This post was originally published on this site

U.S. government bonds just finished their worst quarter since at least 1973, yet some investors aren’t likely to be put off from buying Treasurys again given rising risks of a U.S. recession within the next few years.

A model created by Goldman Sachs

GS,

foresees a 38% chance of a downturn 12 to 24 months from now, up from virtually no chance in the next year. The path of overnight-index swaps, along with a generally flat Treasury yield curve that inverted on Tuesday and Friday, also point to the prospect of an economic downturn in the next couple of years.

Increasing odds of an economic downturn argue in favor of government bonds, as well as holding cash, while making riskier assets like stocks and commodities less attractive, analysts said. That suggests the bond market’s four-decade bull run, which some investors assumed had ended last year, may only be slowly running out of steam.

In One Chart: ‘The dam finally broke’: 10-year Treasury yields spike to breach top of downward trend channel seen since mid-1980s

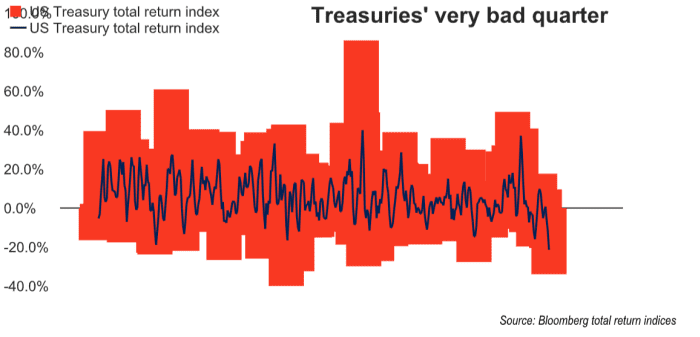

U.S. government bonds lost 5.6% in the first quarter, the worst showing since record-keeping began in 1973, according to the Bloomberg U.S. Treasury Total Return Index. And the 10-year Treasury note just completed its seventh worst quarter since the U.S. Civil War, according to Jim Reid of Deutsche Bank, citing data that includes the 10-year note’s equivalents back to 1865.

Read: U.S. government bonds are having one of their worst quarters since the U.S. Civil War

Source: FHN Financial, Bloomberg total return indices

“Historically, when we’ve had nasty quarters, the next quarter tends to be pretty good,” FHN Financial Chief Economist Chris Low said via phone. “The thing about bonds that’s different from stocks and commodities is that bond prices can’t go down forever. If they did, the economy would eventually stop functioning. Eventually, they are self-correcting.”

Many of FHN’s clients are “holding unusual, if not record amounts, of cash” following the first-quarter’s carnage in bonds, Low said. While there might be some drop in demand for bonds going forward, the “violent” selloff in Treasurys isn’t likely to deter portfolio managers at institutional, pension and insurance funds, who are under pressure to match benchmark indexes and can’t sit on too much cash for prolonged periods, he said.

Bonds, a traditional safe haven, are the asset class that gets hit hardest by high inflation, which eats into fixed returns. So the first-quarter’s aggressive selloff of government debt isn’t too surprising considering U.S. inflation is at a four-decade high.

What is surprising is that prospective buyers may not necessarily be put off by that fact or the recent selloff, analysts said. Though the selloff stung existing bondholders, it offers prospective investors the chance to get back in at relatively lower prices and higher yields than any other time in the past few years.

“There’s a need for yield,” said Rob Daly, director of fixed income at Glenmede Investment Management. “The bond market isn’t necessarily providing inflation-adjusted returns at all — in fact, real returns are quite negative as inflation remains high — but there’s a balancing act that has to take place between risk and safe-haven assets.

“There’s going to be a point where buyers come back to bonds, but how seriously they come back is a question mark,” Daly said in a phone interview. “The market is trying to put its finger on when and why to buy the bond market.”

The first quarter’s record selloff in bonds was accompanied by a substantial rise in market-based interest rates, which is contributing to a slowdown in the housing sector and affecting equities and commodities. All three major stock indexes DJIA SPX COMP finished the first quarter with their biggest percentage declines in two years on Thursday.

Demand for mortgage refinancing has dried up, pending home sales are declining, and housing-goods companies like mattress maker Tempur Sealy International Inc.

TPX,

have issued sales warnings. Meanwhile, the “cost of financing is going higher, eroding potential returns and weighing on growth” — all of which affect equities — while cash remains “a valuable asset because there’s no safe place to be right now,” said Glenmede’s Daly.

Continued interest in bonds going forward would put pressure on yields, and keep them from rising by more than what would ordinarily be the case. The end result would be back-and-forth action between buying and selling — similar to what was seen this week — that leaves investors adjusting to higher interest rates and keeps yields from climbing too far.

In an email to MarketWatch, rates strategist Bruno Braizinha at B. of A. Securities, said a case can be made that the 10-year Treasury

TMUBMUSD10Y,

will reach a “relatively low” peak yield in the current business cycle of around, or slightly above, 2.5% — not far from where it is now.

That’s low considering Federal Reserve officials are seen as likely to deliver a larger-than-normal half percentage point interest rate hike in May, plus a series of hikes through 2023, while also attempting to shrink the central bank’s balance sheet. Traders are pricing in a slight chance the Fed’s main policy rate target could go above 3% by year-end from a current level of 0.25% to 0.5%.

“If you believe what the curve and OIS paths are telling you, you have to expect portfolios to be more conservative both on tactical and strategic asset allocation profiles” targeting six months to one year and up to three years out, said Braizinha. This means Treasurys “are likely to stay supported” even as the Federal Reserve pulls out of the bond market as a buyer.

Still, high inflation “changes the utility of Treasurys as a risk-off hedge for portfolios, so PMs (portfolio managers) will need to be more creative in how they hedge tail risks,” he said. “We have recommended using options as an overlay to the traditional long duration hedges.”

Next week’s U.S. economic calendar is light, but highlighted by Wednesday’s release of minutes from the Fed’s March 15-16 meeting. Monday brings February factory orders and core capital equipment orders. On Tuesday, data is released on the February foreign trade deficit, S&P Global’s final reading of the March service sector purchasing managers’ index, and the Institute for Supply Management’s services index for March.

Thursday brings weekly jobless claims and February’s consumer credit data, followed by a February wholesale inventories report on Friday.