said Smith.

Corebridge had net income of $6.4 billion in the first half of the year on revenue of $16 billion, according to its filing documents. The company is planning to pay quarterly dividends, offering a 4.1% annualized yield at the midpoint of its range, said Smith.

Just two of 2022’s deals have raised more than $500 million, that of private-equity firm TPG Inc.

TPG,

in January and healthcare company Bausch + Lomb

BLCO,

in May.

TPG raised $1.0 billion to join rivals such as Blackstone

BX,

Apollo Global Management

APO,

KKR & Co. Inc.

KKR,

and Carlyle Group

CG,

in public markets.

Also Read: The TPG IPO: 5 things to know about private-equity firm valued at $9 billion

Bausch + Lomb raised $630 million for its selling shareholder Bausch Health Cos.

BHC,

Rounding out this week’s action are four smaller deals, led by biotech Third Harmonic Bio.

THRD,

The company specializes in treatments for allergic and inflammatory diseases and plans to offer 9 million shares priced at $16 to $18 each.

Morgan Stanley, Jefferies, Cowen and Lifesci Capital are underwriting the deal. The company has applied to list on Nasdaq under the ticker ‘THRD.’ Proceeds will be used to finance clinical development and R&D, as well as for working capital and general corporate purposes.

Linkbancorp., which operates Pennsylvania-based The Gratz Bank, is uplisting from the OTC market to Nasdaq with plans to raise up to $43 million.

Then there is Know Labs

KNW,

which is developing a non-invasive glucose monitor, and plans to raise $6 million.

Renaissance Capital counts two other small deals on tap this week: China-based Lichen China

LICN,

a financial and tax-service provider, which is expected to raise $25 million on Friday and start trading on Monday; and Israel-based Wearable Devices

WLDS,

which is aiming to raise $22 million.

The Renaissance IPO ETF

IPO,

has fallen 42% in the year to date, while the S&P 500

SPX,

has fallen 14%.