This post was originally published on this site

Those looking for a bit of good news to start the week may have to cast the net further out. Stock futures are tilting lower as COVID-19 cases flare up in China, threatening more lockdowns.

And the plate was already full for investors this week, with inflation one of several data points to watch, and banks set to get earnings season started — no doubt the hunt for recession clues from corporate America will be on.

“This is a very important season (aren’t they all) as the collapse in equities so far in 2022 is largely due to margin compression [costs rise for companies that can’t pass onto consumers] and not really earnings weakness,” said a team of strategists led by Jim Reid at Deutsche Bank.

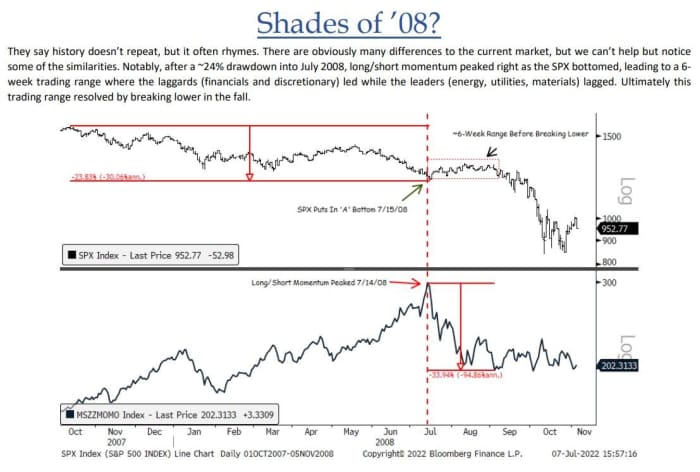

On to our call of the day, from BTIG, where chief market technician Jonathan Krinsky takes another crack at some chart similarities between 2022 and crashy 2008.

“Notably since mid-June, there has been a significant momentum and performance unwind with many YTD leaders performing the worst since then and vice versa. This has shades of ’08 when starting in mid-July, financials (the worst performing sector YTD) performed the best over a ~6-week stretch while energy did the opposite,” he told client in a note.

Ultimately, that stretched resolved with a swing lower in the autumn, he said.

BTIG

For investors, the tough call is whether they buy what has rallied the most — biotech, growth, auto & components) in hopes the bounce will keep going — or fall back to former leaders such as energy and defensives in hopes they will resume a climb.

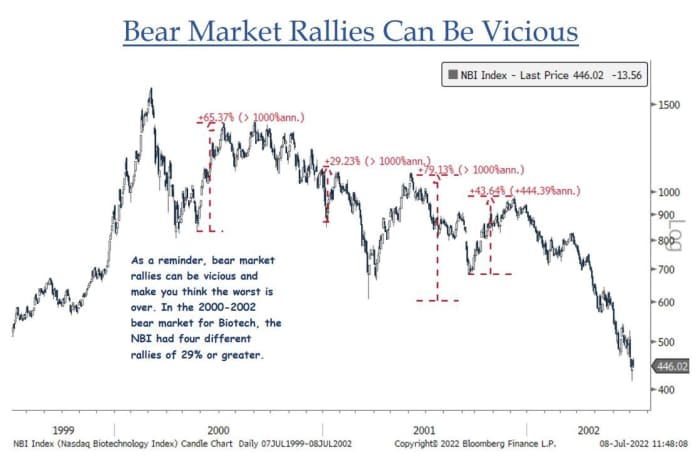

Risky business indeed, especially in light of his next observation, that “bear market rallies can be vicious and make you think the worst is over. The 2000-2002 bear market for biotech included four rallies of 29% or more for the Nasdaq Biotechnology Index

NBI,

” he said, providing this chart:

BTIG

The SPDR S&P Biotech ETF

XBI,

is around 36% off its lows, and maybe there is more room to run here, but “near-term risk/reward is hard to defend,” he said, adding that he also sees some charts of highflying auto components companies, who have been in the grips of a strong rally, looking vulnerable.

