This post was originally published on this site

Can Dr. Copper save the economy from slipping into a crude-oil-induced recession? “Dr. Copper” is copper metal

HG00,

which is seen as an accurate predictor of turning points in the economy. The metal’s price recently rose to an all-time high, a potentially positive sign for economic growth and industrial demand.

My reference to an oil-induced recession reflects the belief that a rising oil price

CL00,

is bad for the economy. Jim Bianco, President of Bianco Research, recently argued that “every 50% rise in crude [oil’s price] has led [to] a recession.” That’s a worrisome omen indeed, since oil’s price over the past year has more than doubled.

Fortunately or unfortunately, depending on your point of view, neither copper nor oil is an infallible economic indicator.

Copper vs. crude

If copper were a such good leading economic indicator, you’d expect it to top out in advance of the economy slipping into a recession. Consider the 2008 global financial crisis. (That’s the most recent U.S. recession other than the short-lived one that accompanied the first months of the COVID-19 pandemic; it’s unreasonable to expect any indicator to have anticipated that downturn.) The U.S. economy topped out in December 2007, according to the National Bureau of Economic Research (NBER), the semi-official arbiter of when recessions begin and end in the U.S. Far from anticipating the beginning of that recession, the price of copper kept rising until July 2008, seven months later, and only then turned down. In other words, it was a lagging indicator, not a leading one.

Crude oil didn’t do any better job than copper as a leading economic indicator. It also topped in July 2008, just like copper.

Or take the recession that, according to the NBER, lasted from July 1990 until March 1991. Copper topped out in August 1990. Though a one-month lag isn’t as bad as the seven-month lag in the case of the 2008 financial crisis, it’s still a lag.

Oil didn’t fare much better during that nine-month recession. Over the first half of it crude oil’s price more than doubled, and in the second half it fell back almost to where it stood at the beginning.

Neither cooper nor oil has always done poorly as a leading economic indicator. But each has failed often enough to raise serious doubts about using either as an early warning signal for an economic downturn. That doesn’t help us much in the current situation, since they are telling such diametrically opposite stories.

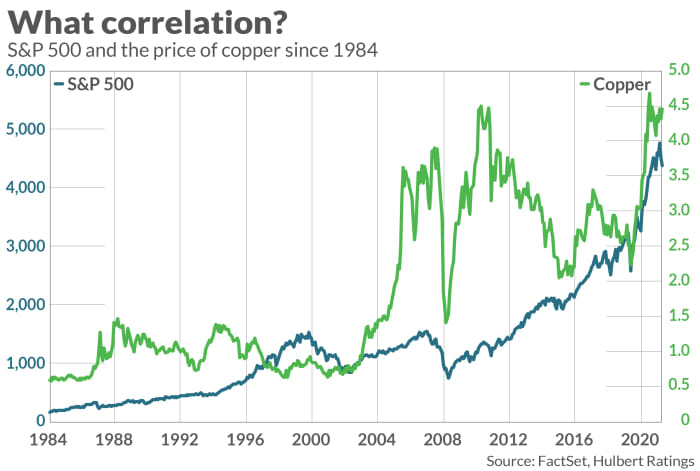

Might copper or oil do better as leading indicators of the stock market? First, consider copper. As you can see from the chart above, the metal on some occasions has anticipated the stock market’s turning points, but other times it has lagged. And sometimes copper has made major moves that have no correlation whatsoever with the stock market, either leading or lagging. Copper’s price fell by more than 50% between 2011 and 2015, and yet the bull market on Wall Street kept right on going. The same overall story applies to oil.

Eyeballing a chart doesn’t always capture a statistically significant relationship, so I next calculated the correlation coefficients between the S&P 500’s

SPX,

monthly returns and the monthly returns of copper and crude oil. The correlation coefficient ranges from a theoretical minimum of minus 1.0 (when the two data series are perfectly inversely related to each other) to a theoretical maximum of plus 1.0 (when the two move in perfect lockstep with each other).

Since 1984, the trailing 36-month correlation coefficient between crude oil and the S&P 500 has fluctuated from a low of minus 0.58 to a high of plus 0.77. For the correlation between copper and the S&P 500, the coefficient has ranged from a low of minus 0.18 to a high of plus 0.79. In each case, in other words, there is not a stable statistical relationship.

I’ve been unable to determine the original source of the notions that either copper or crude is a good leading economic indicator. But this discussion illustrates, once again, how we like to tell stories that appear to make sense of the otherwise inscrutable economy and stock market.

No one doubts that both copper and oil are incredibly important to the global economy. But, needless to say, many other things do too. The interaction between all these factors is incredibly complex. We need to resist the temptation to oversimplify.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at mark@hulbertratings.com.

Plus: Russia’s invasion of Ukraine is bitcoin’s first big test to topple gold as a safe haven