This post was originally published on this site

Workday Inc. shares fell in the extended session Thursday after the human resources cloud-software company reported earnings that missed the Wall Street consensus and slightly raised its forecast.

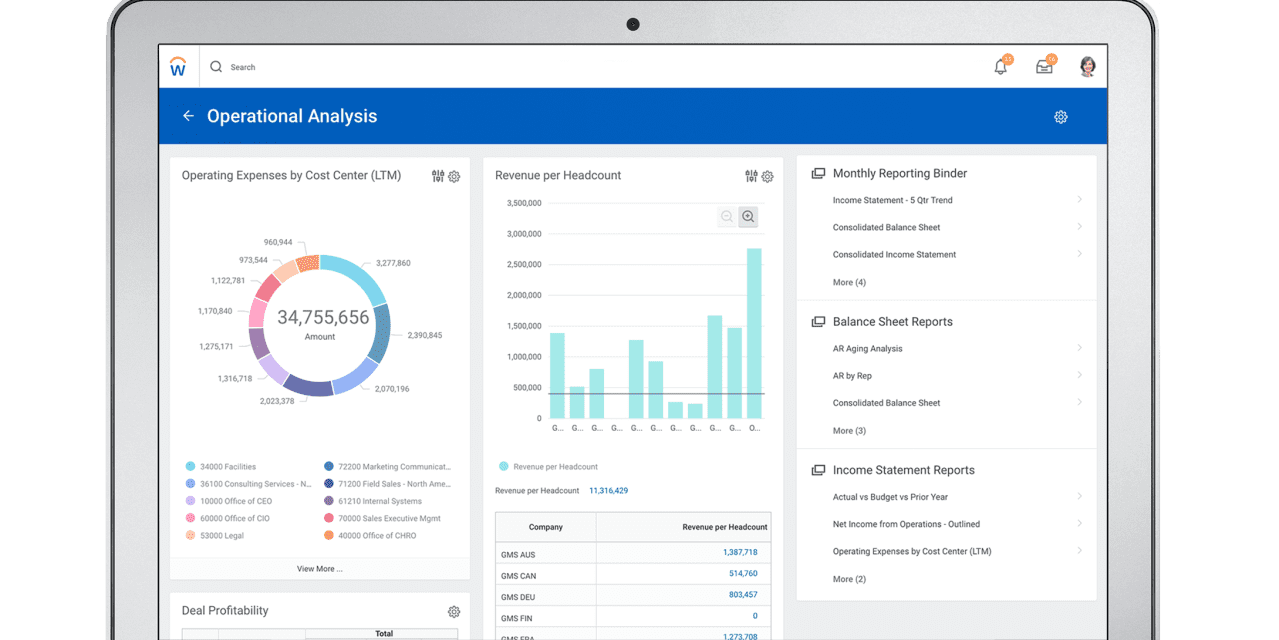

Workday

WDAY,

shares fell 9% after hours, following a 2.2% gain in the regular session to close at $168.15.

“We had a solid start to the year, as organizations across the globe continue to choose Workday as their strategic finance and HR partner,” said Barbara Larson, Workday’s chief financial officer, in a statement. “As a result, we are raising our fiscal 2023 subscription revenue.”

Workday increased its subscription revenue to a range between $5.54 billion and $5.56 billion, up from a previous $5.53 billion to $5.55 billion range, while analysts surveyed by FactSet have already been forecasting subscription revenue of $5.55 billion for the year.

The company also expects subscription revenue of about $1.35 billion for the second quarter, in line with what analysts expect.

The Pleasanton, Calif.-based company reported a first-quarter loss of $102.2 million, or 41 cents a share, compared with a loss of $46.5 million, or 19 cents a share, in the year-ago period.

Adjusted earnings, which exclude stock-based compensation expenses and other items, were 83 cents a share, compared with 87 cents a share in the year-ago period.

Revenue rose to $1.43 billion from $1.18 billion in the year-ago quarter, while subscription revenue rose 23% to $1.27 billion from a year ago.

Analysts had forecast 85 cents a share on revenue of $1.43 billion and subscription revenue of $1.26 billion.