This post was originally published on this site

Investors can always expect uncertainty. While volatile periods like the one we’re experiencing now can be intense, investors who learn to embrace uncertainty may often triumph in the long run. Reacting to down markets is a good way to derail progress made toward reaching your financial goals.

Here are three lessons to keep in mind during periods of volatility that can help you stick to your well-built plan. And if you don’t have a plan, there’s a suggestion for that too.

1. A recession is not a reason to sell

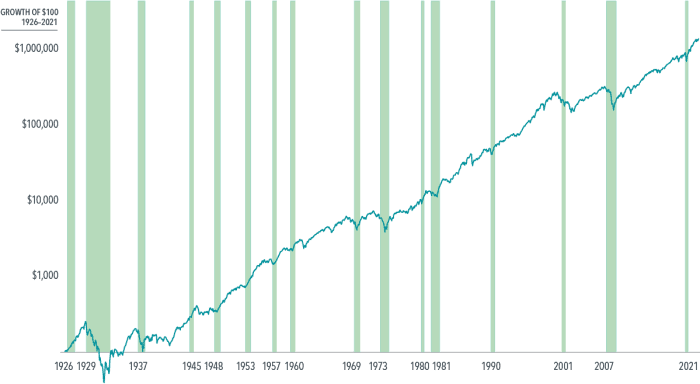

A hypothetical $100 investment in the securities in the Fama/French US Total Market Research Index, a value-weighed U.S. market index, from July 1926 through December 2021. Recessions shaded in green.

Ken French website: https://mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html

Are we headed into a recession? A century of economic cycles teaches us we may well be in one before economists make that call.

But one of the best predictors of the economy is the stock market itself. Markets tend to fall in advance of recessions and start climbing earlier than the economy does. As the chart above shows, returns have often been positive while in a recession.

All the dots in the upper left quadrant in the chart below are years where the U.S. economy contracted but U.S. stocks still outperformed less-risky Treasury bills. It’s a great illustration of the forward-looking nature of markets. If you’re worried, other investors are too, and that uncertainty is reflected in stock prices.

Stock-market returns and GDP growth are not highly correlated

Dimensional Fund Advisors. Data is from 1930 to 2020.

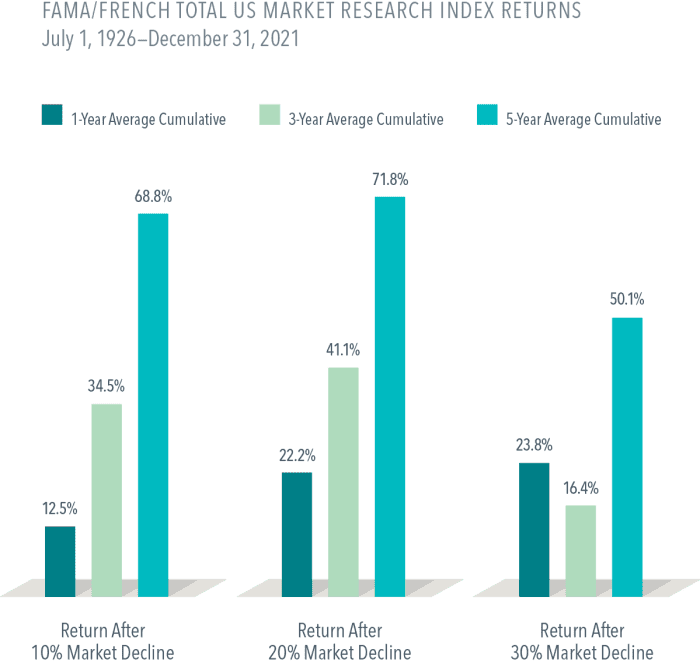

Whether accompanied by recessions or not, market downturns can be unsettling. But over the past century, U.S. stocks have averaged positive returns over one-year, three-year, and five-year periods following a steep decline.

A year after the S&P 500 crossed into bear market territory (a 20% fall from the market’s previous peak), it rebounded by about 20% on average. And after five years, the S&P 500 averaged over 70%.

Ken French website: https://mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html

Fama/French US Total Market Research Index, a value-weighed U.S. market index, from July 1926 through December 2021.

Source: Ken French website

Staying invested puts you in the best position to capture the recovery. If you take risk out of your portfolio, it should be a strategic, not tactical, choice. The only good reason to sell out of a stock portfolio now—so long as it’s diversified and low-cost—is because you learned something about your risk tolerance or your investment goals have changed.

2. Time the market at your peril

When stocks have declined, it might be tempting to sell to stem further losses. You might think, “I’ll sit out until things get a bit better.” But by the time markets are less volatile, you’ll have often missed part of the recovery. Yes, it stings to watch your portfolio shrink, but imagine how you’ll feel when it’s stuck while the market rebounds.

Big return days are hard to predict, and you really don’t want to miss them. If you invested $1,000 in the S&P 500 continuously from the beginning of 1990 through the end of 2020, you would have $20,451. If you missed the single best day, you’d only have $18,329—and only $12,917 if you missed the best five days.

History shows the stock market tends to rebound quickly. The same can’t be said for individual stocks or even entire sectors. (How many railroad stocks do you own?) So, while investing means taking on some risk for expected reward, investors should mitigate risks where they can. Diversification is a top risk mitigation tool, along with investing in fixed income and having a financial plan.

3. It may be a good time to reassess your portfolio and your plan

We saw many fads crop up through the pandemic, from baking to puppy adoption. Did you experiment with one of the pandemic investment fads—FAANGs or meme stocks or dogecoin? If so, it may be time to put those fads in the rearview.

Do you know the names of all the stocks you own? Then you probably own too few. How much of your portfolio sits outside the U.S.? Because about half the global market is comprised of foreign stocks. If you only invest in the S&P 500

SPX,

you’re missing half of the investment opportunity set. A market-cap-weighted global portfolio is a better starting point than chasing segments of the market that have outperformed in the past few years.

And if you want to outperform the market, allow decades of academic research to light the way. Portfolios focused on small caps, value stocks and more profitable companies have had higher returns over the long run. The portfolio I use is invested across more than 10,000 global equities in over 40 countries.

Beyond a well-designed portfolio, one of the best ways to deal with volatile markets and disappointing returns is to have planned for them. A financial advisor can help you develop a plan that bakes in the chances you’ll experience some market lows. And they can help you find the confidence to weather the current storm and get to the other side.

A sound approach to investing—through a plan, a well-designed portfolio, and an advisor—is the ultimate self-care during these rough markets. Your future self will thank you.

Marlena Lee is global head of investment solutions at Dimensional Fund Advisors in Austin, Texas.