This post was originally published on this site

The highest inflation rates in four decades are squeezing the people, but corporations are doing quite well.

While wages and other forms of personal incomes continue to fall behind inflation, corporate profits having been soaring, the government’s Bureau of Economic Analysis reported Thursday.

More on the GDP report: GDP shrank at 0.6% annual pace in second quarter, but it wasn’t all bad news

After-tax corporate profits rose at a 41% annual rate after inflation in the second quarter of the year and have risen at a 17% annual pace since the pandemic recession ended two years ago. Meanwhile, the inflation-adjusted purchasing power of individuals’ after-tax income has fallen for five quarters in a row.

“ These facts blow a very large hole in the prevailing theory of inflation, which holds that prices are high because regular folks have too much money to spend. ”

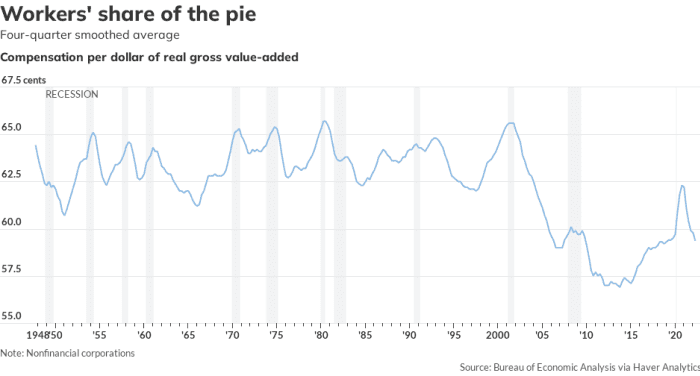

Stated simply, workers’ share of the national pie is shrinking, while corporate owners are taking far more than they used to.

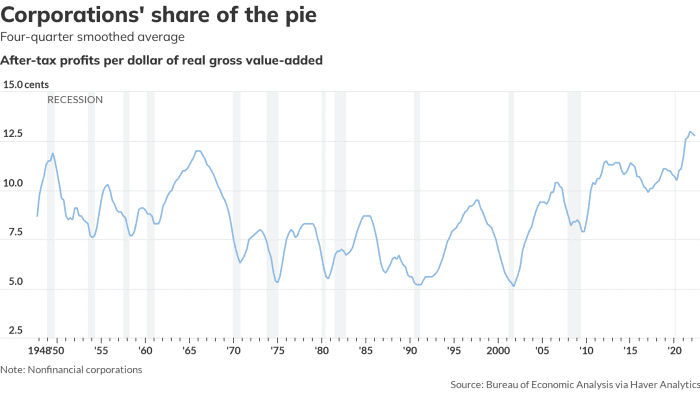

After-tax profit margins have risen to record levels since the pandemic recession ended.

MarketWatch

Profit margins are way up

The government data let us look inside the nonfinancial corporate sector, which has a gross value added of more than $13 trillion annually. Gross value added is the value a company creates in the production process. It’s the difference between a company’s costs for the inputs it buys and the sales revenue it receives.

For every dollar of gross value added, workers got 59 cents; taxes, depreciation and other fixed costs took 28 cents; and owners got the remaining 13 cents in after-tax profits.

Profit margins set a record at 13.5% of gross valued added in the second quarter of 2021 and have barely come down from that peak despite inflation raging at 40-year highs. The last time inflation was this hot, profit margins were only half as high.

More on profit margins: Corporate profit is at a level well beyond what we have ever seen, and it’s expected to keep growing

The long-term averages for these numbers are 63% for workers’ wages and benefits, 28% for taxes, depreciation and fixed costs, and 9% for owners’ profits.

Compared with the historical averages, the current higher profit margins are coming at the expense of wages.

Before the pandemic, profit margins had never exceeded 13% and had topped 12% on just two occasions: in 1949 and in 1965. In the last eight quarters since the pandemic recession ended, margins have accelerated past 13% three times and exceeded 12% in three other quarters.

Workers wages and benefits are a smaller share of gross value added since the pandemic ended.

MarketWatch

Companies hoard all the money

These facts blow a very large hole in the prevailing theory of inflation, which holds that prices are high because regular folks have too much money to spend. Higher wages, it’s believed, are forcing companies to raise their selling prices, which then prompts workers in turn to demand even higher wages, and so forth.

This so-called wage-price spiral theory of inflation is the basis of the Federal Reserve’s policy to starve inflation by slowing the growth of personal income and thereby stopping the people from trying to buy more stuff than the economy can produce.

Some people — mostly Democrats — have proposed an alternative theory of inflation that puts corporate incomes in the picture. Whether you call it price gouging, corporate greed or just business as usual, this theory suggests that the pandemic broke something in the economy that previously had kept inflation in check. For whatever reason, corporations regained the ability to set prices.

When corporations can raise prices without hurting their profit margins, they will. The data released by the government on Thursday is evidence that charging higher prices hasn’t hurt corporations’ bottom line at all. In fact, higher prices have been a boon for corporations.

More on corporate pricing power: Companies are using the pain of inflation as an opportunity to boost profit and line shareholder pockets, report shows

And this: Will companies continue to raise prices to maintain their record profit margins?

And what about the workers? The data show that hourly compensation declined at a 1.5% annual rate in the first half of the year after adjusting for higher prices and is now down 2.3% since the end of the pandemic recession.

That’s a lot of numbers to digest, I know. But here’s the bottom line: After adjusting for inflation, corporate profits are up, and hourly compensation is down.

That doesn’t sound like a world in which workers have the upper hand when it comes to bargaining with their bosses. And it doesn’t sound like the textbooks that blame inflation on regular folks having too much money.

Rex Nutting is a columnist for MarketWatch who has been covering the economy for more than 25 years.

More on inflation from Rex Nutting

Stop misreading the Fed: It’s not getting cold feet about wrestling inflation to the ground

Inflation hasn’t peaked yet because rents are still rising fast

Why interest rates aren’t really the right tool to control inflation