This post was originally published on this site

Stifel’s Chief Equity Strategist Barry Bannister should be taking a victory lap right now.

Since Bannister first unveiled his call for a “summer rally” — a call that landed shortly after stocks hit their “peak hawkishness”-inspired bottom last month — the S&P 500

SPX,

has advanced more than 5%. And according to Bannister, the rally could have at least another 5% — or more — to go over the coming weeks.

Bannister, who contends that stocks have entered a secular bear market, expects the bounce to be led by cyclical growth stocks, like the tech stocks that led the market lower earlier this year. For what it’s worth, the Nasdaq Composite

COMP,

is up more than 7% over the past month, compared with a 6% gain for the S&P 500.

Bannister reiterated his call in a note to clients on Monday, arguing that investors have become more bearish than even they probably realize, and that the near-term fundamentals for both corporate profits and the underlying U.S. economy suggest the rebound could have more room to run.

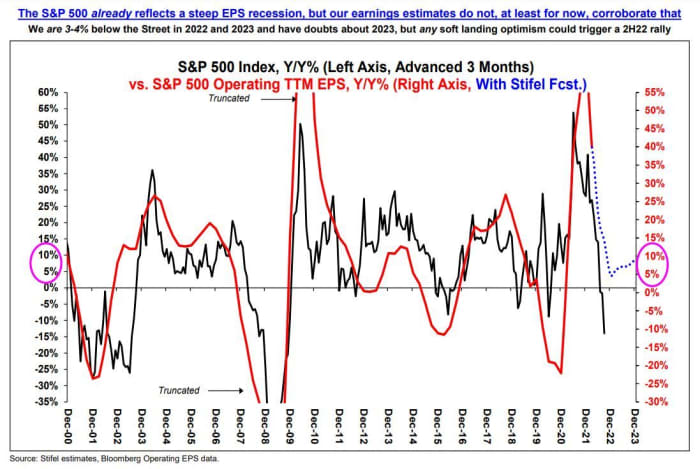

Stocks have already surrendered all of their post-COVID froth, and on a valuation basis, they are being valued as if a corporate earnings recession has already arrived — but it hasn’t.

What’s more, Stifel doesn’t see a recession arriving before the end of the year. This is quickly becoming a contrarian view on Wall Street, as many of the biggest financial supermarkets in the U.S. are adjusting their own expectations to accommodate what many see as the rising risk that a U.S. recession is either imminent, or perhaps has already arrived.

Late last week, Bank of America’s economists said that they now expect “a mild recession” beginning in the U.S. before the end of the year, while the bank’s equity strategists cut their end-of-year forecasts for stocks.

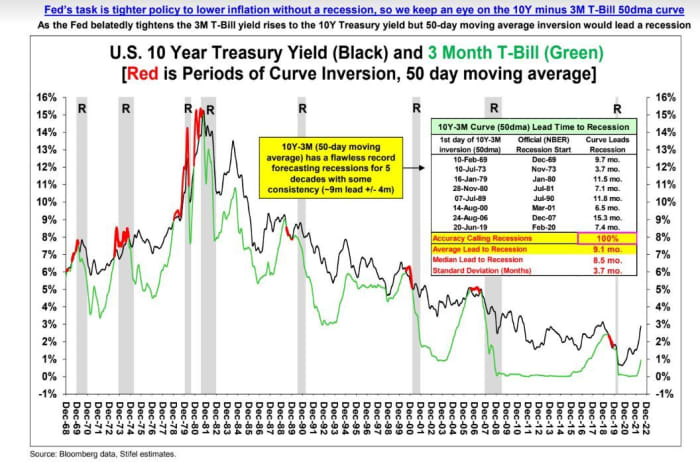

But Stifel doesn’t see reliable indicators of a recession in the economic data, or in the markets, even after last week’s inversion of the Treasury yield curve.

