This post was originally published on this site

Are the bears just getting started?

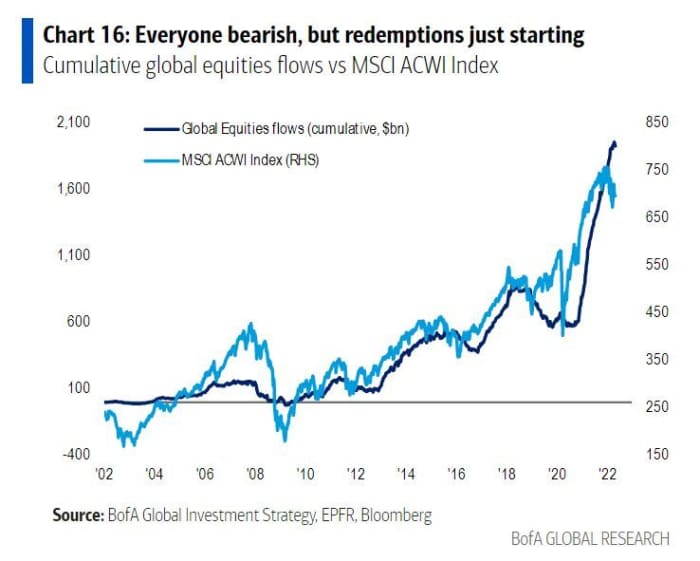

That’s a question posed by strategists at Bank of America, who noted Friday that investors pulled $17.5 billion out of global equities over the past week, making for the biggest weekly outflow so far this year.

They cautioned that those outflows could well deepen. Since Nov. 2021, Nasdaq peak inflows to stocks have occurred in 16 of 20 weeks, for a total of $229 billion, while private clients bought stocks 17 out of 20 weeks, pointed out Bank of America’s Michael Hartnett, who provided the below chart:

Uncredited

Investors also pulled $8.7 billion out of bonds and $55.4 billion from cash, pouring $900 million into gold. That was before Friday’s stock-market rout, which saw the S&P 500

SPX,

slump 2.8% and the Dow Jones Industrial Average

DJIA,

plummet 981.36 points, or 2.8%. The S&P 500 is down 10.4% year to date, while the Dow is off 7%. The tech-heavy Nasdaq Composite

COMP,

is down 17.9% so far in 2022, after a 2.5% Friday drop.

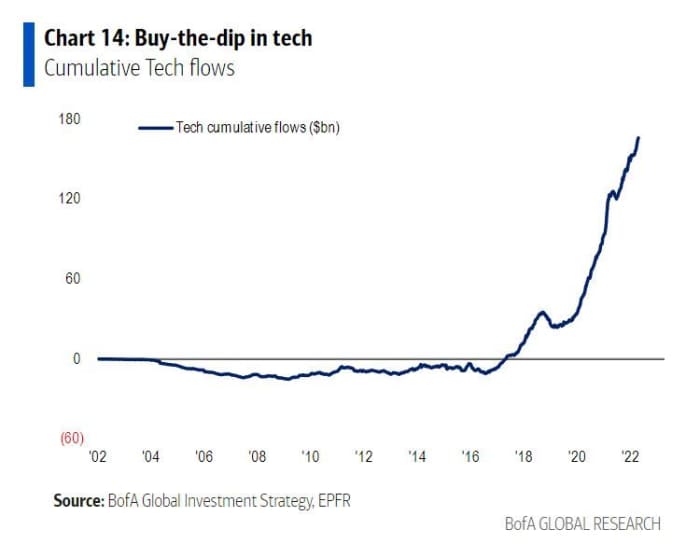

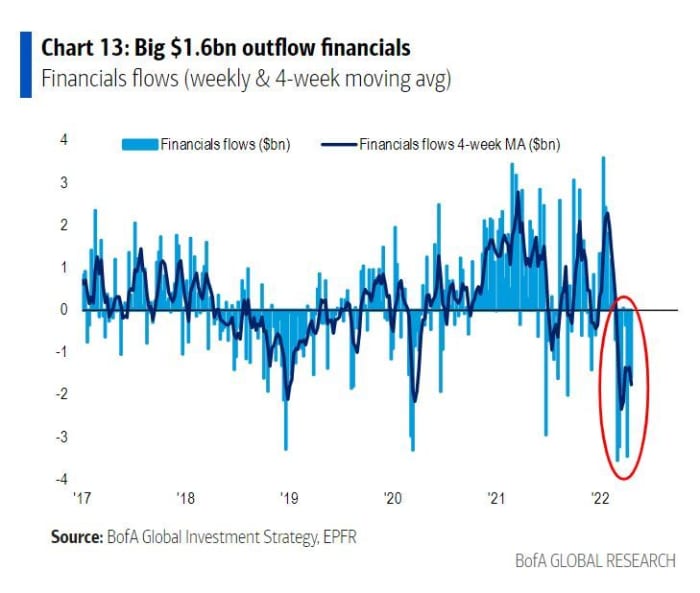

Breaking down some of the equity outflows, Bank of America strategists noted data showing Europe saw the 10th straight weekly outflow — $2.9 billion, while $1.6 billion exited financials, as money flowed back into buying the technology sector dip. Materials, meanwhile, marked a record 8-weeks of inflows.

Uncredited

Uncredited

Need to know: Stocks have weathered surging bond yields but can’t take too much more, this Morgan Stanley strategist warns