This post was originally published on this site

Shares of both AMC Entertainment Holdings Inc. and GameStop Corp. traded well above levels that had capped previous rallies and reached multi-month highs in intraday trading Tuesday, before pulling back later in the session.

The intraday rallies come after Ihor Dusaniwsky, managing director of predictive analytics at S3 Partners, said the two “meme” stocks made his list of the 25 most “squeezable” U.S. stocks, or those that are most susceptible to a short-covering rally.

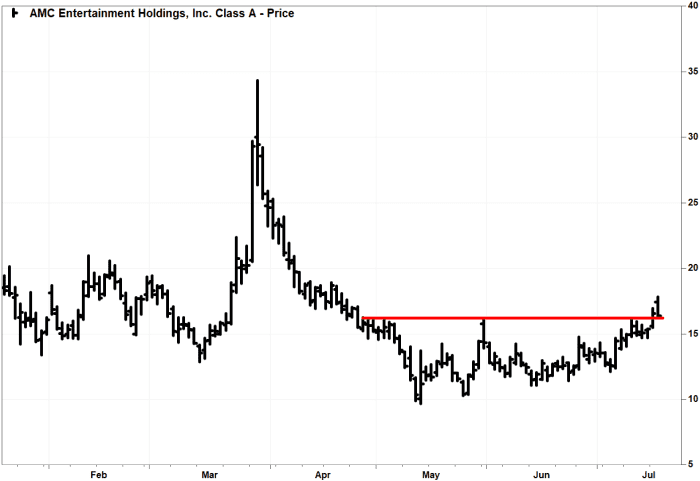

AMC’s stock

AMC,

ran up as much as 7.7% to an intraday high of $17.82, before reversing course to slip 0.7% in afternoon trading. The stock had closed Monday at the highest price since April 25.

The movie theater operator’s stock’s gains in the past few months have been capped just above the $16 level, until it closed Monday at $16.54 to break above that resistance area.

FactSet, MarketWatch

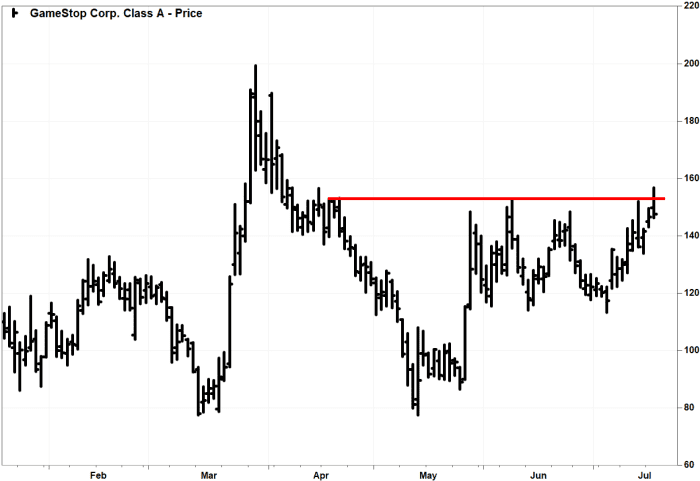

GameStop shares

GME,

were headed for the highest close since April 20. They were up as much as 7.0% at an intraday high of $156.84, before pulling back to be up 0.3% in recent trading.

The videogame and consumer electronics retailer’s stock has peaked in previous intraday breakout attempts at around $153, but closed each time well below those highs.

FactSet, MarketWatch

Meanwhile, S3’s Dusaniwsky provided his list of 25 U.S. stocks at most risk of a short squeeze, or sharp rally fueled by investors rushing to close out losing bearish bets. Read more about the mechanics behind short selling.

Dusaniwsky said the list is based on S3’s “Squeeze” metric and “Crowded Score,” which take into consideration total short dollars at risk, short interest as a true percentage of a company’s tradable float, stock loan liquidity and trading liquidity.

Short interest as a percent of float was 19.66% for AMC, based on the latest exchange short data, and was 21.16% for GameStop.

He said an additional variable that makes a stock “squeezable” is substantial net-of-financing mark-to-market losses.

Over the past month, AMC’s stock has soared 31.1% and GameStop shares have hiked up 8.8%, while the S&P 500 index

SPX,

has gained 6.8%.

“[T]he chances of getting a tap on the shoulder from a Chief Risk Officer to cut losses and get out of a trade is higher for these stocks,” Dusaniwsky wrote in a note to clients. “The higher chance that short sellers may be forced to buy-to-cover will only help push stock prices even higher — and making the squeeze even tighter for the shorts still in the stock.”

AMC, which had about $1.50 billion worth of short interest still open, was 16th on Dusaniwsky’s list, and GameStop, with $1.92 billion worth of short interest, was 24th.

Read more: AMC may have been a meme-stock darling, but weakness in some key areas has the company on shaky ground.

Meanwhile, the top 5 stocks on Dusaniwksy’s list were those of Faraday Future Intelligent Electric Inc.

FFIE,

Canoo Inc.

GOEV,

Gossamer Bio Inc.

GOSS,

Verve Therapeutics Inc.

VERV,

and Lightwave Logic Inc.

LWLG,