According to Stifel, the inversion of the 2-year

TMUBMUSD02Y,

versus 10-year measure of the yield curve — seen as a historically reliable recession warning flag — isn’t enough. Instead, the 50-day moving average of the three-month Treasury bill yield

TMUBMUSD03M,

must eclipse the 50-day moving average of the 10-year note yield

TMUBMUSD10Y,

for an extended period before it becomes a truly reliable indicator of a recession, he argued.

Source: Stifel

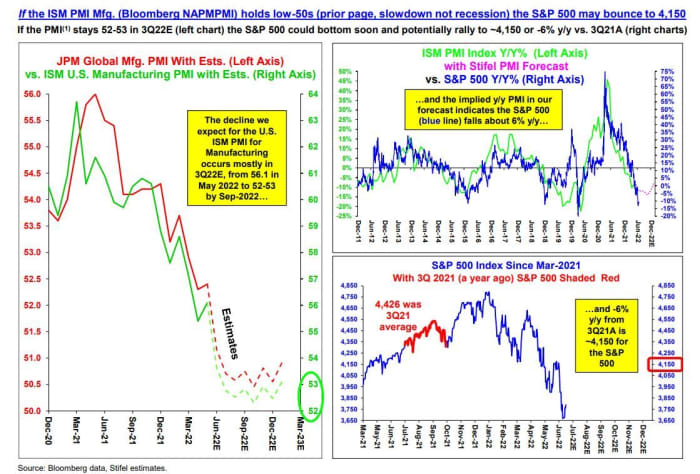

As for the economic data, Bannister and his team will be keeping a close eye on the Institute for Supply Management’s manufacturing index, which they see as an important recession harbinger, along with corporate credit spreads.

Source: Stifel

Part of Stifel’s expectations for a durable bear-market rally is the notion that corporate earnings expectations have grown too downcast. Stifel doesn’t expect a corporate earnings recession — that is, two quarters of contracting corporate profits — until next year.

Source: Stifel

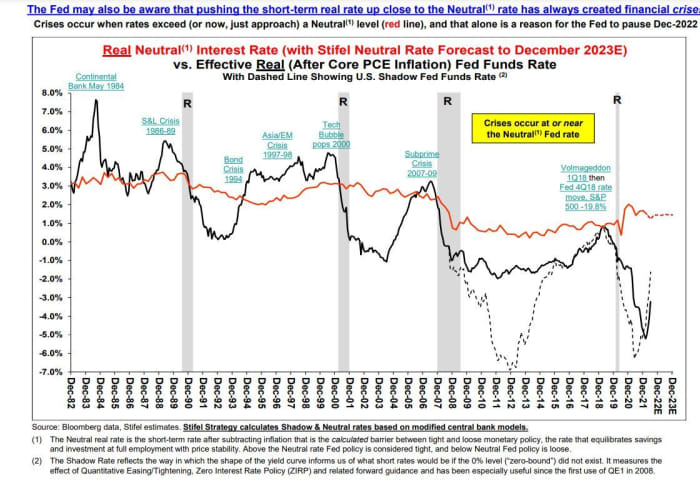

As for inflation, the market has already received plenty of good news in the form of oil prices, which have fallen by more than 10% over the past month. As consumer’s inflation expectations continue to moderate, Stifel expects core inflation, as measured by the personal-consumption-expenditures price index, will slow to “the Fed’s view of 2.7% by 2023.”

But if the Fed needs another reason to contemplate a break from the relentless pace of rate hikes that began back in March, there’s also this: the chart below — seemingly one of Bannister’s favorites — purports to show that the risk of financial crises rises as the Fed’s benchmark rate gets closer to the real neutral rate — a measure of the rate where an economy is finely balanced for both maximum employment and minimal price pressures.

Source: Stifel

So far, at least, markets appear to be in the middle of a durable bear-market rally. Stocks finished higher on Friday after one of the market’s best performances in three weeks. And on Monday, stocks looked set to add to their gains, with the S&P 500 up 0.8% at 3,896 shortly after the open, while the Dow Jones Industrial Average

DJIA,

remained up 175 points, or 0.6%.