This post was originally published on this site

Wall Street’s go-to spot for parking cash overnight finally might be getting some competition next year.

Ever since May, demand for the Federal Reserve’s overnight reverse repurchase facility, or the RRF, has topped the $2 trillion mark daily, nearly double its $1 trillion daily level about a year ago.

The facility has played a vital role in financial plumbing over the past two years, as a place for money-market funds, banks and other eligible users to sock away cash at the Fed, after trillions of dollars’ worth of pandemic aid began sloshing through financial markets and economy.

Use of the facility, however, has remained high this year, even as the Fed reversed its easy-money stance, “because alternative investment rates are so low” and because money-market funds that heavily rely on the program remain hesitant about the central bank’s interest-rate hiking plans, said BofA Global’s U.S. rates team led by Mark Cabana, in a Monday client note.

Along with several jumbo Fed rate hikes recently, the facility’s overnight rate has climbed to 2.3% from 0.05% a year ago.

Market dynamics should begin to shift in early 2023, with higher bill supply to be “the most direct way to drain” demand for the repo facility, but also as banks “compete for funds in time,” even though that process is “just getting started,” the team said.

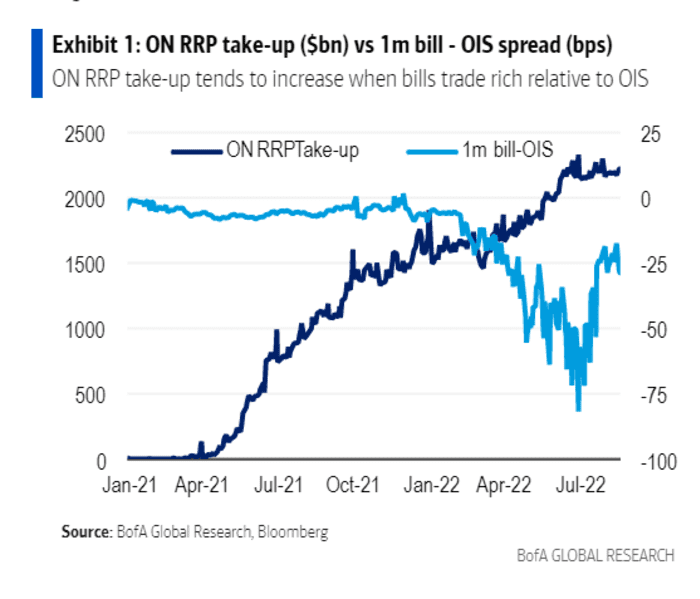

This chart shows the upward march in overnight repo use since April 2021, as the relative attractiveness of 1-month bills declined:

Use climbed to $2 trillion as bills became less attractive investments.

BofA Global Research

Economist expect Fed Chairman Jerome Powell on Friday to reiterate the central bank’s plan to tighten financial conditions until it can wrestle inflation back down to its 2% target range, even if it means sparking a recession.

The Fed’s policy rate already has increased to a range of 2.25%-2.5%, while leaving another 75-basis-point hike on the table for September. Consumer inflation was pegged at 8.5% annually in July.

Fears of higher interest rates that could derail the U.S. economy have been weighing on stocks in recent sessions, after the S&P 500 index

SPX,

shot up this summer more than 17% from its mid-June low.

On Monday, the S&P 500 and Dow Jones Industrial Average

DJIA,

posted their worst daily declines in two months, while the 10-year Treasury rate

TMUBMUSD10Y,

topped 3% for the first time since June.

On the flip side, banks can benefit from higher interest rates, particularly when they help boost earnings. BofA’s rates team said the “Fed seems perfectly fine with elevated” use of its repo facility and “likely believes this is an important way to encourage more bank-funding competition.”

At the same time, they expect the Fed’s balance sheet to decline to about $8.5 trillion by the end of this year, and to about $6.5 trillion by the end of 2025.

Read from April: The Fed’s plan to rapidly slash its balance sheet is out. Here’s what happens to money in the system.