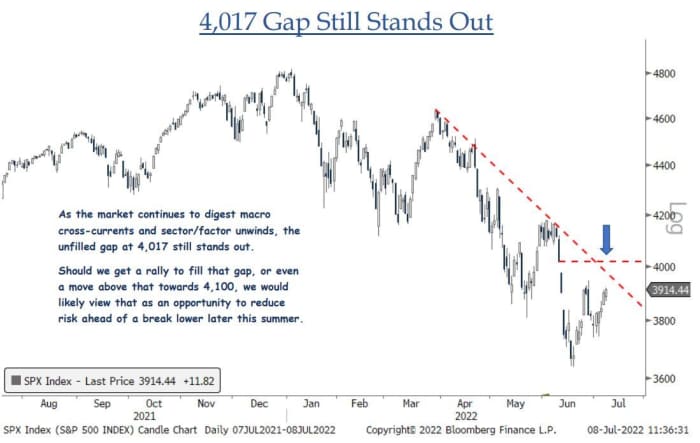

Circling back to the S&P 500, Krinsky has his eye on some dead space around the 4,017 level for the index. “Should we get a rally to fill that gap, or even a move above that toward 4,100, we would likely view that as an opportunity to reduce risk ahead of a break lower later this summer,” he said.

BTIG

The buzz

Twitter

TWTR,

and Elon Musk have each hired heavyweight legal firms after the Tesla

TSLA,

CEO on Friday pulled out of a $44 billion deal for the social-media company. Musk has also been trolling Twitter, whose shares are taking a hit this morning, while Tesla inches up.

Casino stocks Wynn Resorts

WYNN,

and MGM Resorts

MGM,

are both down, after world gambling hub Macau shut nearly all its businesses for a week due to COVID-19 spread.

Shanghai officials have detected the highly contagious new Omicron BA.5 coronavirus subvariant, which is spreading fast across India.

The week will see several big data points, including consumer prices on Wednesday and retail sales and the University of Michigan sentiment survey on Friday. Three-year inflation expectations will be released Monday.

Earnings season also gets under way this week, with JPMorgan

JPM,

and Citigroup

C,

due to report later this week.

Texas is warning of a blackout risk for Monday, as grid operator ERCOT asks businesses and Texans to conserve.

Canada said it would allow delivery on a turbine needed for the German-Russian Nord Stream 1 gas pipeline, which shuts down for 10 days starting Monday. Europe has been stockpiling gas on fears Russia will extend that cutoff.

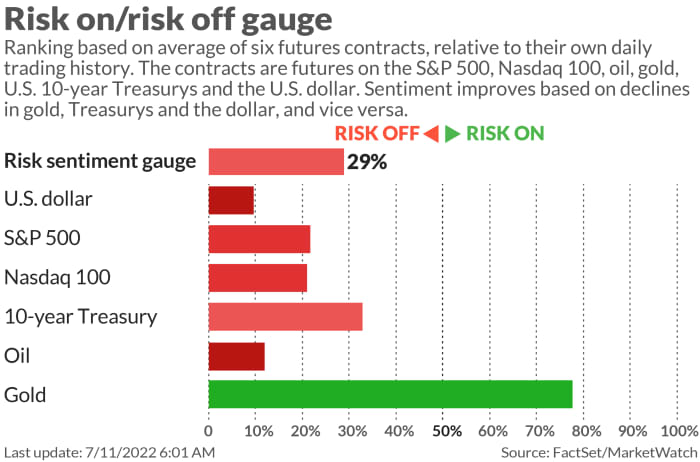

The markets

Stock futures

ES00,

YM00,

are lower, with tech

NQ00,

leading the way south. Oil prices

CL.1,

BRN00,

are tumbling on China demand worries, while natural-gas prices

NG00,

are up 4%. The dollar

DXY,

is up, which is denting gold

GC00,

as no one loves the pound

GBPUSD,

or the euro

EURUSD,

which slides closer toward parity. Bitcoin

BTCUSD,

is lower, hanging onto the $20,000 level.

The chart

More on King Dollar from Lance Roberts, chief strategist at RIA Advisors, who says greenback strength bodes poorly forU.S. companies:

The tickers

These were the top-searched tickers on MarketWatch as of 6 a.m. Eastern:

| Ticker | Security name |

|

TSLA, |

Tesla |

|

GME, |

GameStop |

|

AMC, |

AMC Entertainment |

|

NIO, |

NIO |

|

TWTR, |

|

|

AAPL, |

Apple |

|

AMZN, |

Amazon |

|

PHUN, |

Phunware |

|

BABA, |

Alibaba |

|

MULN, |

Mullen Automotive |

Random reads

Actress Cameron Diaz thinks she had a stint as a drug mule.

Birth control for squirrels. The U.K. is considering it.

Meet the man at the Waffle House in Midway, Fla., who has given away $13,000 to strangers because his dying mother told him to “love every body.”

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.