This post was originally published on this site

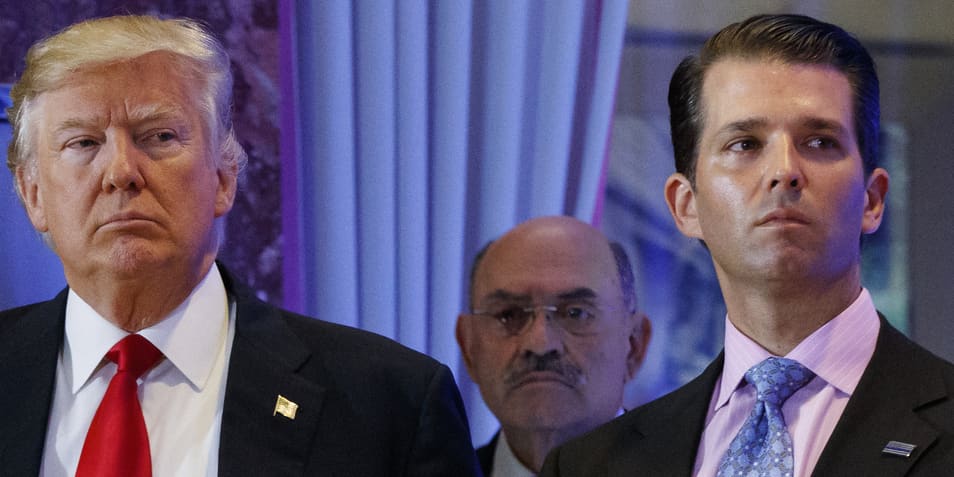

Allen Weisselberg, the former chief financial officer of the Trump Organization, on Thursday pleaded guilty to 15 felonies related to a tax-fraud scheme and agreed to testify against the company — without implicating former President Donald Trump himself.

A plea bargain requires the former CFO to testify as a witness for the prosecution when the Trump Organization goes on trial in October on related charges. The former president himself isn’t charged in the case, and the Trump Organization has pleaded not guilty. Weisselberg, leaving court, had no reply when a reporter asked him whether he had any message for Trump, the Associated Press reported.

Weisselberg becomes the latest in a string of people connected to Trump to plead guilty to or to be convicted of crimes, including Steve Bannon, Trump’s chief campaign and later White House strategist, who was convicted in July of contempt of Congress for defying a subpoena related to the investigation of the Jan. 6 insurrection at the U.S. Capitol; Michael Cohen, longtime lawyer and “fixer” for the Trump Organization, who was sentenced to 36 months behind bars on tax-fraud and campaign violations before cooperating in investigations of Trump; and Paul Manafort, Trump’s 2016 campaign chairman, who received a prison sentence of nearly four years after a financial-fraud conviction.

From the archives (December 2020): Trump’s dozens of pardons late Wednesday go to former campaign manager Paul Manafort, longtime adviser Roger Stone, Jared Kushner’s father Charles

Opinion (February 2020): Trump’s pardons demonstrate his belief that white-collar crime isn’t real crime

The guilty plea by Weisselberg comes amid a string of dramatic news for the ex-president, who has suggested he will seek another White House term. Those include the search of his Florida home by the FBI and his invoking Fifth Amendment protections against self-incrimination more than 400 times in a civil investigation into his company.

Trump, meanwhile, is running only narrowly behind Florida Gov. Ron DeSantis in PredictIt odds for capturing the Republican presidential nomination.

Manhattan District Attorney Alvin L Bragg, Jr. said Weisselberg that evaded payment of taxes due on more than $1.7 million in unreported income.

Jury selection in the Trump Organization’s criminal trial is scheduled to begin Oct. 24, Bragg’s office announced Thursday.

Weisselberg, even by giving testimony against the company, won’t implicate any Trump family members, CNN has reported. If the Trump Organization is convicted, it could be required to pay back taxes and fines. No family members were accused of wrongdoing, and no individual will go to prison, according to CNN.