This post was originally published on this site

The bear market in stocks probably isn’t over — and could have much longer to run if the economy falls into a 1970s-style stagflation scenario, a Wall Street equities strategist warned this week.

The S&P 500 officially entered a bear market last week, falling more than 20% from its Jan. 3 record finish. The U.S. equity benchmark is on track for a historically ugly half-year performance as markets expect tighter monetary policy to get a grip on the inflation but worry the interest rates will rise to levels that cause a recession.

“We have been and remain in a ‘de-risking, defensive and de-rating’ mindset for 2022, as Fed hikes in the current downturn should create collateral damage, leading us to adopt a bearish stance on U.S. Consumer, Financials and Small-caps,” said Manish Kabra, Societe Generale’s head of U.S. equities, in a Tuesday note. “But the committed fight against inflation looks set to trigger a domino effect, with the Housing and Credit markets looking like the next dominos to drop.”

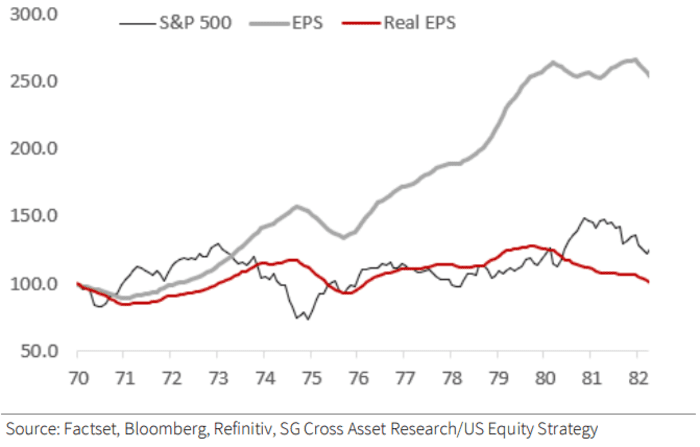

If the Fed fails to get a grip on prices, a 1970’s style inflation shock followed by a recession could push the S&P 500

SPX,

down by another 33% from its current level to trade at 2,525, Kabra said.

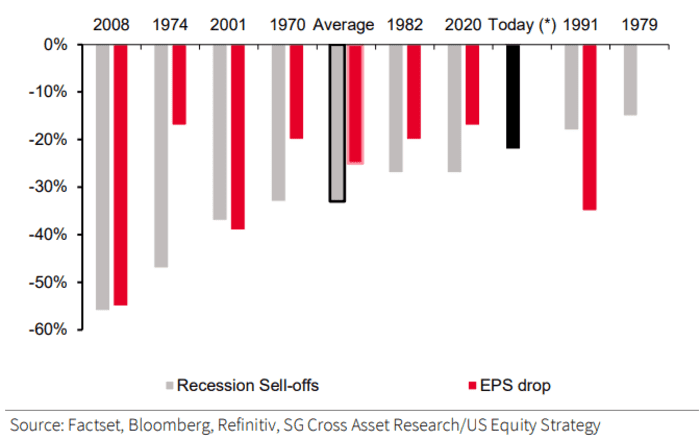

The S&P 500 falls on an average of 33% during a typical recession, but “the current 24% drop in equities suggests we have discounted 72% of an average recession (i.e. a 72% recession probability is priced in),” according to Société Générale’s report. “At 3,200 the S&P 500 will fully discount a typical recession.”

The S&P falls on average by 33% during a typical recession, and the current 24% drop suggests 72% recession probability is priced in, says SocGen. SOURCE: FACTSET, BLOOMBERG, REFINITIV, SG CROSS ASSET RESEARCH/US EQUITY STRATEGY

The S&P 500 was down 0.1% near 3,762 late Wednesday after Federal Reserve Chairman Jerome Powell confirmed his plan to combat inflation and said the U.S. economy could handle steep rate hikes. The Dow Jones Industrial Average

DJIA,

was flat near 30,530.

“We continue to see the fair value of the S&P 500 at 3,850 and reaching 5,000 by 2024 when the inflation shock should have moderated, the Fed is likely to not only have finished hiking, but also started a rate-cut cycle and the U.S. 10-year yield

TMUBMUSD10Y,

is closer to 2% again,” Kabra wrote in the report.

The yield on the 10-year U.S. Treasury

TMUBMUSD10Y,

note fell 14 basis points to 3.16% on Wednesday. Treasury yields move opposite to price.

1970s-style stagnating growth + lower multiples = S&P 500 at 2525. SOURCE: FACTSET, BLOOMBERG, REFINITIV, SG CROSS ASSET RESEARCH/US EQUITY STRATEGY

Consumers will continue to feel the impact of rising prices for another year amid negative wage growth as retail gasoline prices hit all-time highs and mortgage rates surge to the highest level since 2008.

“The core reason for our bearishness on the U.S. consumer has been the negative real-wage growth for the past four quarters,” Kabra said. “Moreover, the real wages are unlikely to be positive until the summer next year.”