This post was originally published on this site

https://i-invdn-com.investing.com/news/LYNXMPEB280F6_M.jpg

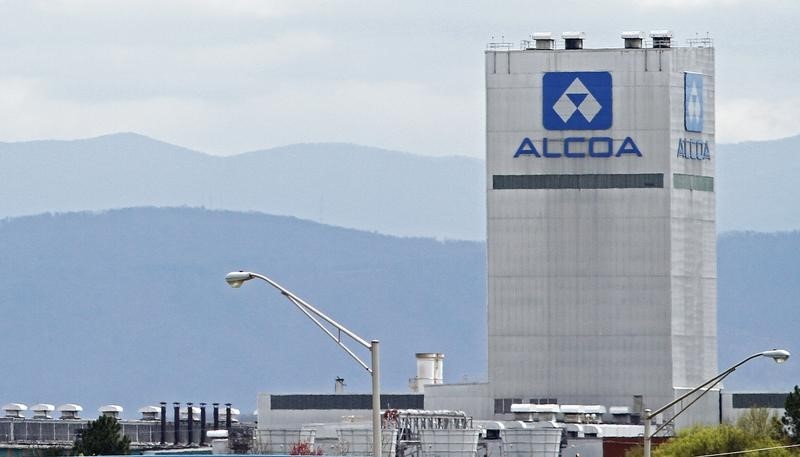

Alcoa (NYSE:AA) shares were trading more than 5% higher after-hours following the company’s reported Q2 results, with EPS of $2.67 coming in better than the consensus estimate of $2.57. Revenue came in at $3.6 billion, compared to the consensus estimate of $3.56 billion, primarily due to improved shipments in Alumina and Aluminum and higher pricing.

The company provided its full 2022-year outlook, expecting total Aluminum segment shipments to remain unchanged from the prior forecast, in the range of 2.5-2.6 million metric tons. In Alumina, the company lowered its 2022 estimate for shipments to 13.6-13.8 million metric tons, primarily due to the lower shipments in H1/22. In Bauxite, the company lowered its full-year estimate for shipments to 44-45 million dry metric tons, due to continuous disruptions in the Atlantic bauxite market and lower demand from refineries in H1/22.